ACCC report and COVID-19 highlight how CVC is an artificial handbrake on the NBN

In usual quarters, the total bandwidth purchased by retailers from NBN increases by a percentage in the low teens, but not this quarter.

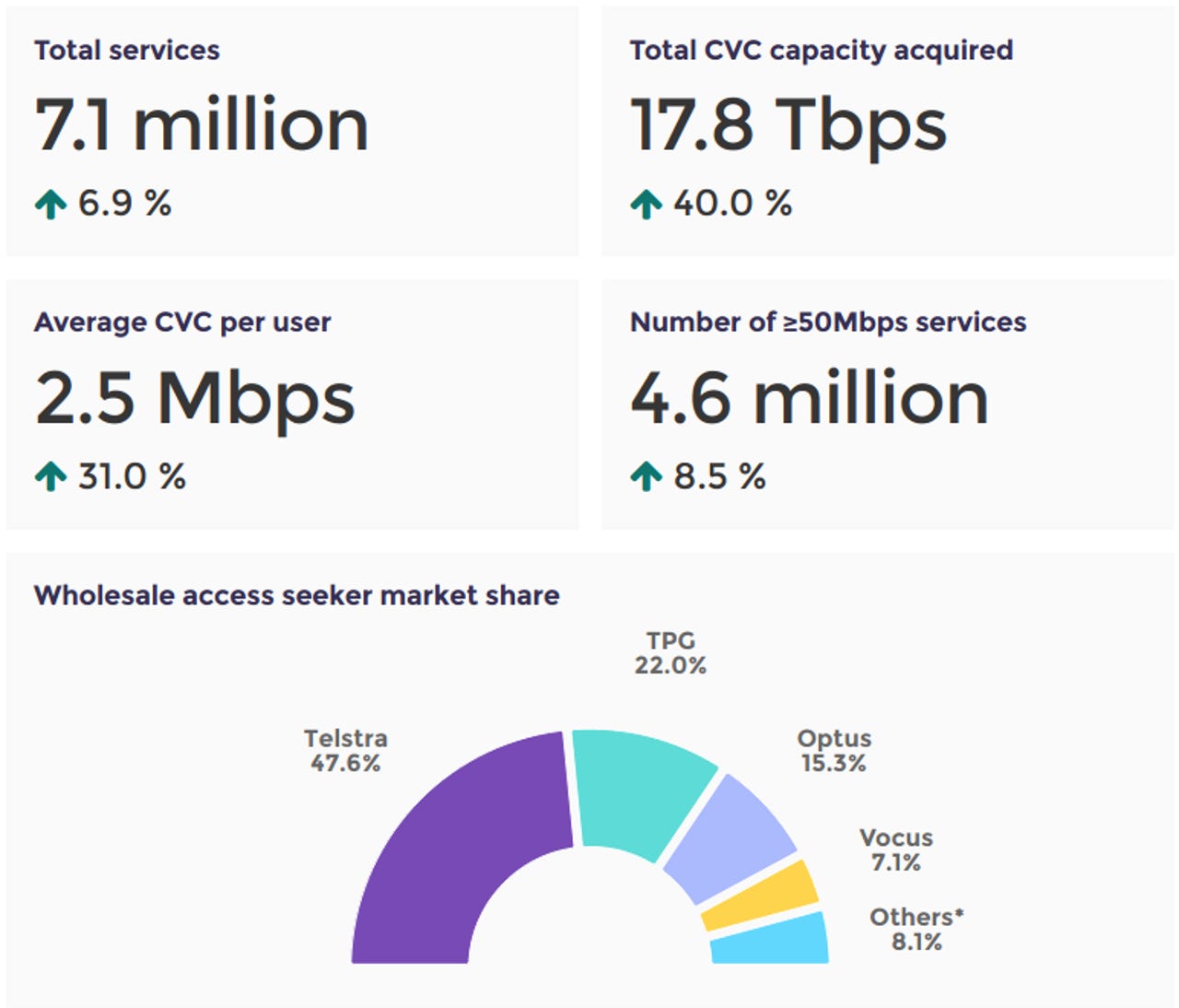

But in its latest Wholesale Market Indicators Report, the Australian Competition and Consumer Commission (ACCC) has said total capacity purchased on the network grew 40% to 17.8Tbps, while the average capacity per user grew 31% to 2.5Mbps.

The figures from the ACCC were as of the end of March, while NBN offered its 40% capacity boost in response to the coronavirus pandemic only seven days before the end of the month.

Examining traffic and capacity graphs and history from Aussie Broadband -- which is one of the few to publicly disclose capacity and usage at each NBN point of interconnect -- the information shows the retailer did not jump all-in as soon as the offer came into force. Instead, it steadily ramped up throughout April, a period the ACCC report does not capture.

All up, it highlights how much the loathed connectivity virtual circuit (CVC) pricing structure -- where retailers are charged on a per Mbps basis -- has been holding back the network.

A 40% jump in CVC is the sort of growth the network experiences yearly, and it happened in this quarter, and there is more to be measured next time.

Little wonder telcos have hated it since its inception, and it has been seen as an artificial handbrake on the speeds consumers receive.

Shadow Communications Minister Michelle Rowland raised the prospect of what happens once the CVC boost is taken away.

"The question from here is how do we transition CVC pricing to a new normal in a fair and economically responsible way?" she said. "Hastily undoing the capacity boost would be problematic given this could force up prices or lead to congestion.

"For this reason, Labor would prefer to see a considered transition of NBN capacity pricing in consultation with retail providers, informed by traffic trends as COVID-19 restrictions wind down."

Elsewhere, the report said 455,000 services were added to the network over the quarter, representing a 7% growth and taking it past the figure of 7 million connected premises. Of the new premises or ones that changed plans, over 310,000 were added to the 50Mbps speed tier, almost 94,500 moved to 25Mbps plans, and over 56,000 connected on 100Mbps plans. This was offset by the total number of 12Mbps premises dropping by 6,500 premises.

In total, 4 million premises are on 50Mbps, followed by 1.16 million on 12Mbps, 1 million on 25Mbps, and 772,00 on 100Mbps.

The ACCC also pointed to what it labelled as "smaller RSPs" picking up market share, with genuine small player Aussie Broadband picking up 3% of the market, while the Australian output of the Vodafone international behemoth sat at 1.9%.

Telstra is still well ahead with 47.6% of all NBN services, followed by Vodafone-marriage-partner TPG with 22%, Optus on 15.3%, and Vocus on 7.1%.

During the quarter, Aussie Broadband took its total number of premises on 1000Mbps connections past 50, and on Tuesday, said it would widely offer a 1000/50Mbps plan to consumers on full fibre and HFC connections from next week.

In February, Telstra said it only offer speeds greater than 100Mbps on full fibre and HFC connections.

No point upgrading from FttN to FttC when FttP is the same cost: NBN

Separately, the company responsible for the National Broadband Network responded to a number of questions on notice from Senate estimates this week.

NBN explained that it does not offer an upgrade path from fibre to the node (FttN) to fibre to the curb (FttC) under its technology choices program because it is roughly the same cost as an upgrade to full fibre.

"NBN Co's FttC solution uses a 'Distribution Point Unit' (DPU) box that is placed in a pit. Each of these DPUs is designed to connect four premises," the company said.

"Connecting a single premise to FttC via technology choice would still require the full four-premises DPU to be installed, which makes the cost comparable to connecting a single premises via FTTP."

NBN said to March 25, it had completed 971 quotes to upgrade from FttN to FttP, 147 quotes to upgrade from HFC to FttP, and 92 from fixed wireless to FttP during the life of the company. It had also spent AU$2.7 billion in total capital expenditure for its fixed wireless network, which as of the end of February consisted of 2,276 towers and 16,105 cells.

Across its entire life to February 28, NBN has taken in AU$8.9 billion in revenue and paid out AU$22.7 billion in operating expenses and payments to Telstra and Optus. Cumulative interest on loans to the same date was AU$800 million.

The company added that 97% of HFC and 96% of FttC connection appointments have not needed lead-ins to be remediated.

In responding to a question to provide an update on the amount of copper purchased by the company, which are typically used to connect existing pillars with new nodes, NBN took a swipe at the media.

"This question is asked regularly but the answer is often misinterpreted in the media as being indicative of the amount of copper that is being used to replace existing copper in the network," it said.

"In reality, the copper is used for purposes such as running a new copper connection between the fibre-connected FttN node and the copper-connected pillar. Specialised copper cable is also used in the FttC network construction for short extensions of copper lead-in cables to the FttC DPU location.

"This particular purpose alone has required 19,771 km of copper as at 3 March 2020."

In April last year, the company said it had purchased almost 29,460km of copper in total, without the above restriction to FttC.

Updated 3:04pm AEST Tuesday 26 January 2020: Added comments from Rowland and NBN responses to the Senate.

Related Coverage

- Aussie Broadband throws 1Gbps speeds at full fibre and HFC users

- Monash, Swinburne, and RMIT universities use optical chip to achieve 44Tbps data speed

- It wasn't just you, the NBN was slower at the back end of March

- NBN broadband tax clears Parliament

- NBN reports nine-month revenue up by over a third but EBITDA loss only closes by 9%

- Australian telco networks to get AU$37 million disaster resiliency boost

- NBN lines up AU$6.1 billion in bank credit