Could IBM's falling revenues turn around next year?

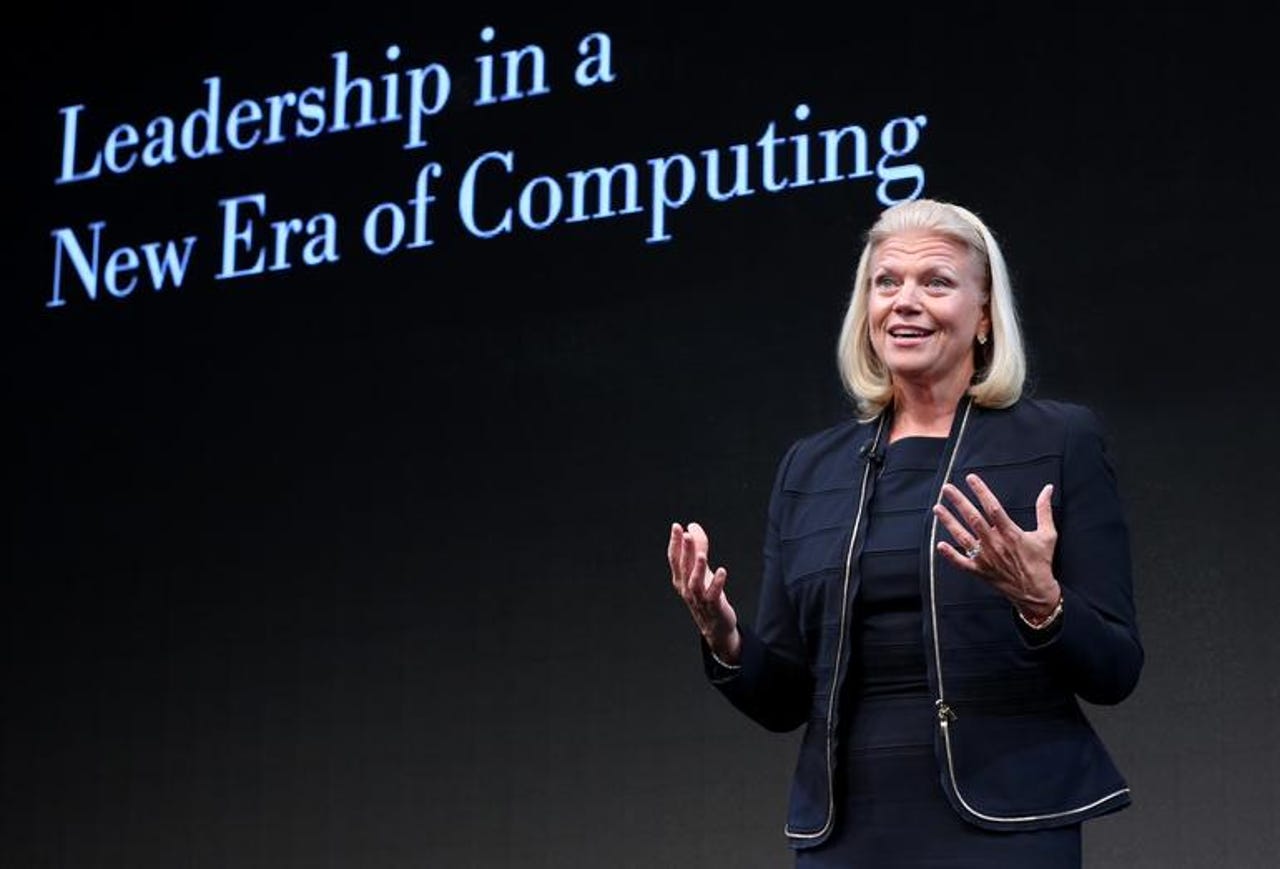

IBM CEO Virginia "Ginni" Rometty has led the company's decline since October 2011

In a recent post, I pointed out that IBM had registered 20 consecutive quarters - five whole years - of revenue declines. The once-mighty Big Blue's annual revenues peaked at $106.9 billion in 2011 before slumping to $79.9bn today, and I wondered if it would ever see $100bn again.

I did intend to return to this topic, but somebody has beaten me to it. Thomas Pangia has just posted calculations at the investors' website SeekingAlpha, suggesting that IBM's revenues will grow again from 2018. Further, he reckons the company will have revenues of more than $100bn in 2024.

If you follow IBM, you will know that it has been following a simple strategy based on what it calls "strategic imperatives". The strategy is to run down or get rid of low-margin businesses and invest in high-margin businesses, thus increasing its profitability.

In the past, it has spun off or otherwise disposed of its businesses in printers, PCs, x86 servers and hard drives, and it paid GlobalFoundries to take away its chip business. IBM has also bought more than a hundred companies, including SoftLayer, which is a cloud business.

Pangia made the calculation I intended to make. Assume that the "historic" IBM businesses continue to decline while the "strategic imperatives" keep growing and see where they cross over. Pangia assumes that the traditional business will keep falling by 10 percent a year, which is more than reasonable. He also assumes that the "strategic imperatives" will grow by 13 percent a year, which is a bit bigger than I would have chosen. Either way, the resulting projection is as follows:

Year ..... IBM Revenues

2016 .... $79.9

2017 .... $79.5

2018 .... $80.0

2019 .... $81.7

2020 .... $84.4

2021 .... $88.2

2022 .... $93.3

2023 .... $96.9

2024 .... $101.3

2025 .... $106.6

2026 .... $112.7

If Pangia is correct, IBM will finally surpass its 2011 peak revenues in 2026.

There are not many technology companies where you'd be impressed if they could get back to where they were after 15 years, but IBM may be an exception.

Since Pangia is writing for potential investors, his post includes a lot more information about cost of capital, cost of debt, free cash flow, fair value range and other stuff. You can use his numbers at your own risk.

Pangia describes himself as "a chemist and part-time investor," and as one of the comments to his post says, "good luck with your 'catch a falling knife' approach to investing".

As I have noted here before, I am totally unqualified to give financial advice, so I don't. Any predictions I may accidentally have made in the past have been staggeringly wrong. No sensible person would trust me with their lunch money.