COVID-19 pandemic leads to sharp drop in Q1 PC shipments

According to GartnerDespite some pockets of demand for notebooks driven by remote employees and e-learning students, the COVID-19 outbreak seriously disrupted both supply and demand in the PC market in the first quarter of 2020, according to IDC and Gartner.

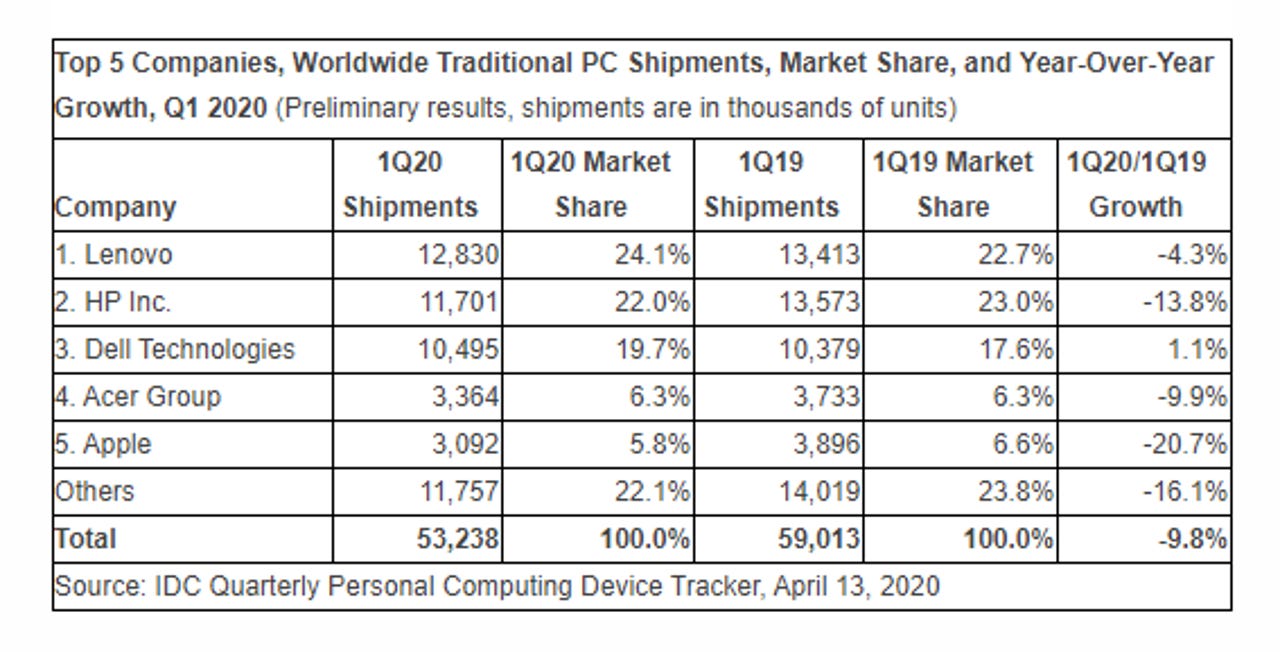

The global PC market declined 9.8 percent year-over-year, according to IDC, reaching a total of 53.2 million shipments. According to Gartner, worldwide PC shipments in Q1 totaled 51.6 million units, amounting to a 12.3 percent decline year-over-year. Gartner called it the worst decline since 2013.

Gartner and IDC define the PC market slightly differently: Gartner's data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads. IDC counts desktops, notebooks (including Chromebooks) and workstations, but not tablets or x86 Servers.

IDC attributed the Q1 drop in sales largely to supply problems that arose from the extended closure of factories in China in February, along with logistics and labor problems toward the end of the quarter. Demand was up in the quarter, IDC reports, as employees sought to upgrade their PCs to work from home and gamers looked for new devices.

Gartner research director Mikako Kitagawa concurred, saying in a statement that the supply could not keep up with "sudden pockets of PC demand for remote workers and online classrooms that PC manufacturers could not keep up with."

Lenovo, HP and Dell remained the top there vendors globally, according to both research firms. No. 3 vendor Dell actually managed to marginally grow its sales year-over-year, while all other top vendors saw sales decline.

Lenovo took a particularly hard hit in the Asia Pacific region, as did HP.

Overall, the Asia Pacific region saw a double-digit decline in shipments in Q1, due in large part to the shutdown of business activities in regions of China. Europe, Middle East, and Africa (EMEA) saw a single-digit decline in shipments.

In the US, Gartner reports sales were effectively flat, while IDC reports a 4 percent decline. IDC expects the notebook market in the US to contract by more than 8 percent.