Mastercard's new banking tools promise faster, simpler payments by easing ACH latency pains

It happens to many of us at some point -- a monthly bill comes due but the payment doesn't go through because the funds aren't available on time. For a small monthly payment, such as a department store bill, it's an annoyance that could be resolved with a phone call (with a long waiting time to reach customer service). But for larger monthly payments that are more impactful to one's credit score, such as rent, mortgage, or student loans, a missing or late payment can be painful, not just for the delinquent payer, but for the company expecting the payment, as both sides strive to find a way to finalize the transaction -- often with a sizable late fee attached to it.

Finance

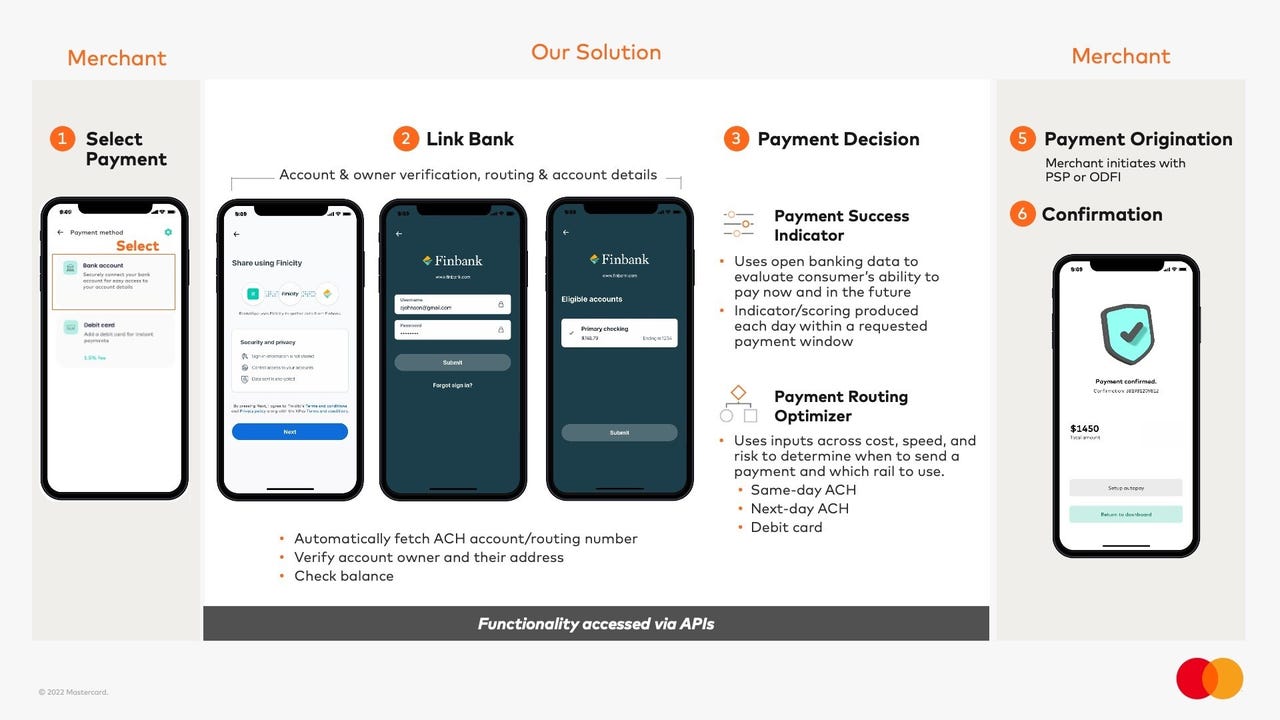

But now, as part of its initiative to utilize open banking solutions -- using advanced data analytics and machine learning tools -- Mastercard today announced the introduction of two Smart Payment Decisioning tools under its Finicity open banking division, that will help facilitate payment transactions more seamlessly and securely: Payment Success Indicator and Payment Routing Optimizer. "It's all about consumer convenience, providing consumer choice and really listening to consumers' desires to have access to different security types and ease of use -- that's at the center of these news tools," says Silvana Hernandez, senior vice president of Digital Payments for Mastercard in an interview with ZDNet.

The type of payment rail at the center of Mastercard's new Smart Payment Decisioning tools is the Automated Clearing House, or ACH Network, used for automatic bill payments, brokerage account deposits, and direct payroll deposits. Hernandez told ZDNet that when developing its tools, Mastercard discovered through its research that ACH payments, while gaining popularity in the era of digital banking, still have many pain points that affect both consumers and merchants.

The two most prevalent pain points for ACH payments are the complexity of making ACH payments (finding and entering account and routing numbers correctly) and customers having insufficient funds at the time the money is withdrawn, usually because they don't have enough cash in their account at the time the transaction is due (improper timing of cash flow and balance in their account). "It has to do with the basic fact that ACH has a latency process; you trigger a transaction today, but it won't settle in the next two to five days, and so that creates a timing mismatch that's painful for both merchants and consumers," says Hernandez, who adds that merchants are affected with heavy operational burdens including managing teams to track down late payments.

How it works

Payment Success Indicator and Payment Routing Optimizer work hand-in-hand. The Payment Success Indicator leverages open banking data -- consumer-permission data that the consumer controls but Mastercard manages -- and uses AI and machine learning to process the data and provide the merchant with a better score and prediction when determining if a transaction will be successful or not, based on the timing, the amount and the type of transaction.

On the other hand, Smart Routing Optimizer takes the data, prediction, and analytics and determines the best way to execute a transaction. Rather than sticking with one payment rail, such as ACH, it will find the best solution to trigger a transaction, recommending another payment rail that's more suited to the consumer. So, for example, if Payment Success Indicator reveals that the balance for a transaction is available today but may not be in the next few days, then Payment Routing Optimizer will recommend using Same Day ACH. The purpose is to find the right rail for the consumer and merchant to execute the transaction in the best way possible.

"We're building these solutions for the benefit of the banking ecosystem," Hernandez says. "Banks don't want a payment to be declined from a consumer just because of bad timing. So, it's trying to address everyone's needs in the ecosystem by leveraging the data the consumer gives us permission to use, running the analytics on that data and providing insights and recommendations for the benefit of merchants, financial institutions and consumers," she says.

Current release

Payment Success Indicator and Payment Routing Optimizer are currently limited to the rental home space, with general availability scheduled for later this year, Mastercard said. The first customer of these tools now is Bilt Rewards Alliance, which is a collection of more than two million rental homes in the US that enables renters to earn points by paying rent. "Our mission is to help renters get the most value out of one of their biggest expenses, and returned payments create significant expense and friction for both residents and landlords," says Ankur Jain, CEO and founder of Bilt Rewards. In Mastercard's press release, Jain notes that he expects Payment Success Indicator to reduce the potential for returned payments.

Although these two new tools are limited to only one client now, Hernandez says Mastercard will bring in more partners later this year. "Right now, our solutions are meant to address the pain points of verticals that today have meaningful reliance on ACH. Education, health care, insurance -- those would be the targets," she said.

Both Payment Success Indicator and Payment Routing Optimizer are made possible through the concept of open banking, which enables third-party financial service companies the ability to have open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions using application programming interfaces, or APIs. So, through open banking, consumers, financial institutions, and third-party service providers will use a network of accounts and data across institutions. Using networks rather than centralization, open banking can help financial services customers share their financial data with other financial institutions more securely.

In Mastercard's recent study, "The Rise of Open Banking," nearly three-fourths (74%) of American consumers said they have or would connect their bank accounts to automate financial tasks. What's more, 90% of GenZ and Millennial consumers are already connecting their bank accounts to apps, Mastercard said.