Sprint makes right long-term moves, gets pummeled for them

Sprint outlined its network vision---which includes a heavy dose of Long-Term Evolution on its own wireless spectrum and a dumping of Clearwire/WiMax over the next two years---and got hammered for it by analysts and investors. The $10 billion in capital spending on LTE along with another reported $20 billion spent to land Apple's iPhone 4 and iPhone 4S is too much to digest today.

However, assuming Sprint can navigate the next two years, these bets on the iPhone and LTE make a lot of sense. Investors are obviously queasy because assuming Sprint comes through the next two years unscathed isn't a sure bet.

The bottom line here is that Sprint has little choice, sees itself at an inflection point and is playing a high-stakes game to solidify its future. Some analysts disagree.

Deutsche Bank analyst Brett Feldman cut Sprint to a hold following the analyst meeting. Feldman said:

We are downgrading Sprint to Hold following Friday's analyst meeting which left us with too many unanswered questions about critical issues including (1) the company's 4G spectrum strategy and the fate of its relationship with Clearwire, (2) its funding plans for Network Vision and (3) the expected financial impact of the iPhone.

Here's the quick recap from Sprint's strategy day:

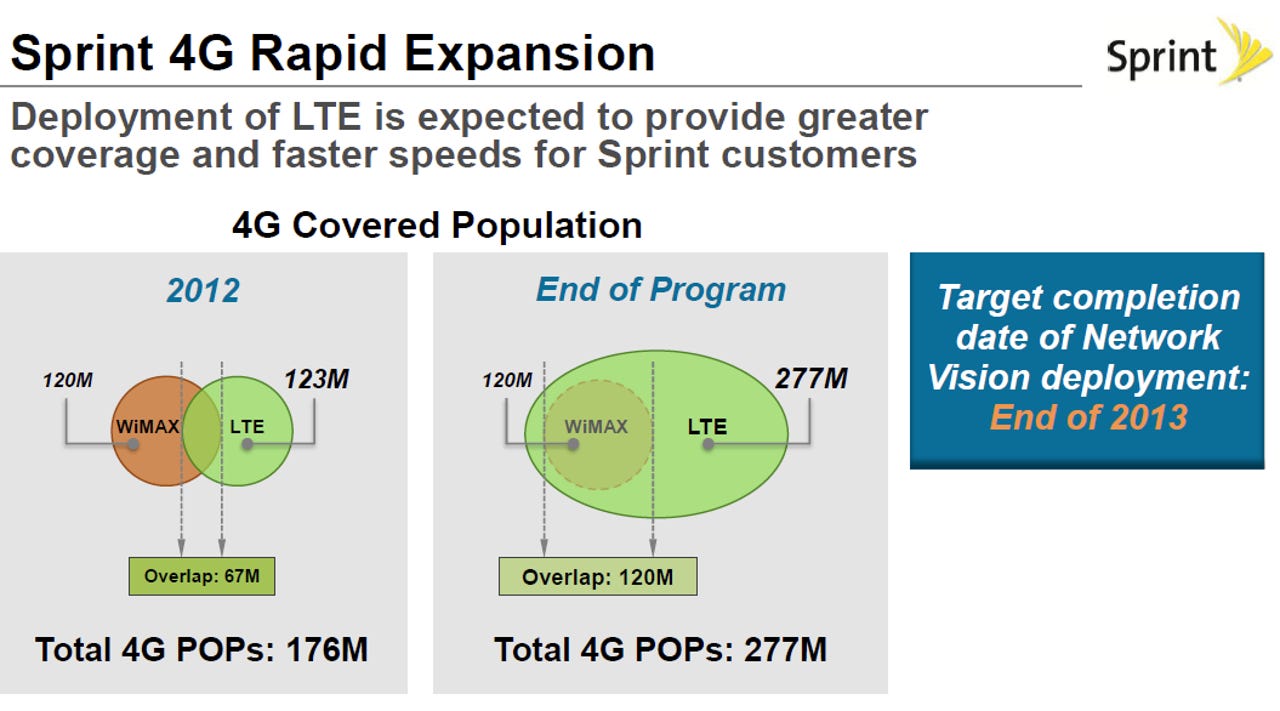

- Sprint plans to complete an aggressive LTE rollout that will cover 250 million people by the end of 2013. This LTE launch will trail Verizon and AT&T, but isn't so far behind to prove fatal.

- The company is rolling out the iPhone 4 and iPhone 4S with an unlimited data plan that is a key differentiator. Assuming the network holds---yes folks that's another assumption---Sprint will attract plenty of consumers.

- Clearwire is on its own and Sprint gave no indication that it would provide additional financing in the WiMax service provider. CNET News' Roger Cheng noted how analyst got testy with Sprint CEO Dan Hesse over the company's plan to focus on its own spectrum for 4G.

This slide highlights how WiMax---and ultimately Clearwire---has no future at Sprint.

The elephant in the room was clearly debt. Sprint will have to tap the equity markets at some point for more capital. Sprint already has a large debt load, but maturities that can be managed over the next two years. With the decision to ultimately cut its losses on Clearwire, Sprint will get control of its own destiny.

How exactly will Sprint pay for this network rollout as well as the iPhone? That question was largely unanswered on Friday aside from float more shares or go to the debt markets. Sprint's outlook excluded iPhone costs---a move that didn't make much sense given presales started Friday.

Sprint also has key questions. Among them:

- Sprint will sell WiMax devices through 2012, but will an LTE rollout freeze those sales? After all 15 LTE devices will come in 2012.

- How will the iPhone play out at Sprint? Executives noted that the iPhone levels the playing field for Sprint, cuts churn, increases gross ads and adds more data revenue. However, the iPhone will also pressure Sprint's free cash flow.

- How will Clearwire and LightSquared work out? Obviously Clearwire will have issues with Sprint. But Sprint's move to control its LTE fate also puts the LightSquared deal in question.

In other words, Sprint is making the right longer-term moves, but has a convoy of "ifs" riding behind its strategy. Piper Jaffray analyst Christopher Larsen said in a research note:

Sprint indicated this morning that it plans to have its first LTE networks launched by mid-2012. This certainly lags industry leaders AT&T and Verizon; however, Sprint also announced that it plans to have its initial build largely complete by year-end 2013. This is in line with AT&T's accelerated schedule and is exactly what we were looking for to keep the company from the perception of a second-rate network...Sprint will have owner economics with its own LTE network. With this and other benefits of Network Vision, Sprint believes it can reduce cost/ GB and cost/minute by 50%. Sprint will allocate network traffic first to its own network, second to hosted networks (potentially LightSquared) and last to wholesale networks (Clearwire.)

Macquarie analyst Keith Smithen said that Sprint's failure to include iPhone in its estimates were a misstep. Smithen also cut his free cash flow estimates for 2012 and 2013. He expects debt rating agencies to cut Sprint too---along with Clearwire.

William Blair analyst Jim Breen said:

Sprint will be free cash flow negative through 2013, and the balance sheet will be pressured further as a result of the LTE deployment. Free cash flow will likely be pressured even more in the near term due to increased subsidies associated with Sprint’s commitment to the iPhone. With $18.5 billion in debt and $4.2 billion in cash on the balance sheet, Sprint may need to return to the market to fully fund the LTE build out and debt obligations.

The upshot is that there's a dust flying around Sprint and the best bet is to wait for it to clear. Sprint is a work in progress for the next two years at least. If successful, Sprint will be well positioned for the future---or at least have a network that is worth acquiring by a larger company---but two years is a long time to wait around.

For consumers, these questions are probably overshadowed by an unlimited data plan and the iPhone. Ironically, that influx of customers may pressure Sprint's free cash flow even more.