Twitter Q3 disappoints as does Q4 outlook amid ad business woes

Twitter's third quarter sales and outlook fell short of expectations as the company said "more work remains to deliver improved revenue products."

CFO Ned Segal said the company will prioritize its ad products and strive to deliver "better ad formats will deliver better outcomes." That's a fancy way to say Twitter's ad business struggled in the third quarter.

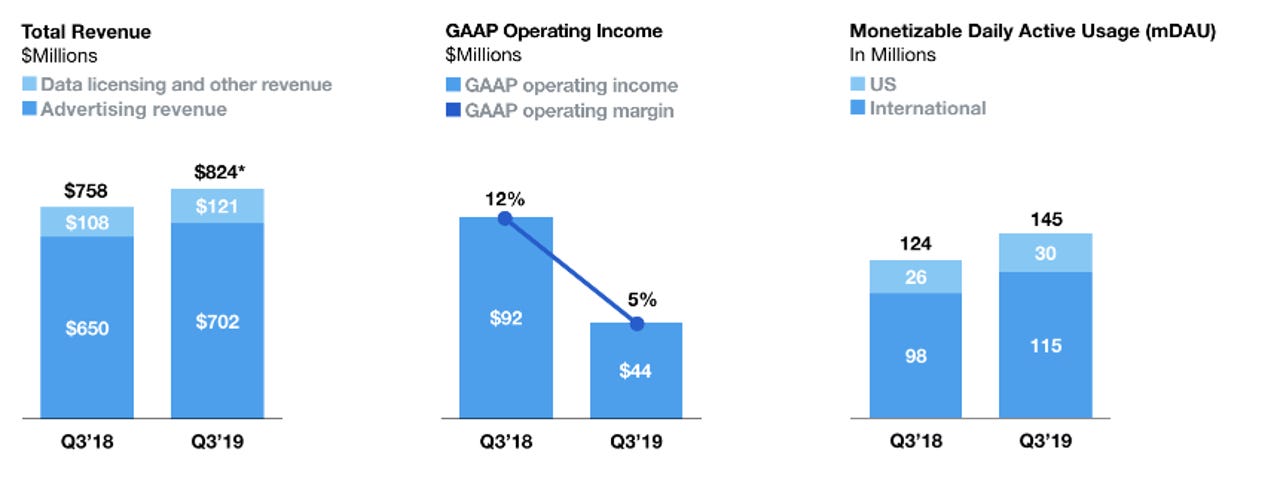

The company reported net income of $37 million, or 5 cents a share, on revenue of $824 million, up 9% from a year ago. Advertising revenue was $702 million, up 8% from a year ago. Non-GAAP earnings for the quarter were 17 cents a share.

Wall Street was looking for non-GAAP earnings of 20 cents a share on revenue of $874 million for the third quarter.

"Performance was impacted by revenue product issues, which we believe reduced year-over-year growth by 3 or more points, along with greater-than-expected seasonality," according to Twitter.

Data licensing revenue was $121 million, up 12% from a year ago.

The outlook from Twitter also fell short of expectations. Twitter projected fourth quarter revenue of $940 million to $1.01 billion and Wall Street estimated $1.06 billion.

Twitter said:

Our guidance for Q4, as in prior quarters, reflects the most likely range of outcomes based on our current visibility. We have considered the rebound in our advertising business in September, the strength of our bookings, and the organic events and product and service launches expected in Q4, along with the lingering headwinds we expect from the previously discussed revenue product issues we experienced in Q3. While we are taking steps to remediate these issues, we expect them to continue to weigh on the overall performance of our advertising business in the near term.

Specifically, Twitter said that its Mobile Application Promotion product, issues with personalization and data settings will hamper its growth.

On the bright side, Twitter's count of monetizable daily active users was 145 million compared to estimates of 142 million.

As for Twitter's service, the company said in a shareholder letter that it is improving its machine learning models, improving on boarding flow and making it easier to find content and people to follow.