Break up no strain on our IT: NAB

The National Australia Bank (NAB) has denied suggestions from analysts that the success of its "break-up" campaign has caused strain on its IT infrastructure, leading to multiple instances of batch processing delays.

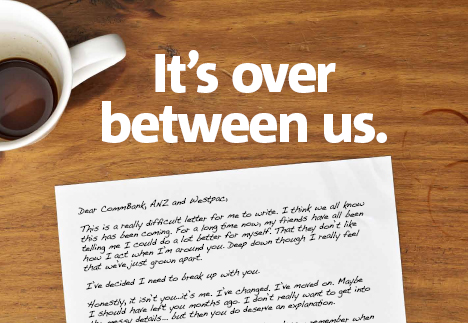

NAB's "break-up" letter (Credit: NAB)

Matthew Oostveen, senior program manager, infrastructure, with analyst firm IDC, believes that the influx of new customers from the public "break-up" campaign added to the existing customer base has caused the bank's IT infrastructure to sag.

"There has been a rapid expansion of NAB's customer base with the aggressive marketing ... and there's been large amounts of customer migration towards the bank from other banks.

The theory is that the bank has not been able to keep up with the influx of new customers," Oostveen proposed.

NAB told ZDNet Australia that in the first three weeks of the campaign, it has attracted:

- a 20 per cent increase in new transaction account openings;

- a 50 per cent increase in credit card applications;

- a 35 per cent increase in mortgages enquiries; and

- a 45 per cent increase in mortgage re-finance applications from customers of other banks wanting to switch to NAB.

NAB has refuted Oostveen's theory, saying that there's nothing of the sort going on.

Whether or not the bank's issues were due to its popularity, Oostveen said that organisations should beef-up the technical backbone at the same time as ramping up efforts to attract new customers.

"All the banks are trying to upgrade their infrastructure and the hardware that sits on the datacentre floor as well as the facility itself, but if you start throwing a lot of your customers [at your infrastructure], you need to start beefing up that cascade," he said.

Being able to power, cool and install new server infrastructure is crucial to keeping customer transactions flowing, he added.

Meanwhile, another analyst believes that NAB's public "break-up" campaign may come back to bite it if they are unable to keep customers happy.

Harry Senlitonga, senior analyst for Datamonitor, believes that while customers switch banks for lower fees and a better deal, they may quickly leave again if plagued by technology issues.

"Banks can compete in pricing to a certain extent. Moving forward and when the pricing market becomes saturated, technology becomes the differentiating factor," Senlitonga said.

"We should expect more people to switch due to technology," he added.