Atlassian Q2 fares well on collaboration demand, server products to shift to cloud

Atlassian delivered better-than-expected fiscal second quarter results as demand for collaboration software continued to surge.

The company, best known for its Jira Service Management software, reported a second quarter net loss of $621.5 million, or $2.49 a share, on revenue of $501.4 million, up 23% from a year ago. Adjusted earnings, which exclude expenses due to exchanging senior notes, were 37 cents a share for the second quarter.

Wall Street was expecting Atlassian to report second quarter revenue of $471.66 million and non-GAAP earnings of 32 cents a share.

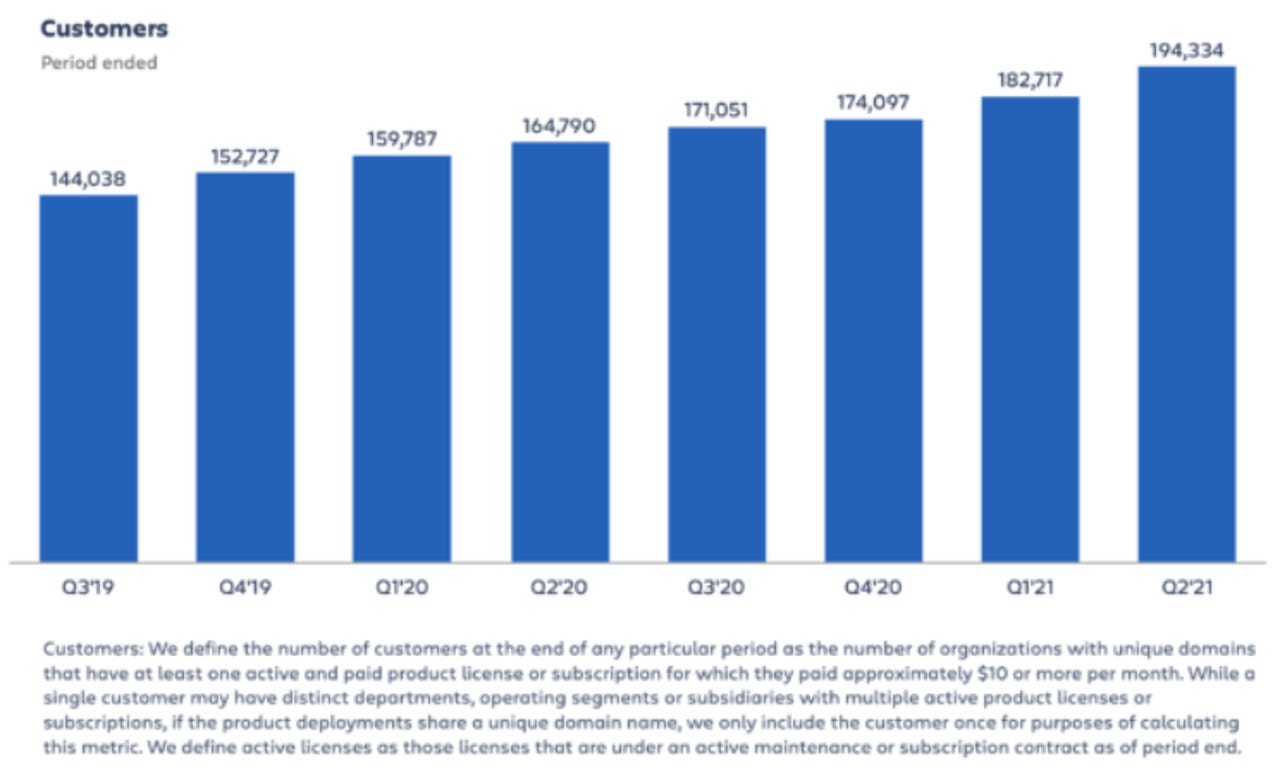

Scott Farquhar, Atlassian's co-founder and co-CEO, said "total customers rose to 194,000."

During the quarter, Atlassian launched Jira Service Management and moved to a cloud model by ending new server license sales and scaled the customer base. Atlassian will end new server license sales Feb. 2 and end support for all server products Feb. 2, 2024.

- Atlassian to end sale and support of on-premise server products by 2024

- Atlassian brings new machine learning capabilities to Jira, Confluence platforms

- Atlassian touts future of work will be underpinned by flexibility and choice

As for the outlook, Atlassian projected third quarter revenue of $475 million to $490 million with a non-IFRS earnings range of 20 cents a share to 21 cents a share. Wall Street was modeling third quarter revenue of $472 million with non-GAAP earnings of 25 cents a share on a non-IFRS basis.

In its shareholder letter, Atlassian added more color about the third quarter.

In Q3, we continue to expect the overall server revenue growth rate to decline from Q2. That said, with the end of new server license sales and on-premises price changes effective February 2, 2021, we expect some server customers will purchase additional licenses and early renew their maintenance contracts. We did observe a modest amount of early renewal activity in Q2...

Subscription revenue will be the primary driver of growth. We expect to achieve subscription revenue growth in the mid-30%s consistent with the mid-term fiscal 2021 and fiscal 2022 targets articulated at Investor Day.

While the initial leading indicators are encouraging, migrations will have only a modest impact on fiscal 2021 revenue. We continue to expect this revenue driver to build steadily over time. As shared at Investor Day, we expect half of our server customers will migrate in fiscal 2023 and beyond. It's important to note our assumption that medium and large-sized customers, which have a greater impact on revenue, will take more time to migrate than smaller customers. Of this cohort, we estimate that approximately two-thirds will migrate after fiscal 2022.