For Intel, the PC business is just fine

Intel’s latest financial results show the chipmaker is weathering the PC slowdown nicely. The company grew both sales and profits at a faster rate than expected, and for the first time it shipped more than 100 million processors in a single quarter.

News stories suggest this is because Intel is diversifying into new areas, in particular mobile devices and the so-called Internet of Things. The reality is that these “growth areas,” while important, are still very small. Intel barely booked any revenues in mobile and it is now losing more than $1 billion per quarter on the business as it seeks to break ARM’s grip on tablets and smartphones. The Internet of Things generates lots of headlines but is still less than 4 percent of sales.

The truth is that most of Intel’s business still comes from chips for PCs, which generated 63 percent of revenues and more than 90 percent of operating profits in the most recent quarter. Overall, shipments of PC processors grew 15 percent compared to the same period a year ago. Notebook shipments were particularly strong, growing 21 percent; desktop growth was slower but on average Intel was selling those chips for a higher prices than a year ago.

All of this comes in a quarter which the marker research firms have said was slightly down compared to a year ago. IDC said worldwide PC shipments totaled 78.5 million units, a decline of 1.7 percent, while Gartner said the market was roughly flat at 79.4 million units. So the question is how is Intel managing to grow so much faster than the broader PC market?

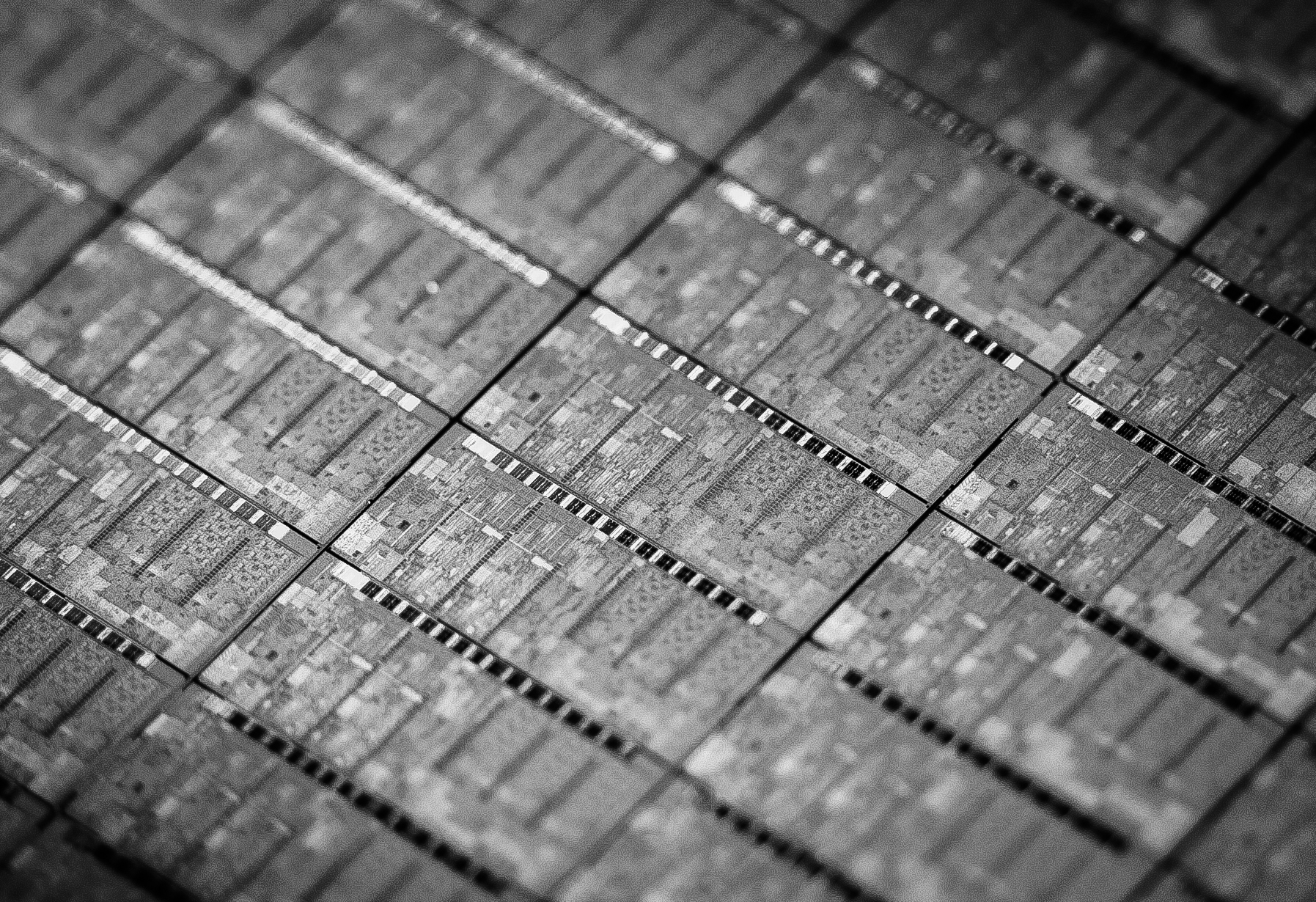

Intel had several explanations for this. First, its 22nm manufacturing process is so mature by now that it can crank out chips at very low cost. This has enabled Intel to compete for the lowest-cost systems such as Chromebooks and HP Stream laptops without sacrificing margins. After a delay, the first systems with 14nm Core M processors will be available by the end of the month. Second, its customers are now building up some inventory in anticipation of a decent holiday season. Finally, Intel executives said they gained market share. The company downplayed this a bit, but given how much faster it grew than the overall PC market, Intel may have gained a lot. We’ll get a better sense of just how much when AMD reveals it latest results later this week.

The data center—an area where Intel already has a dominant market share—continues to be a bright spot as well. Sales of chips for servers grew 16 percent and it accounts for 42 percent of Intel’s operating profits. The recent release of the Grantley-EP platform, with the Xeon E5-2600 v3, is responsible for much of this growth.

All this isn’t to say that Intel isn’t making progress in new markets. The company seems to be on track to reach its goal of 40 million tablets this year. Tablets based on a cheaper version of its Bay Trail Atom processor should be available soon, followed by a new 14nm chip (Cherry Trail) and the first smartphone processors with integrated 3G wireless by the end of this year with a 4G LTE version due next year. Intel’s deals to develop mobile processors with Rockchip and Spreadtrum should also help it break into China.

It is still early days for the Internet of Things but Intel announced the $50 Edison developer board at last month’s developer forum and it has been rushing to develop wearables such as the MICA smart bracelet, Basis Peak fitness band and SMS Audio BioSport in-ear headphones.

These aren’t big enough yet to make a real difference in the company’s results. Despite all the talk, Intel remains a PC and server processor company, and it’s still too early to tell whether it can finally make meaningful inroads in mobile. But it is impressive to see how Intel has used its technology and manufacturing to outrun the PC market, while simultaneously preparing the company for a different future.

See also: