VCs a glum bunch over economy, lack of exits

Venture capitalists are having a confidence crisis as dwindling exit opportunities and a weak economy conspire to put the kibosh on returns.

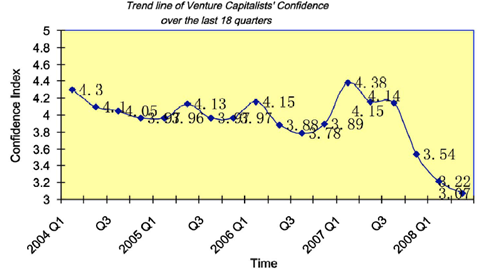

According to the Silicon Valley Venture Capital Confidence Index the second quarter registered a reading of 3.07 on a 5 point scale, down from the first quarter's mark of 3.22. That's the third consecutive new low in the 4.5 year history of the index.

The study, conducted by Mark Cannice, a business and management prof at the University of San Francisco, points the finger at the weak economy. Steve Carnevale of Point Cypress Ventures said in the study that there are major economic problems worldwide that "will impact the revenue generation of portfolio companies, as well as exit strategies and funding sources.”

Cannice writes in his report:

The continuing significant drop in venture capitalists’ confidence over the last three quarters is unprecedented in the four and a half year history of this quarterly index and indicates an on-going decline of sentiment among the majority of surveyed venture capitalists regarding the future high-growth venture environment in the Bay Area. It bears noting that the major decline in VC confidence in Q1 of 2008 preceded the worst quarter (Q2) for venture-backed IPOs in 30 years, with no venture-backed firms completing an IPO (according to the NVCA). Therefore, the further decline in confidence in Q2 would appear to signal continuing difficulty for the near term entrepreneurial environment.

However, deal flow looks fairly healthy. The problem is these investments may become roach motels if VCs can't gracefully get out of them with good returns.

The VC confidence index is the latest in a long line of reports declaring a startup crisis.

This confidence issue means that VCs are becoming tightwads and holding on to their cash. Actually, that may not be such a bad move. Cash is king in a crappy market. Cannice adds:

Debra Beresini of invencor indicated that “Many venture firms have money to invest in entrepreneurial companies now. Most, however, are holding onto cash – it could be a reaction to the downturn of a few years ago.” A derivative to this notion of tighter money was made by an anonymous survey participant who stated that “the follow on financing environment requires that any companies currently in one’s portfolio perform at a high level.” And Igor Sill of Geneva Venture Partners concurred, saying “Concerns over higher rates will naturally slow growth and the availability of venture capital follow-on funding.” David Epstein confirms that the “IPO market is non-existent and larger companies are not willing to pay for smaller companies which would not be accretive day one. This means exits are not plentiful, leading to VC's wanting to conserve cash and move slower in findings which in turn lowers valuations."