SoftBank posts ¥5 trillion profit off the back of strong Vision Fund gains

SoftBank has reported net profit of ¥4.99 trillion for the year ended March, marking a sharp turnaround from the ¥961 billion loss recorded in the year prior.

The primary reason for the turnaround was the ¥4.03 trillion profit from its Vision Fund unit, which was a ¥5.4 trillion improvement from FY2019 when the Vision Fund unit lost ¥1.4 trillion due to various investments across consumer, real estate, and transportation underperforming that year.

According to SoftBank, the ¥4.03 trillion profit was the Vision Fund unit's strongest annual performance ever.

The strong performance during FY2020 largely came off the back of gains from the recently-listed Coupang and DoorDash, which provided unrealised valuation gains amounting to $25.3 billion and $7.6 billion, respectively.

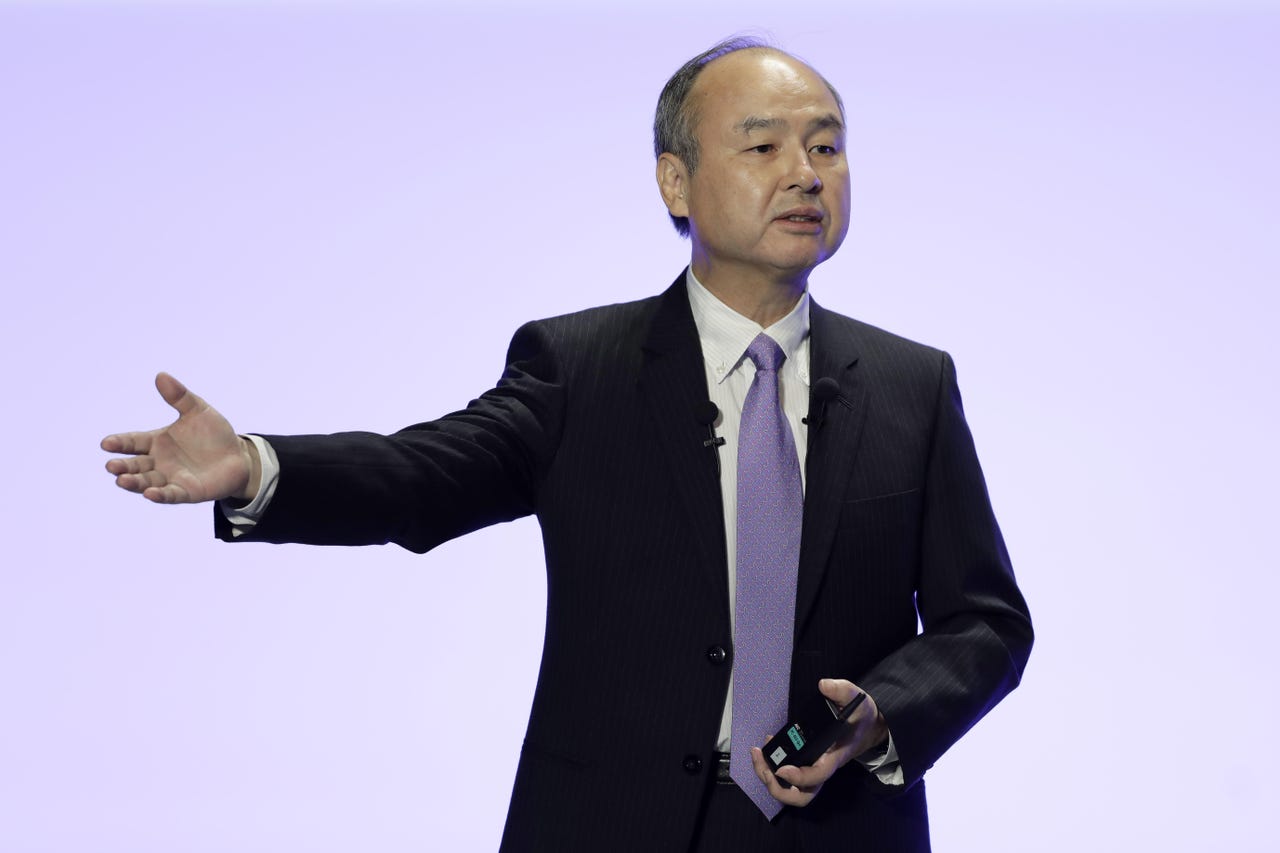

During the full-year results presentation, SoftBank CEO and chairman Masayoshi Son reused the "golden goose" motif mentioned during the third-quarter presentation when saying SoftBank would need similar results from other unlisted companies in the Vision fund portfolio if it is to maintain the same profit trajectory.

"We call ourselves an investment company. We don't do any gambling or focus on one-time gains from market rallies -- that's not what we are looking for. We like to be looking at continuous gains through AI for new technologies," Son said during the results presentation.

In addition, SoftBank also separately announced it was tripling the size of its Vision Fund 2, from $10 billion from $30 billion.

SoftBank Corp, the conglomerate's telco, also improved its performance from the year prior, increasing its net sales by 7% year-on-year to ¥848 billion. This led to a 4% year-on-year jump in the segment's total income, which rose to ¥848 billion.

During the year, SoftBank Corp also saw its mobile subscriber base grow by 3% to 47.2 million while its broadband services gained 300,000 more customers.

Meanwhile, SoftBank's soon-to-be-sold chip segment, Arm, posted a ¥33.9 billion loss. This is despite Arm's net sales, increasing by 6% year-on-year to ¥210 billion, which comprised of $1.28 billion in technology royalty revenue and $702 million in non-royalty revenue.

The loss was mainly due to charges that arose from increases being made to the share-based remuneration of Arm employees following the agreement for SoftBank to sell Arm to Nvidia.

The $40 billion sale is still pending as the UK's competition regulator is currently in the midst of an investigation into the deal. Providing comment on the pending sale, Son said he remained "hopeful" that the transaction will close while adding an Arm IPO could be in the cards if the deal cannot be completed.

During the full year to March 2021, SoftBank also earned ¥422 billion through selling two-thirds of its T-Mobile shares and ¥601 billion on equity method investments from Alibaba.

At the same time, SoftBank lost ¥477 billion from prepaid forward contracts that used Alibaba shares, the company said.

Related Coverage

- SoftBank spends $2.8 billion to buy 40% stake in warehouse robotics firm AutoStore

- SoftBank's Vision Fund continues bounce back by posting ¥844 billion profit in Q3

- Hyundai confirms acquisition of Boston Dynamics from SoftBank in deal valued at $1.1 billion

- SoftBank earns ¥1.56 trillion in half-year following Vision Funds bounce back

- SoftBank parts with OSISoft in a $5 billion deal

- SoftBank Group bounces back in Q1 from record loss

- It's official: Nvidia purchases Arm in $40 billion deal