AT&T Q3 mixed, outlines 3-year plan

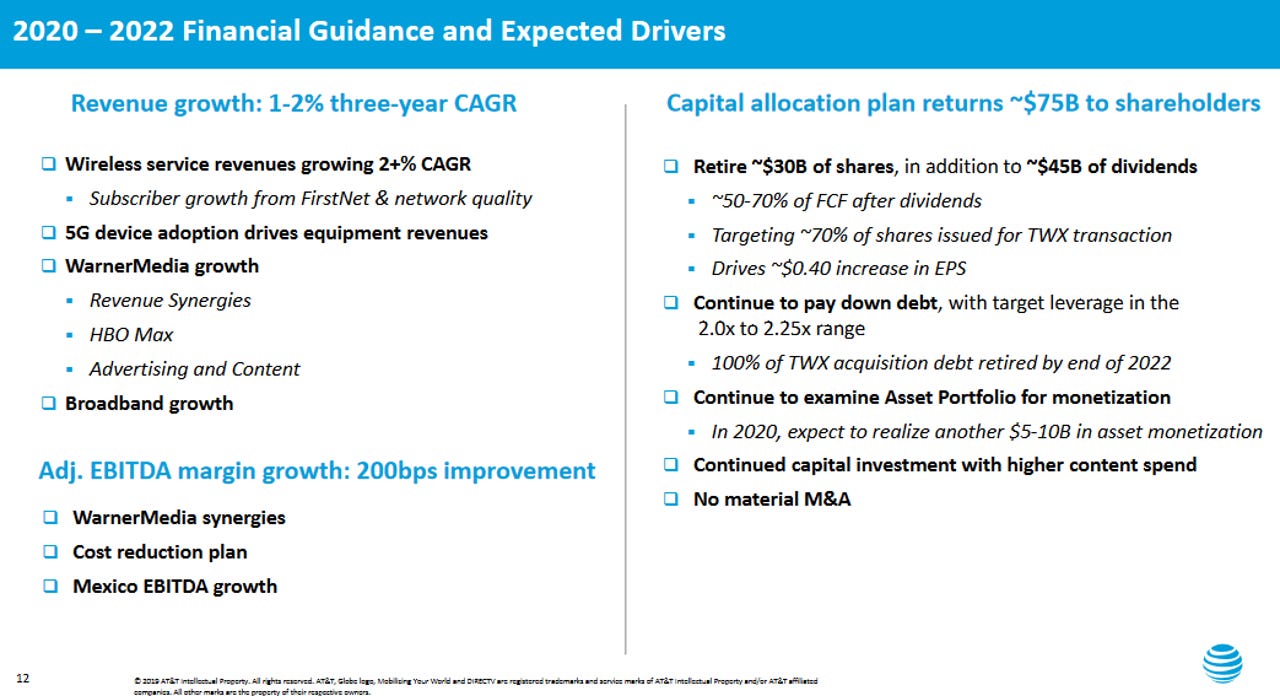

AT&T's third quarter was mixed as the company laid out a 3-year plan that calls for 1% to 2% revenue growth a year with improving margins due to cost reductions and more focus.

The wireless and media giant reported third quarter earnings of 50 cents a share on revenue of $44.6 billion. Non-GAAP earnings were 94 cents a share in the third quarter. Wall Street was expecting AT&T to report non-GAAP earnings of 93 cents a share on revenue of $45.11 billion.

Verizon's Q3 insulated by B2B wireless net adds as it scales 5G rollout

AT&T's 3-year plan gives Elliott Management, an activist investment, some of the items the firm wanted. CEO Randall Stephenson said the company will grow earnings and EBITDA each year with free cash flow accelerating over the plan.

In addition, AT&T said it would review its portfolio and divest non-strategic assets. AT&T also said it wouldn't make any major acquisitions. The company also plans to pay down its debt, buy back shares and maintain its dividend payments.

For 2020, AT&T said it expects adjusted earnings to be $3.60 to $3.70 a share and improve to $4.50 to $4.80 in 2022. The earnings include investments in HBO Max.

While AT&T outlines its plan, its wireless business added 255,000 net phone adds in the third quarter. Wireless service revenue was up 0.7%.