Amazon's search ad business to whittle away at Google market share through 2021, says eMarketer

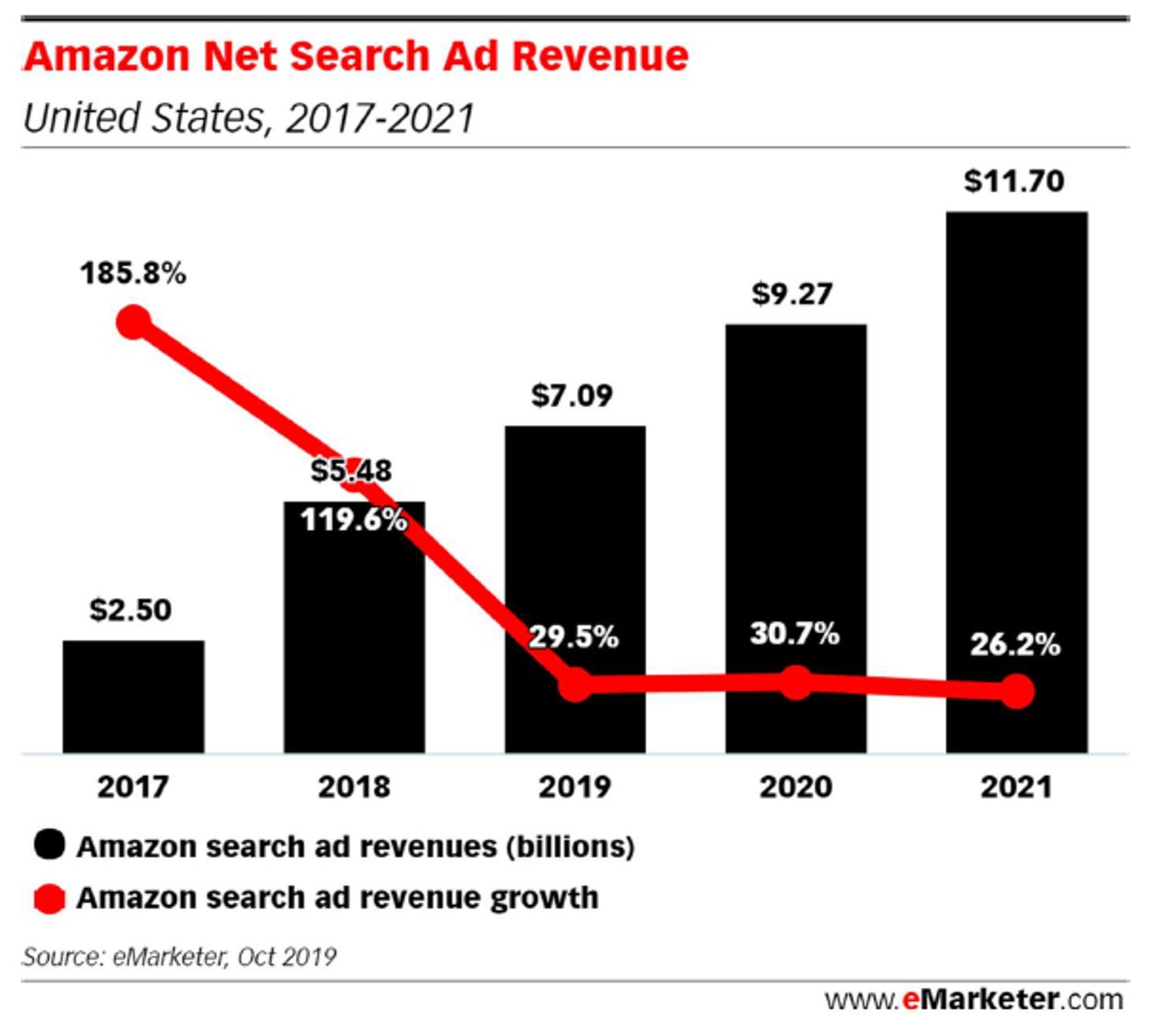

Amazon's search ad revenue will hit $11.7 billion in 2021 as it continues to take share from Google, Microsoft and other players, according to an eMarketer report.

The report finds that Google will continue to dominate search advertising, but its share will fall over time. Amazon is expected to show search ad revenue growth of 29.5% in 2019, 30.7% in 2020 and 26.2% in 2021.

Amazon's advertising business has surged past Microsoft to be No. 2 behind Google, which has 73.1% of the search ad market. Amazon will end 2019 with 12.9%, followed by Microsoft at 6.5%. Verizon Media and Yelp round out the top five with market share of about 2%.

In addition, Amazon's advertising business is closely watched among Wall Street analysts. The search ad business falls into Amazon's "other" revenue category and many analysts expect it to be a break out business like Amazon Web Services.

Google's market share in the search advertising market is expected to drop to 70.5% by 2021, according to eMarketer estimates.

According to eMarketer, Amazon's search ad growth boils down to the reality that consumers start product searches at the e-commerce vendor. And Amazon's e-commerce focused business means that consumers who are clicking on the search ads are already at the buying point. Typically, advertisers need to nurture prospective customers down the buying funnel.

Meanwhile, eMarketer said other search ad players such as Walmart, Target and eBay are also nibbling away at Google market share. The upshot is that advertisers want other search ad vendors because they need a counterweight to Google.