Motorola posts Q1 loss, despite rise in smartphones shipments

Motorola Mobility's first-quarter results show a slight net loss, despite the company reporting a rapid rise in smartphone sales.

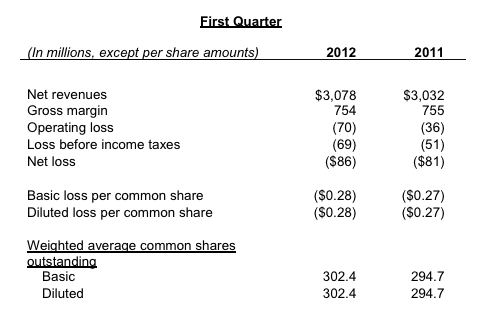

The smartphone maker reported a net loss of $86 million, or 28 cents per share, compared to a net loss of $81 million a year earlier, or 27 cents a share. Revenue was higher than Wall Street estimates, growing to $3.08 billion, up 1.5 percent on $3.03 billion from last year's first quarter.

Motorola shipped 8.9 million mobile devices, of which 5.1 million were smartphones. During 2011, the company shipped 9.3 million mobile devices, including 4.1 million smartphones.

It noted in its operating results that net revenues in its mobile devices unit were $2.2 billion, up 3 percent. Even though its operational costs have risen, Motorola is just about making a profit, but faces stiff competition from rivals such as Samsung and Apple.

Motorola's total cash pile stands at $3.5 billion.

Motorola split into two companies early this year: a mobile device unit, and a home segment.

Motorola's mobile device unit accounted for 71 percent of its total sales, marking a boom in its smartphone and tablet business. The company did not disclose how many tablets it sold during the quarter. Boosted by the Droid Razr and the Droid Razr Maxx, which has a larger battery life, the two smartphones practically carried the company through the first few months of the year, just as it did on the previous quarter.

Latest comScore figures show Motorola has just shy of 13 percent of the mobile OEM market share between December and March, though it dropped by 0.5 percent.

Its home business, which includes television set-top boxes, showed net revenues falling by 2 percent to $884 million, but overall saw improvement on previous earnings. Its operating costs were $91 million on a non-GAAP basis compared to $81 million a year ago.

Following Google's $12.5 billion acquisition bid for the company last year, the merger still faces regulatory approval in China. Motorola accepted the terms following board approval. U.S. and European regulators passed the deal subject to conditions earlier this year.

Subject to China's approval, the deal could be completed by the end of the second-quarter, making this quarter's earnings likely to be Motorola's last as its own company.

ZDNet's Charlie Osborne contributed to this report.

Related: