Uncalculated Risk: The Fall Of Housing Prices. What Goldman Saw.

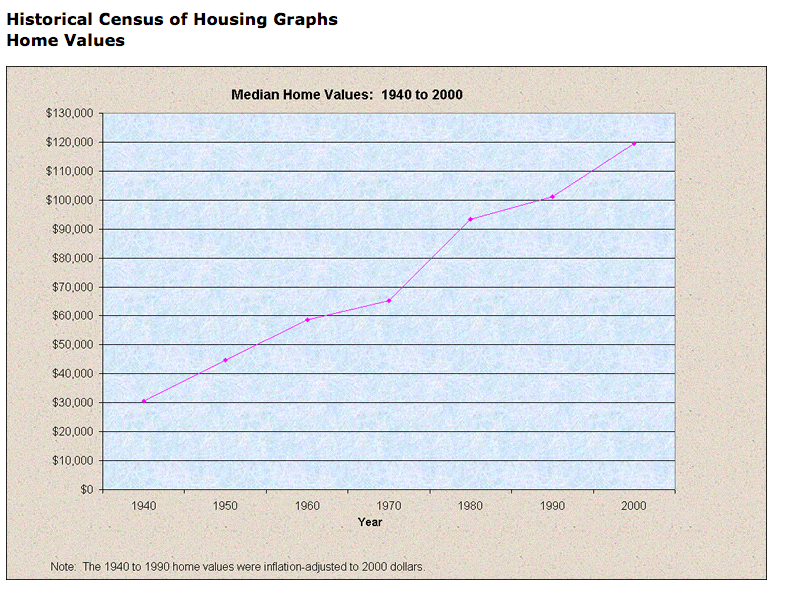

This is the U.S. Census Bureau's graphing of housing values from 1940-2000.

Nationally, housing prices march upward for six uninterrupted decades.

This kept up for another six years. But as the S&P/Case-Shiller Index, below, shows housing prices -- nationwide -- peaked in the second quarter of 2006. And have been falling since.

This is the kind of monumental change that ought to wake up anyone that runs risk assessment programs against their portfolio of complex financial instruments. Particularly, if the underlying securities are home loans.

In fact, it wouldn't take a sophisticated piece of software to make the call to get out of mortgage-backed securities, as soon as housing prices began to fall.

But the only investment bank to make the call before 2006 ended was Goldman Sachs. Which was even able to make a profit out of selling housing derivatives short and accumulating credit default swaps. For a while.

What is it about Goldman's culture and systems that makes it entertain the notion that it should swim against the stream, even if trading in a given class of securities is still hot?

That question was the subject of a ZDNet Undercover report, published here yesterday. And if you want to understand the culture, financial characteristics and risk systems involved in making such a call, tune in at 2 p.m. Eastern time Wednesday (February 11) -- tomorrow -- for a interactive discussion with:

• Charles D. Ellis, author, "The Partnership: The Making of Goldman Sachs" (Penguin, 2008), who will discuss the nature of the Goldman culture, after 139 years of development.

• Robert Arvanitis, principal, Risk Finance Advisors, who will parse the ways securities risks are analyzed. He is a former managing director at Merrill Lynch, where he was head of its Global New Derivatives practice.

and,

• Ron Papanek, head of the RiskMetrics Labs at RiskMetrics Group. This is the outfit spun out of JP Morgan that first delivered something called the "4:15 Report" and set up the principles behind figuring out what value is at risk, in daily trading of securities.

You will be able to use your keyboard to ask questions of these corporate, finance and technical experts on this ZDNet Webcast examining just how risk gets identified, evaluated and calculated. And how the principles can be applied and deployed in organizations whose operations or businesses are not based on Wall Street or securities trading at all.

Here's the signup page for Live Webcast: Calculated Risk: Inside the Billion-Dollar 'Gut' of Goldman Sachs