Splunk's Q3 strong, Nutanix makes earnings debut, Autodesk cuts outlook

Splunk delivered a better-than-expected third quarter, while Autodesk's outlook disappointed and Guidewire and Nutanix had solid results.

The company, which provides software that uses big data tools to monitor operations, reported a third-quarter net loss of $93.45 million, or 69 cents a share, on revenue of $244.8 million, up from $174.4 million a year ago. Non-GAAP earnings for the third quarter were 12 cents a share.

Wall Street was expecting Splunk to deliver non-GAAP earnings of 8 cents a share on sales of $230 million.

Splunk said it added almost 500 enterprise customers.

As for the outlook, Splunk projected fourth-quarter revenue between $286 million to $288 million. For the fiscal year ending Jan. 31, Splunk said revenue will be between $930 million and $932 million.

Among other tech earnings:

Autodesk's transition to a cloud model continues. Autodesk reported a third-quarter net loss of 64 cents a share, or 19 cents a share, on a non-GAAP basis. Sales for the quarter were down 18 percent from a year ago to $490 million. The Autodesk loss was better than the 24 cents a share on sales of $476.8 million projected by Wall Street.

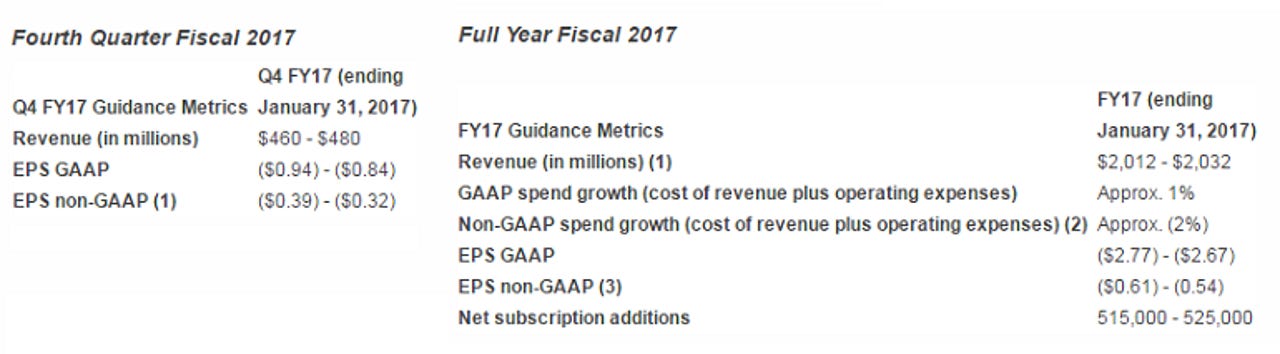

The company's outlook fell short of expectations. Autodesk said non-GAAP results would be in the range of a loss of 32 cents a share to 39 cents a share on revenue of $460 million to $480 million. Wall Street was expecting Autodesk to report a fourth quarter non-GAAP loss of 31 cents a share on revenue of $488.5 million.

Autodesk ended the third quarter with 2.95 million subscriptions. The software maker only sold subscriptions this quarter.

For fiscal 2017, Autodesk projected revenue between $2.01 billion to $2.03 billion, with a non-GAAP loss of 54 cents a share to 61 cents a share.

Here's the Autodesk outlook.

Nutanix reported a first quarter net loss of $162.2. million, or $2.18 a share, on revenue of $166.9 million, up 90.1 percent from a year ago. Non-GAAP loss was 37 cents a share.

The company ended the quarter with 4,473 customers.

Nutanix projected second quarter revenue between $175 million and $180 million with a non-GAAP loss between 35 cents a share and 36 cents a share. Wall Street was expecting sales of $168.4 million with a second quarter non-GAAP loss of 37 cents a share. Related: Nutanix buys PernixData, Calm.io in a move to bolster its cloud ambitions