Disrupting insurance: data-driven customer value

Insurance is big business. Life insurance in the US alone amounts to a total value of life direct premiums of US$ 552.51 billion by a total of more than 800 companies. It's also a business that seems like a natural match for big data applications, as some of its core functions like estimating customer value and using various channels to reach out and interact with them can be tied in to a multitude of data points and produce yet more data to be fed back into the process.

Surprisingly, there seems to be a lack of data-driven products targeting this market. According to Dror Katzav, CEO of Atidot, it's a sort of catch 22 as the volume and complexity of data that is relevant for the domain make it hard to approach. That is precisely what Atidot is out to address: their goal is to bring data-driven decisions in the insurance industry.

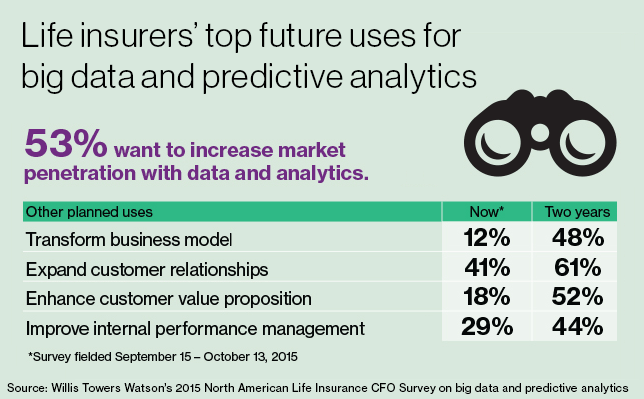

The insurance industry seems ripe for disruption. Image: Willis Towers Watson's 2015 North American Life Insurance CFO Survey on big data and predictive analytics

Customer value

Atidot just launched their SaaS solution, initially focusing on life insurance. The use cases they primarily address at this point are centered around customer value.

Atidot collects and integrates data that can help estimate customer value for insurance companies, and uses that data to generate customer value projections. Building on that, it helps insurance companies formulate and execute different strategies.

Atidot wants to help customers with client development, retention, underwriting and pricing. It can create profile groupings of policyholders by analyzing features such as age, occupation, gender, payment method or average salary for their geographic location. This gives clients an insight into the predicted behavior of their policyholders, so they can adjust their strategy accordingly, for example by pursuing upselling or retention.

Katzav mentioned an example from a customer whose goal was to increase market share. Based on the estimated value of their targeted customers, Atidot generated 2 alternative strategies for reaching out to customers: one focusing on volume and one focusing on value. Each strategy has its own characteristics in terms of targeted demographics, occupations, geographies, premiums and channels.

Atidot also wants to help clients shape and execute strategies. The goal is to enable stakeholders like actuaries and underwriters to work together to define features that are important for shaping strategies, and to enable marketers to use different channels and messages to reach out to customers - something that they are currently working on adding in their offering.

Estimating customer value in insurance depends upon a number of data features. Image: Atidot

Premium data

But how does it all work? There is a number of building blocks and related challenges for a solution like this.

It all starts with getting relevant data. Atidot works with data coming from their clients, but also uses external data sources and integrates them to add value. Client data may be coming from CRM systems or other sources, external data may involve for example combining statistical and geographical data to estimate customer net worth based on their place of residence.

Data integration and cleansing is an important building block for such an approach, and Atidot claims that users can load data in Atidot's platform where it will be automatically cleaned and sorted. That seems like a tall order, considering that even companies like Trifacta whose core business is data wrangling do not claim to completely automate that process.

In fact, Atidot's approach is similar to Trifacta's. Atidot has been working with a number of clients from the insurance domain for the last year. They have been using data from those clients to feed Machine Learning (ML) algorithms.

That data has been labelled and used to train the algorithms to gradually learn to recognize what incoming data is about using supervised learning approach. Having trained the algorithms, new features can also be identified using unsupervised approaches.

It's a reinforcement loop, where the more (and better labelled) data you have, the better the algorithms perform, the more data they are able to assimilate, the better they get. But is it to the point where it's turn-key?

Katzav says that "for any company we work with, a certain amount of data has to come from them. For supervised learning, the labels should come from their systems - like rates and premiums. Based on that, you can build a model and then make projections".

And that is what it really is all about. Data integration and classification are necessary building blocks, but the value comes from being able to predict customer value.

Training predictive models requires data, but the more the model is trained the better it gets at handling even more data. Image: Atidot

Where did that come from?

Predictive analytics - that's the secret sauce. Or is it?

Predictive analytics and ML are becoming household names, the insurance business is not exactly a nascent one, so it's hard to believe nobody thought of that before. While there have been initiatives to apply predictive analytics in the insurance domain, they are few and far between. And none of them has resulted in a product yet. Katzav offers some explanations.

The first has to do with algorithms and complexity.

"While many generic algorithms are out there, answering industry-specific questions has only started to emerge lately. In this industry we have not seen anything like this yet because of the complexity: the amount of data, the big number and different types of features, the tweaking and the manipulation it takes to get the right model that speaks the right language to be able to answer our questions" he says.

Apparently there have been others doing similar work though. So why Atidot, and what gives them an edge?

"Ours is a product, not a service, and that makes a difference" says Katzav. "Atidot has been working with a number of clients in different geographies and segments, ranging from market leaders to niche players. We are the first to market, we have already built the models, and we are getting better all the time by getting more data and better models" he says.

But that's not all there is to it. "You need to build the right team to be able to deliver such a solution - you need domain experts and technical experts. We have the right team" says Katzav. That may actually be closer to home. Yes, Atidot does seem to have a good mix of expertise and experience onboard. But then again, that same mix could have been ignited anywhere else.

Atidot was founded in 2016 by Dror Katzav and Barak Bercovitz, both of whom served in the technological unit of the Intelligence Corp in the Israeli Army, and Assaf Mizan, former Chief Actuary at the Israel Ministry of Finance. It has raised capital from the D.E. Shaw Group and other fintech VCs.

Maybe the fact that Tel-Aviv-based Atidot -whose name means "fortune telling" in Hebrew- comes from what has been called a "startup nation" has something to do with its ambitions, maybe not. While it's still early days, Atidot does not seem to lack in disruptive potential. It will be interesting to see how it plays out.