MyRepublic not late to Singapore mobile market, but must differentiate with customer service

MyRepublic may have lost its bid to be Singapore's fourth licensed telco, but the internet services provider is now looking to gain ground by offering subscribers what it believes they have been lacking--control over their service plans.

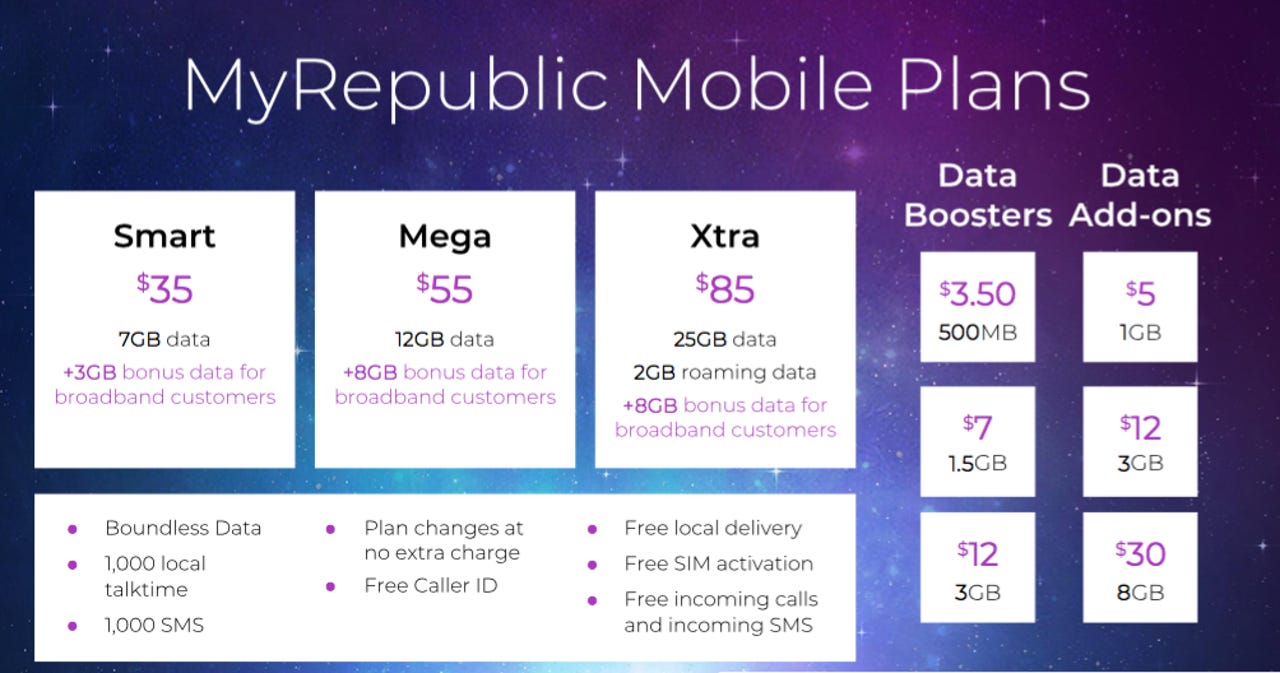

The mobile virtual network operator (MVNO) officially unveiled its mobile services in the city-state Thursday, introducing three mobile plans that offered 7GB of data at S$35 a month, 12GB at S$55 a month, and 25GB at S$85 a month. Subscribers would not have to sign on a service contract and all plans came bundled with free incoming calls, free caller ID service, as well as 1,000 local talktime.

(Source: MyRepublic)

The launch came 18 months after Australian operator TPG Telecom outbid MyRepublic to snag Singapore's fourth telco license in December 2016. The former had yet to launch its services here, but said earlier this year it was on track to do so in the second half of 2018.

Asked if it was late to a market that already had a mobile penetration rate of 150.8 percent, MyRepublic CEO Malcolm Rodrigues suggested that Singapore was in need of new competition. "If we launched six months earlier, there would have been no difference," he said in an interview with ZDNet.

Rodrigues noted that the current three telcos--Singtel, StarHub, and M1--did not compete with each other "in a meaningful way", while other MVNOs had not made significant impact. Pointing to Circles.Life, which launched in May 2016, he said its Facebook page was laden with complaints about its customer service and spotty service delivery.

Rodrigues said his team took note of such developments and wanted to take the time to ensure its service delivery would be robust.

Specifically, the company had focused on enabling its subscribers to easily modify their plans--removing and adding services--via MyRepublic's mobile app, without incurring additional charges.

And rather than pay an additional fee or have their access cut off when they exceed their monthly data quota, its subscribers would be put on a lower connection speed. Subscribers whose connection speeds were "throttled" after exceeding their monthly data quota still would be able to access most services without interruption, including surfing the web, sending messages, making calls, streaming music, and watching low-resolution videos.

They also had the option to pay a one-time "data booster" fee to regain normal connection speeds, either at S$3.50 for an additional 500MB, S$7 for 1.5GB, or S$12 for 3GB.

MyRepublic is betting that its focus on such service options, with emphasis on user transparency and flexibility, would be its key market differentiator.

Rodrigues said: "We don't think [offering] a cheaper price is a game-changer. That's just a path to nowhere. We want to give subscribers value and a worry-free experience that gives them control [over their service plans].

"We're allowing them to make adjustments, including removing and adding services, on-the-fly, and we'll continue to add new functionalities [to our app] in future," he said, but declined to give specifics on what these would be.

The CEO credited the ability to offer this flexibility to MyRepublic's cloud-based digital telecommunication infrastructure and "thick MVNO" model. This, he said, gave it more control over the structure of its mobile plans, while other MVNOs were limited by the pricing and structure of their host network operator's offerings.

Playing to its broadband user base

Nikhil Batra, IDC's Asia-Pacific senior research manager for telecom, not7ed that it also should leverage its broadband subscriber base to boost its mobile play.

MyRepublic currently had 300,000 broadband customers across Singapore, Australia, New Zealand, and Indonesia. Of this, 80,000 were in Singapore.

"Demands for higher speeds, higher data quota, real-time control over their subscribed services, and better quality of service, are forcing service providers to stretch themselves," Batra, who was based in Australia, said in an email interview.

He noted that this could play to MyRepublic's advantage, in particular, with the vendor's cloud-based digital infrastructure, which should be tapped to deliver more innovative and "hyper-personalised" service offerings to different customer segments.

Some subscribers, for example would want higher speed access at particular locations, such as the university, and lower speeds elsewhere, while others might want high-speed connectivity for games or video streaming applications.

Rodrigues also pointed to its broadband user base as a strong foundation, adding that it had begun offering these customers two mobile plans last month.

"So we have a base of people that already like us and our brand and what we stand for. We're trying to be disruptive with the mobile plans we're launching. We're not [just] the new guy trying to attract [new subscribers]," he said.

Batra further underscored the benefits of coupling multiple service offerings: "Bundle. Bundle. Bundle. Triple-play and quad-play have been successful [gameplay] for telcos worldwide and MyRepublic looks to be on that path."

It now should continue to identify consumption trends and, in particular, build partnerships in the content space to build up its customer base, the IDC analyst said. He noted that Singtel Optus in Australia was able to lure more customers to its network after securing the rights to the English Premier League in 2015, and renewing the agreement earlier this year.

Rodrigues said he was open to introducing service bundles as long as there was consumer demand. He added that MyRepublic already offered broadband service bundles, focused on low network latency, that were targeted at online gamers.

Batra noted that market players such as Singtel, StarHub, Telstra, and Vodafone also were investing in their own backend systems and building up software-defined networks to deliver improved customer experience.

MyRepublic would have to ensure it kept up with these players to create a competitive edge and further develop its backend infrastructure to gain more flexibility in its service offerings, he said.

Rodrigues said he was aiming for a 5 percent share of Singapore's mobile market, which was the same target number for all the broadband markets in which the company operated. He declined to give a timeframe for when he hoped to achieve that number, but said it currently had a 6 percent share of Singapore's broadband market.

He added that MyRepublic would extend its mobile services to another market by year-end, and to another two over the next 12 months.

According to the CEO, the company currently was profitable in Singapore, Indonesia, and New Zealand, and likely would be profitable in Australia by end-2018. He added that Indonesia currently was its biggest market, while Australia was its fastest-growing.