Time Warner: AOL's revenue slide continues; We plan to buy Google's 5% AOL stake

Updated: Time Warner's first quarter was weighed down by its AOL unit, which saw revenue fall 23 percent. Time Warner CEO Jeff Bewkes reiterated that the company is looking for "the right ownership structure for AOL" and the company plans to buy back a 5 percent stake owned by Google.

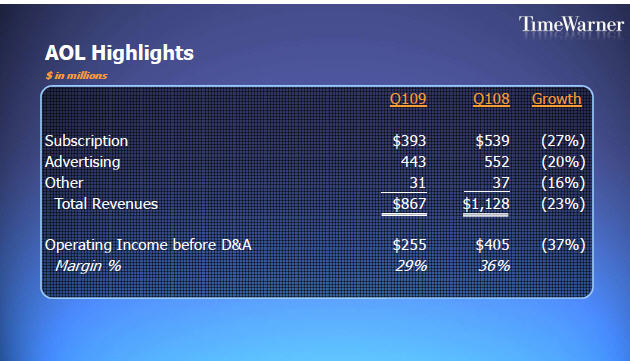

AOL reported first quarter revenue of $867 million, down 23 percent from a year ago. Subscription (dial-up) revenue fell 27 percent and advertising sales declined 20 percent. Both declines were expected and AOL noted that ad sales were weak in all categories (ad networks, display and search). Nevertheless, Time Warner CEO Jeff Bewkes maintained that AOL has "the building blocks for the turnaround." Bewkes added that AOL is restructuring to focus on growth areas such as Bebo and pulling resources from non-growth businesses.

Time Warner also plans to spin off all or part of AOL.

Time Warner CFO John Martin said on a conference call that AOL was squeezed by ad yields on third party networks and pricing pressure on its premium inventory. Martin said that AOL's second quarter decline is shaping up like the first quarter. On the positive side, Martin added that AOL will buy back the 5 percent of the unit owned by Google. "It's not a material amount of money one way or the other," said Martin.

In Time Warner's quarterly SEC filing, the company said:

In late January 2009, Google exercised its right to request that AOL register Google’s 5% equity interest for sale in an initial public offering. Time Warner has the right, but not the obligation, to purchase Google’s equity interest for cash or shares of Time Warner common stock based on the appraised fair market value of the equity interest in lieu of conducting an initial public offering. The Company is in discussions with Google and has notified Google of its intention to purchase the 5% equity interest.

Time Warner has been trying to unload AOL now will attempt a spin-off. AOL recently named former Google exec Tim Armstrong as its CEO to right the ship. There are options: Time Warner could spin off AOL or sell its dial-up business to an outfit like EarthLink.

Simply put, AOL and Time Warner's publishing unit, which had an operating loss of $32 million, are dead weights on the company's overall earnings. Time Warner reported first quarter net income of $661 million, or 55 cents a share, compared to $771 million, or 64 cents a share, a year ago.

Adjusting for investment gains and charges, Time Warner reported earnings of 45 cents a share on revenue of $6.9 billion, down 7 percent. The media giant had a bevy of moving parts---1 for 3 reverse stock split and Time Warner Cable dividend. Wall Street was expecting earnings of 38 cents a share.

Time Warner also reaffirmed its 2009 outlook of flat adjusted earnings of $1.98 a share relative to 2008.