PubMatic raises $45 million; advertising tech heats up

The advertising technology space is getting red hot.

PubMatic announced this week that it raised $45 million from investors -- August Capital led the way -- for its platform that allows large publishers to manage and monitor display ad inventory and optimize pricing with the hope of getting more revenue.

AllThingsD's Peter Kafka first reported the news. Other investors included Draper Fisher Jurvetson, Nexus Venture Partners, Helion Ventures and Silicon Valley Bank.

Advertising, of course, is big business, which is why Google picked up rival AdMeld last year. That leaves two more independent outfits: AppNexus, based in New York, and the Rubicon Project, based in Los Angeles. The former counts eBay and Microsoft among its customers and the latter does the same with News International and Forbes, among others.

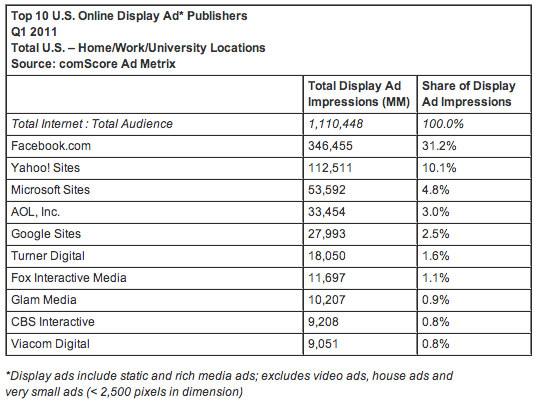

Possible suitors are tech's biggest players: Yahoo, AOL, Microsoft and Amazon, though the folks in Redmond have recently shown that they're willing to let Yahoo take this on.

All of the indie firms are funded to the hilt, so the question is an easy one: which exit to take, public offering or private sale?

In recent years publishers -- including the parent company of ZDNet, CBS Interactive -- have shown a penchant for looking inward for solutions. But many other publishers don't have that kind of weight to swing around, and need an ad network to serve as a one-stop shop for purchasing ads on major media websites.

For online publishers, advertising means technology.

AdAge's Rich Karpinski explained it nicely in 2009:

Large publishers are looking more like ad networks. Publisher-side brokers are moving from being yield optimizers to becoming exchanges in their own right. And ad networks -- at least those of the 400 or so likely to survive -- are focused on targeting and brand safety. Ad exchanges are moving from basic bid-matching to real-time allocation. Agencies are making perhaps the boldest move, aggregating impressions and data for clients -- and themselves. Data exchanges are separating data-about-impressions from the impressions themselves and bringing a new, valuable currency into play.

Like any other enterprise management platform, the desire is efficiency and higher revenues through the optimization of transactional data, thanks to algorithms, datacenters and volumes of data.

Given the tremendous growth here, a lot of money is at stake. How will the cards fall?