Commonwealth Bank backs Backr as the answer for small businesses during COVID-19

The Commonwealth Bank of Australia (CBA) launched X15 Ventures in February, dubbing the initiative as a "venture building entity". But at its very first investment committee meeting straight after launch, X15 was challenged: How was the business going to respond to COVID-19?

The first answer to that, X15 managing director Toby Norton-Smith said, is Backr.

"Backr is a platform that will enable any aspiring entrepreneur, freelancer, future small business owner to launch their business and to launch it in the right way," he said during a briefing with media on Tuesday.

Aware of the challenges and the "emotional leap" required to launch a small business, Norton-Smith pointed to statistics showing that while about 350,000 businesses are launched each year, only about 60% survive beyond the second year.

"We see that and we have the benefit of seeing firsthand some of those experiences in the data from our relationship with CommBank," he said. "I think those challenges, but potentially opportunities, have only grown in the new normal that we're facing."

See also: Launching and building a startup: A founder's guide (free PDF) (TechRepublic)

Norton-Smith said questioning the viability of a plan upfront is going to be more challenging than ever before, but being online from day one, or being online only, should be of key importance.

"How do I think about the new obligations and regulations that are out there and all the sort of raft of benefits and incentives that government and corporates are pushing at me," he said.

According to Norton-Smith, the intent of Backr is to be one source for a small business founder to move right through from plan to profit.

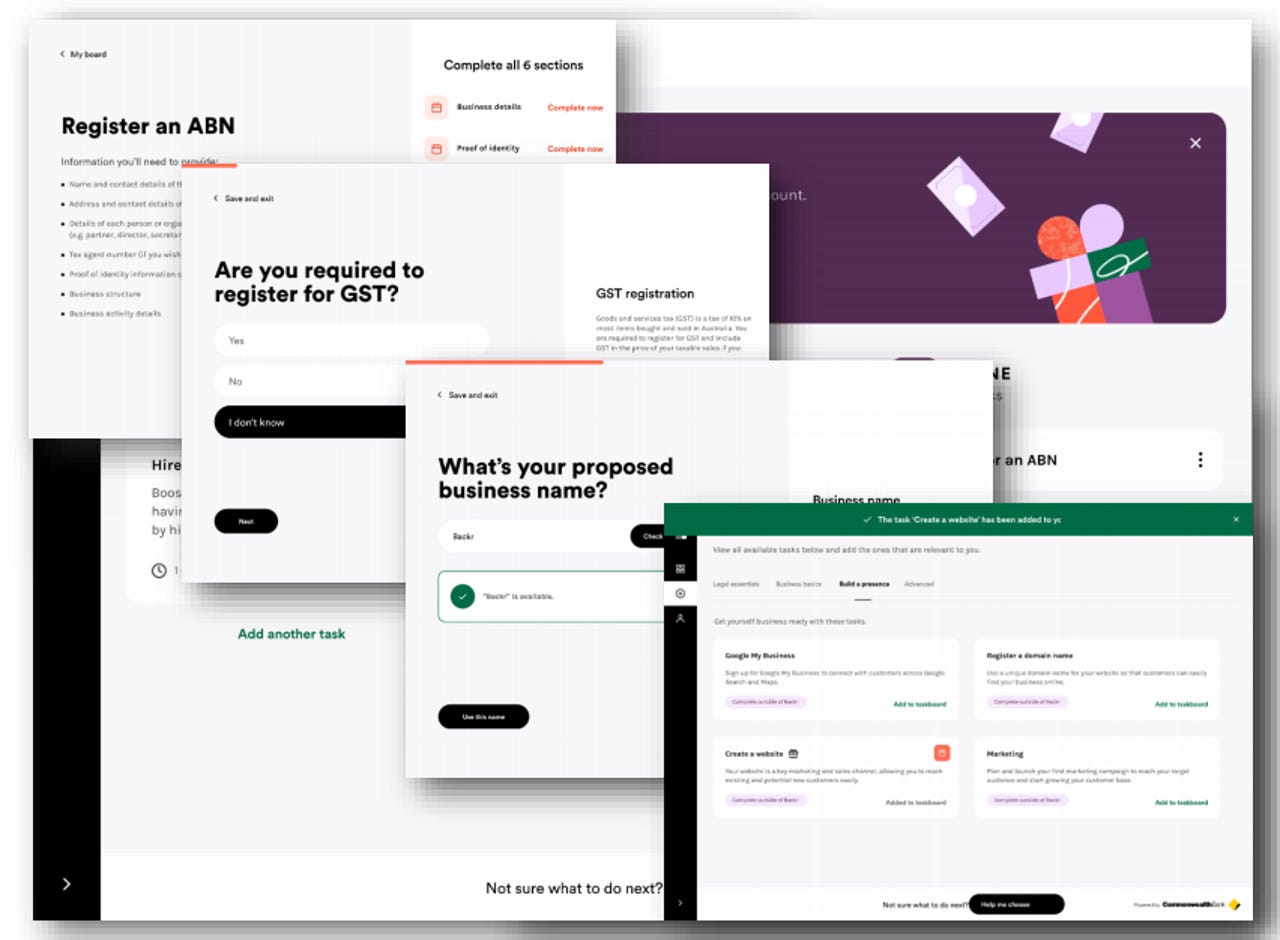

The app offers a digital, task-based approach to starting a small business, guiding business owners through the process step-by-step, from business name registration and getting an ABN, to creating a business plan.

Backr leverages APIs made available from government and corporates rather than referring customers out, as a bank otherwise would.

Backr will start with the trades and freelancers space, with Norton-Smith saying they are both very relevant industry segments amidst COVID-19.

"I think we all know someone right now who's thinking about a side-hustle or thinking about a bit of a shift in career," he said.

For every eligible small business that has started in Australia from now through to the end of the year, and signs up to Backr, CBA said it will deposit AU$500 into their account.

The X15 portfolio stands at four ventures, with Norton-Smith saying the aim is to have six in market by the end of its first 12 months.

In addition to Backr, the portfolio includes business insights startup Vonto, house buying guide Home-In, and credit score-focused CreditSavvy. CreditSavvy is live, with Vonto and Home-In to be launched soon.

Norton-Smith said X15 is also building out a "strong pipeline" of opportunities, in particular with external entrepreneurs and VCs.

CBA has also committed $10 million to the most recent funds for both Australian-based Square Peg and US-based Zetta Venture Partners to support the sourcing, scaling, and financing of local fintechs for X15, as well as the development of emerging artificial intelligence businesses in Australia.

"First and foremost we are very clearly here to build some valuable Australian businesses and that's why I'm incredibly excited today that Square Peg and Zetta have agreed to partner with us on that journey," Norton-Smith said.

"We know that their external perspective, relationships, talent, and ultimately, challenge is what we're going to need to sharpen our portfolio and then re-sharpen it again and again and again. Our objective is to be successful in Australia, but I also think with their judgment you know we'll keep an eye on where selectively a proposition could scale; an Australian venture could go to a global audience."

RELATED COVERAGE

- The plan for Australia's first Indigenous-focused startup accelerator Barayamal

- First Australians Capital pledges to help Indigenous entrepreneurs succeed

- LaunchVic chips in to help Victorian angel groups assist over 40 early-stage startups

- CBA jumps on ANZ, NAB, Westpac-backed Slyp for digital receipts

- How startups can position themselves for growth in the next normal

- Pivot, not panic: How startups are coping with the coronavirus crisis