Assessing Salesforce's platform and ecosystem

Coming out of of the crush and excitement of Dreamforce in San Francisco last week, which has now become the second largest tech event in North America (only after CES), Salesforce sits atop an impressive growth curve, an enviable top 10 position in the industry, and what many regard as one of the more compelling cloud offerings in the marketplace. The organization is often considered one of the leading lights of progress when it comes to enterprise technology as well as business leadership, and its extensive philanthropic pursuits are well known.

Overall, the outlook continues to look good for the company: Of the aforementioned top 10 software firms, of the companies that are in the cloud, only Amazon Web Services is growing faster (70% vs. Salesforce's 24% year-over-year growth.)

Yet the outlook isn't necessarily entirely rosy. Headwinds are on the horizon as technology continues to change and companies look for new ways to digitize, yet somehow remain in control of their IT systems. The company's strict 100% public cloud policy, which has long been touted by CEO Marc Benioff, has been a long-standing issue based on my conversations with CIOs over the years, even as it offers genuinely compelling economies of scale and a real (though partial) solution to the perennial upgrade hell that plagues most IT organizations today. That's because in theory -- and often in practice -- public cloud largely offloads the substantial maintenance headache of keeping applications up to date, allowing IT to focus more of its time and resources on strategic activities like innovation and digital transformation.

Recent industry data also shows that organizations in general are growing more concerned about the control and influence of large cloud suppliers like Salesforce: The typical worries include risks such as the consequences of sole sourcing to one vendor, getting locked into a proprietary platform, and even using new enterprise solutions that are still very much maturing. These vendor issues are valid customer concerns that will likely continue as Salesforce continues expanding its product portfolio into adjacent territories and functional areas well beyond its roots in customer relationship management (CRM.)

Salesforce Well Positioned for the IT End Game: Public Cloud

Yet despite the concerns, the inexorable march towards public cloud has greatly accelerated in recent years, positioning Salesforce well for continued rapid growth over the next few years. The latest trend data available show that sometime during 2018, over half of all IT spending -- and just over half of the overall share of actual computing workloads -- will have permanently shifted to the public cloud, making it the leading operational model for running our business applications for the first time in IT history.

Other leading cloud quasi-competitors, such as Amazon's now vast set of offerings for public cloud, have focused more on the bottom of the cloud computing stack with horizontal technology services like storage and compute power. Amazon has largely let other companies, including now significantly Salesforce itself, build out the top of the cloud stack, where business applications operate.

In this regard, Salesforce offers ready-to-go off-the-shelf enterprise business apps today that are usually in the lead positions of the various analyst scoring charts. For example, Gartner's latest Magic Quadrant for CRM lists Salesforce as far and away the market leader in CRM, even though the company has only about a 20% global marketshare in the segment.

However, the company has also achieved something else important that's no mean feat: The same industry leadership is also true of the company's newer offerings as well, consistently entering new functional sectors like marketing and customer service and solution spaces like horizontal portals or social software already in the leader segments of Gartner's vendor rankings. It's the same with many other analyst scorecards. This implies that organizations that adopt the platform broadly have ready and straightforward access to best-of-breed solutions across the board by virtue of simply selecting the Salesforce platform, even as it ventures into new territories. This is a compelling and desirable value proposition to IT and business buyers both.

Because of Salesforce's reputation in this regard, as steadily offering a wide variety of leading business solutions with the very latest new capabilities baked in on a regular basis -- starting with cloud, and then over time adding capabilities for social, mobile, analytics, and now artificial intelligence -- companies often feel assured that the platform as a whole is taking them towards the future and will stay current.

Related: Salesforce Einstein: Dream versus reality

A Platform Beats an Application Every Time

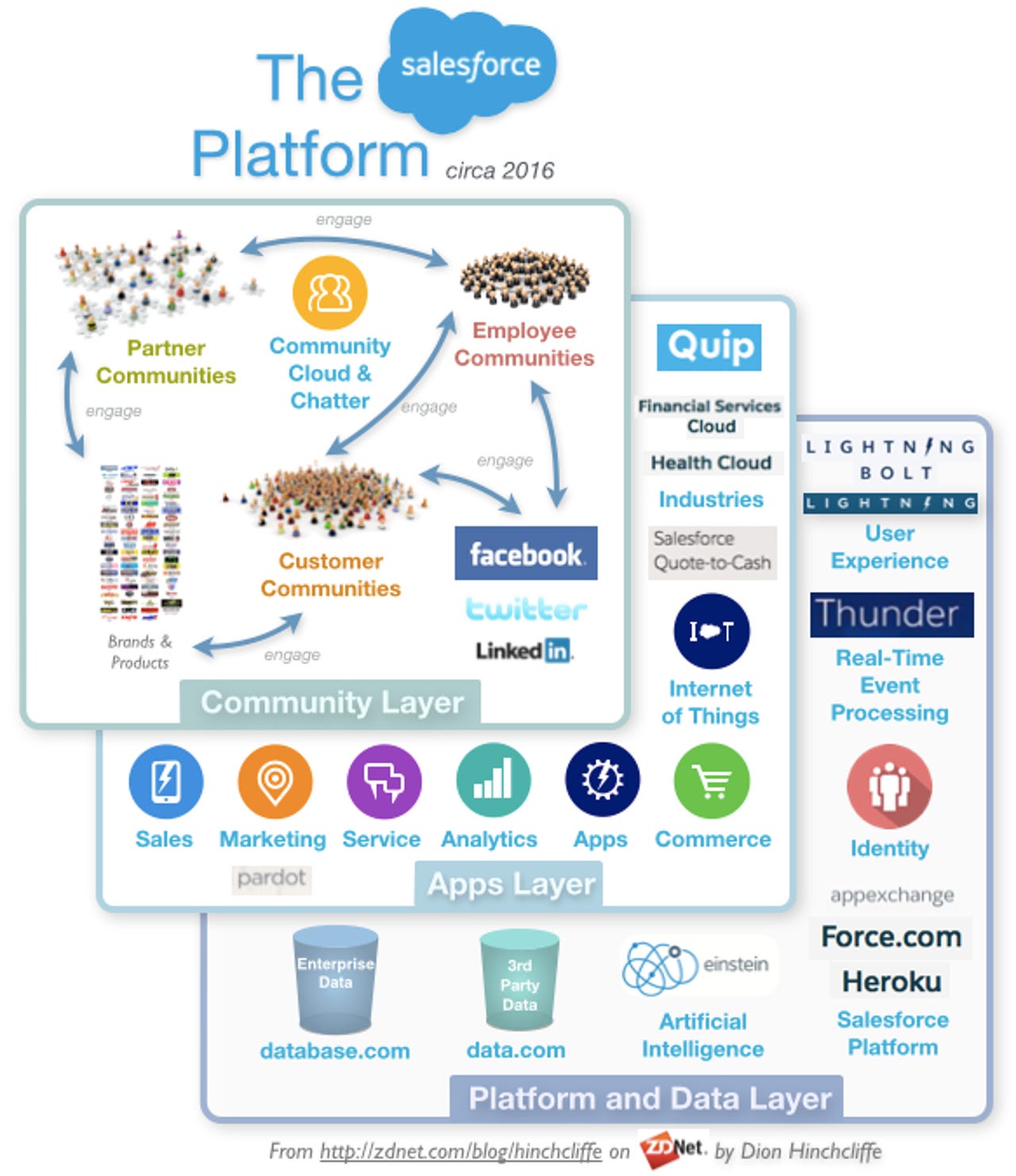

However, Salesforce hasn't stopped there. Realizing that they could never deliver all the innovation their customers needed on their own, a strategic insight that's often made by digital leaders, Salesforce was one of the very first enterprise cloud companies to open their platform to partners to develop on, well before companies like Apple and Google did something similar with their app stores. Known as AppExchange, the company's bustling online marketplace for 3rd party Salesforce solutions was launched way back in 2005, and currently offers over 3,000 business apps built on top of the company's platform, which have now been installed more than 4 million times.

This has resulted in a rich ecosystem for Salesforce that goes well beyond the traditional value-added reseller (VAR) and service provider environment that accumulates around most enterprise software companies. With thousands of software companies (ISVs) building solutions for the Salesforce platform, adding features, functions, software suites, and even entirely new industry capabilities, the company has proactively enabled the external enrichment of its platform such that it can now deliver a wider variety of business functionality than almost any other enterprise cloud company today.

Salesforce has even recently quantified the holistic economic value of its ecosystem of partners, claiming that every $1 spent on the company gains $4.14 more for them. This then is the so-called ecosystem game that the largest consumer companies in the world have long excelled at, and turned into scalable competitive advantage. But notably, Salesforce has translated this model successfully to the enterprise like few others, enriching everyone involved in the process including its customers, partners, and company itself.

An Apparent Commitment to Future Proofing

Salesforce has also not shied away from add new capabilities the market may not be fully ready for today but will be mature by the time it has caught up. Possibly the most challenging addition was the incorporation of social and community features in the platform back in 2011. At the time I wrote that it was a significant move that would position them and their customers well in the future, despite criticisms about social sprawl and stack fatigue:

It's safe to say that Salesforce has a very clear vision that is connected as much as they can to ground truth about what businesses are doing and then distilling where they think the world is going to their products. They are making a big investment in time and resources in attempting to understand the strategies, lessons learned, and best practices that businesses can just adopt by using their platform. Access to this insight merely by virtue of using the platform is going to be compelling for many.

As I recapped last year -- despite ultimately being early to the game -- Salesforce has steadily continued investment in social and has expanded well beyond its Chatter product into its Community Cloud platform. As digital engagement becomes an ever more critical differentiator for organizations, I believe the company's investment in social will likely bear some of the most fruit long term, by holding stakeholders digitally closer than any other known method. This was a brave commitment by Salesforce at the time when it's now clear that many of its customers still weren't ready for what has now become a key plank in digital experience. All of this is why I place the community layer so prominently in the Salesforce product chart above.

The Salesforce Platform: Still Room to Grow

However, despite its forward-looking product lines and robust enterprise ecosystem, the company is still far from a one-stop cloud shop. While you can acquire some of the missing capabilities by selecting 3rd party solutions from AppExchange, there are still significant gaps in Salesforce's own product offerings, despite over a decade of acquisitions and internal development of its platform. Notably missing are many of the components of ERP, which competitors like Oracle and SAP are much more focused on. Capabilities such as accounting, human capital management, supply chain management, and production management are all absent from the platform, which instead tends to focus on the market-facing side what organizations do: Marketing, sales, and customer service.

What this means is that -- for better or for worse -- Salesforce is not yet a cloud provider that can deliver the majority of what's required to run the average enterprise. Admittedly, it's not even clear if this is a strategic goal of the company. But to sustain the platform as it gets larger, and for it to become the industry's ultimate cloud provider for business applications in general, it will likely be encouraged to expand into these areas and others.

So, for organizations that want to move towards the public cloud today, additional partners beyond Salesforce are still required. This then almost certainly highlights potential future directions for the company. It now seems hard to imagine, given its growth into new major corporate functions in recent years, that the company will not eventually expand into the back office and digital workplace when the time is right. For now, however, acquiring one of the the market leaders in ERP, for example, seems unlikely. At least not until the company gets significantly larger and has the resources for such a significant investment.

Thus Salesforce will probably bide its time until either a second tier smaller player breaks out, FinancialForce gets major traction in the ERP space (which Salesforce has an equity stake in), or the company is finally in the position to reshape the top of the industry through a merger or acquisition.

Looking at last week's announcements at Dreamforce can also give us some indication of where Salesforce will decide to go next. Their acquisition of Quip was the most significant move yet for the company into the digital workplace and workforce productivity tools, showing potential interest in moving into the office software space. The addition of Einstein to put artificial intelligence capabilities into the core of the platform shows how the company is future proofing for capabilities that will have competitive significant in the future. Another interesting highlight is the company's continued investment in Internet of Things via its IoT Cloud offering, another addition to the platform that doesn't seem related to its core CRM mission, though the reality could not be further from the truth.

At the end of the day, it's clear that Salesforce appears fully committed to creating the richest, market-leading cloud platform for business software in the industry, out-maneuvering traditional competitors like Oracle and Microsoft when it comes to offering the capabilities that business that will need in the near future. While its market-facing emphasis still means that the platform isn't going to run an entire business -- at least not for a few more years -- it's clear that the company has big plans for the future. In any case, much of what's missing can be sourced in its ecosystem, and as a result has already long become mainstay in many large enterprises.

Ultimately, however, it's perhaps an emerging new mantra from the company that is the most compelling. As I noted in my live blogging of the details of Benioff's keynote at Dreamforce last week, simplicity is a new focus for the company in the face of the growing complexity of its market, its customers, and its products. Benioff pointedly said on stage last week in San Francisco, "We want to take all the complex things in the world and make them easy." That's a technology vision that most organizations could get behind today.

Additional Reading

The leading enterprise intranet, portal, and collaboration platforms for 2016

Salesforce poised to grab more spending as customers eye cloud integration