Google QuickBooks 2007: Death of Yellow Pages, local newspapers?

In “Done Deal: Google partners with Intuit QuickBooks for $120 billion SME ad spend” I present the $120 billion small business market opportunity Google is targeting via its integration of Google advertising and listing services in the next release of QuickBooks.

In announcing the deal, Google CEO Eric Schmidt and Intuit CEO Steve Bennett touted impressive sounding Intuit market penetration numbers and small business statistics:

More than 25% of small businesses use an Intuit product

3.7 million active QuickBooks customers

2.3 million active Quicken customers

50% of small businesses do not have a Web site

Google and Intuit would like us to conclude from their numbers that upon the release of QuickBooks 2007 this Fall, Google will be on its quick and sure way to adding millions of small business customers to its AdWords conquests, displacing traditional small business advertising vehicles such as the Yellow Pages, local newspapers…

Not so fast, literally:

1) The 6 million installed Intuit user base has no direct impact on Google’s QuickBooks 2007.

2) Intuit’s Quicken customers are not impacted by QuickBooks’ Google integration.

3) Intuit must sell new units of QuickBooks 2007 and upgrades to QuickBooks 2007 for Google’s integration to be available to Intuit customers.

4) Intuit sold 1.4 million units of QuickBooks last year and projects 1.5 million unit sales this year.

5) Google must convert QuickBooks 2007 users into Google customers.

How enamored of Google’s integration in QuickBooks will Intuit’s customers be, however?

Will the new “Google icon” in QuickBooks be welcomed as a small business marketing savior, or shunned as a Google intrusion into their private business affairs?

Schmidt and Bennett tout:

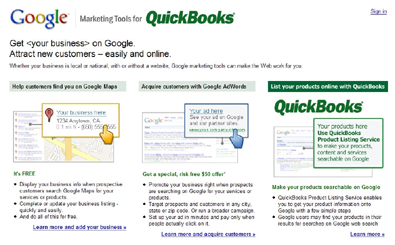

QuickBooks 2007 will include several services that provide an easy way for small businesses to use Google to get their businesses and products noticed on the Internet – right from an icon on the QuickBooks Home page.

Schmidt and Bennett will even have small business believe that Google wants to market them and obtain new customers for them, all free of charge:

Google AdWords Starting with $50 in Google AdWords credits, QuickBooks users can use AdWords to advertise themselves online.

Google Maps – Businesses using QuickBooks can more easily be found online with a free business listing.

QuickBooks Product Listing Service- Product-based businesses will now have the ability to turn local shoppers into their customers with the new QuickBooks Product Listing Service, which will be in Beta at time of the QuickBooks 2007 launch. Small businesses can let online shoppers know they carry a specific product by using this service to make their merchandise searchable on Google through Google Base.

Google’s touted “free” marketing of small businesses, however, can actually be likened to a “bait and switch” scheme, as I discuss in “Done Deal: Google partners with Intuit QuickBooks for $120 billion SME ad spend”:

Google “free” business listings services and Google Base listings are merely vehicles for Google to obtain SME content, cost free, with the goal of selling the content owners AdWords.

In “Google Verticals vs. Google.com: What is Google's end-game?” I put forth Google’s shrewd third party content exploitation strategy: Google aims to obtain, control and own more content, cost-free to Google, for inclusion in its core search product via a no-cost content acquisition strategy through various Google Verticals…

The allure of surfacing “Google Base content in Google search results” is attracting more content uploads to Google from content owners. Once Google obtains and controls content owners’ content, however, a Google AdWords pitch is what is often surfaced.

I also present in “Done Deal: Google partners with Intuit QuickBooks for $120 billion SME ad spend” the data security risk Intuit customers expose themselves to due to the Google integration:

Google will have direct access to the confidential financial, inventory, client, employee and sales data of QuickBooks users. In “Next Google Apps targets: Intuit QuickBooks, MS Money?” I enumerate the sensitive data exposure risks to organizations:

A Google hosted financial application, in fact, might very well represent the most ominous of Google’s prospective collection, analysis, archiving and retention of organizations’ and individuals’ private data:

Client Lists, Vendor Relationships, Contractual Agreements, Salary Negotiations, Tax Returns, Asset Base, Liability Profile, Insurance Policies, Inventory Levels, Sales Records…

Google CEO Eric Schmidt unwittingly made a telling remark during the conference call announcement today of Google’s direct integration in Intuit’s QuickBooks:

'All of your (QuickBooks user) critical data stored in a server in the Google cloud.'

In “Google wants $10 billion local online ad spend” I reveal Google’s past unsuccessful collaborative attempts at cracking the small business advertising market:

“In “Google targets $100 billion Yellow Pages industry?” I discuss how Google’s self-serve ad sales model has not succeeded in penetrating the local advertising market:

The strength of a traditional Yellow Pages publisher is its vast sales force network of “feet on the street” calling upon local small businesses. A “feet on the street” sales strategy does not come cheap, but it is often what is necessary to reach, and acquire, local merchant accounts. While Google’s advertiser self-provisioning system is cost-effective, it has not been overwhelmingly adopted by the millions of small businesses in the U.S.

Verizon SuperPages.com partnered with Google earlier this year to marry its sales channel opportunities with Google's vast advertising network. The marriage has apparently not been consummated, however. Google's Sandberg on percentage of Google search advertising revenues that is local:

'We don’t release specific numbers, local advertising is part of our revenue certainly but we think it is a much smaller part than we think it could be in the future.'

Google has been unsuccessful to date in capturing the small business advertising market on its own and in collaboration with a direct sales partner; Its alliance with Intuit does not present itself as a sure fire way to improve its track record.

Contrary to Schmidt’s beliefs, savvy small businesses are not waiting impatiently for Google to give them a turnkey desktop icon enabling Google to fetch all of their company financial information to do what it likes with.

Contrary to Schmidt’s beliefs, savvy small businesses are not waiting impatiently for Google to give them a turnkey icon on their desktop so they can get sucked into the Google-centric AdWords raise your bid continuously auction scheme.

Schmidt is hoping to lure Intuit’s small business customers by declaring AdWords is:

Currently used by hundreds of thousands of businesses worldwide to gain new customers in a cost-effective way.

AdWords may be a Google money machine, but hundreds of thousands of businesses world wide is not an impressive penetration of the world wide advertising market and Google’s QuickBooks 2007 is not setting itself up as a vehicle which will radically improve Google’s low rate of small business adoption.

At the end of the Google day, QuickBooks may even prove to be Google’s third strike in its small business market at bat:

STRIKE 1 Google Print

In “Will Google ever build another billion dollar business?” I discuss its failed attempt at luring small businesses to print advertising auctions via Google:

In”Google’s print auction fizzles” last March, Business Week describes how Google’s attempt to bring the “accountability” of Google’s “targeted advertising” to print media failed to meet Google’s lofty expectations; “The search giant's auction of magazine ad space didn't generate much enthusiasm — or business, in the case of one successful bidder”…

Google has apparently abandoned its print diversification efforts which had been aimed at determining "where and how we might best bring value to print advertising”; its “AdSense for Paper” homepage has not been updated since April, following its failed initiative.

STRIKE 2 Google - Verizon Alliance

Google's partnership with Verizon SuperPages.com earlier this year to marry its sales channel opportunities with Google's vast advertising network was not consummated, as I discuss above.

STRIKE 3 Google’s QuickBooks 2007?