Netflix recovery ongoing with Q4 earnings

After a bumpy 2011, a recovery for Netflix is now underway as it posted smashing fourth quarter earnings on Wednesday afternoon.

Netflix reported fourth quarter earnings of $41 million, or 73 cents a share (statement). Non-GAAP earnings were 76 cents a share on a revenue of $875.6 million.

Wall Street was expecting Netflix to report fourth quarter earnings of 54 cents a share on revenue of $857 million.

Analysts were also expecting Netflix to have 26.1 million subscribers by the end of the fourth quarter. Worldwide, Netflix has approximately 26.6 million subscribers, thanks especially to a huge expansion internationally during the second half of 2011 in Latin America, the United Kingdom, and Ireland.

That breaks down to 24.40 domestic subscribers and 1.86 international subscribers.

What might be most impressive is the surge in domestic streaming-only subscriptions, which jumped from 220,000 to 21.67 million during the fourth quarter. That's more reflective of subscribers jumping away from the DVD-only plan to the streaming-only plan in the wake of price hikes last summer.

Although Netflix might finally look like it is stabilizing after a rough year, Netflix executives acknowledged in a statement to shareholders that there is still plenty of work to be done:

In general, member growth or contraction in a quarter effects revenue the following quarter more than the quarter of the change. The sharp decline in DVD members in Q4 means that in Q1 our DVD revenue will decline by about as much as our streaming revenue will increase, resulting in approximately flat sequential revenue in Q1...

...As a result, we expect modest quarterly losses, as well as losses for the calendar year. Until we achieve our goal of returning to global profitability, we do not intend to launch additional international markets.

Netflix is still expecting a net loss of approximately 1.5 million DVD subscriptions during the first quarter of 2012.

However, Netflix doesn't seem too worried about much of the digital video competition out there -- with the exception of one source: TV Everywhere, especially HBO GO. Netflix says that HBO has "great content," which means that Netflix probably wants it.

Nevertheless, Netflix doesn't think the others will make a difference to its market share going into 2012:

One class of competitors is the other over-the-top pure plays such as Hulu Plus and Amazon Prime. We expect Amazon to continue to offer their video service as a free extra with Prime domestically but also to brand their video subscription offering as a standalone service at a price less than ours. Both Amazon and Hulu Plus’s content is a fraction of our content, and we believe their respective total viewing hours are each less than 10% of ours. In the case of Hulu Plus, subscribers have to pay for the service ($7.99) and still watch commercials (unlike, commercial-free Netflix). Even if Hulu could afford our level of content spend, at the same price consumers would prefer commercial-free Netflix over commercial-interrupted Hulu Plus.

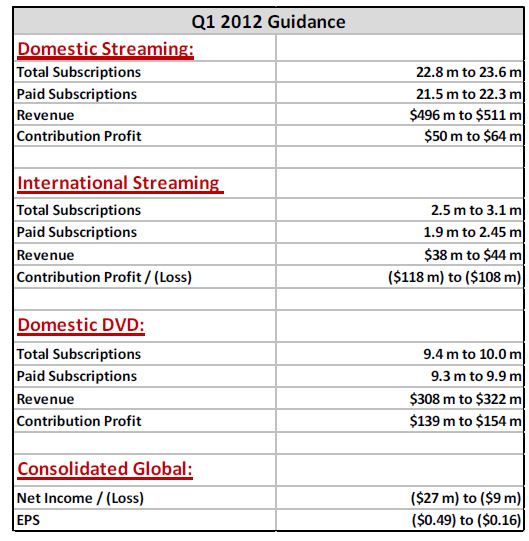

Here's a glance at the breakdown for Netflix's guidance going into 2012:

Key points:

- The weekly rate of DVD cancellations has subsided from peak levels in September.

- In 46 of the 47 countries where Netflix is available, members can currently enjoy automatic seamless video sharing between friends on Facebook. The exception is the United States.

- The remaining Starz titles will come off the domestic streaming service at the end of February.

- Introduced new user interfaces for Xbox 360/Kinect, the iPad, and added new features to the Nintendo Wii version

By the numbers:

- International revenue of $29 million, and that was in-line with Netflix's expectations.

- The domestic streaming segment delivered $52 million of contribution profit, or 10.9 percent contribution margin.

Related: