Human Services has now wiped over 31,000 'robo-debts'

The Department of Human Services (DHS) has provided updated information regarding its online compliance intervention (OCI) program, disclosing that from 1 July 2016 to 31 March 2019, 31,160 debts had been fully-waived.

From 1 July 2018 through to 31 March 2019, DHS had fully waived 8,710 debts.

Meanwhile, 57,386 debts have been reduced and 24,788 have been partially waived since 1 July 2016.

DHS confirmed these statistics in response to Senate Estimates Questions on Notice from April, noting that whenever a debt is reduced, it simply meant the individual had been "working with the department" to determine their debt.

In addition, 198,000 debts have been recovered in full, with 42,854 of them having been paid after the start of the 2018-19 financial year, DHS said.

In total, the department said it had raised 500,281 debts and recovered AU$326.6 million in the period 1 July 2016 through to 31 March 2019.

173,310 debts have been issued to a debt collector since DHS kicked off the data-matching program of work in 2016.

As of June 2018, a total of AU$375 million had been spent by DHS on the contentious data-matching project.

SEE ALSO: Australian Budget 2019: Everything you need to know

The OCI initiative automatically issues debt notices to those in receipt of welfare payments through the country's Centrelink scheme.

The program automatically compares the income declared to the ATO against income declared to Centrelink, resulting in debt notices -- along with a 10% recovery fee -- being issued whenever a disparity in government data is detected.

One large error in the system that became known colloquially as "robo-debt", was that it incorrectly calculated a recipient's income, basing fortnightly pay on their annual salary rather than taking a cumulative 26-week snapshot of what the recipient had paid.

Offering further information through responses to Questions on Notice, DHS also said it has not prescribed the minimum information required to complete an online compliance review.

"During a compliance review, information such as payslips, bank statements, employment separation certificates, or information from the Australian Taxation Office may be used," DHS wrote.

"Prior to accepting a debt outcome following an online compliance review, customers can access a comprehensive debt explanation in their online account or from a compliance officer over the phone. When a review is finalised with a debt, customers are provided a debt explanation in the outcome letter, in their online account or by a compliance officer over the phone."

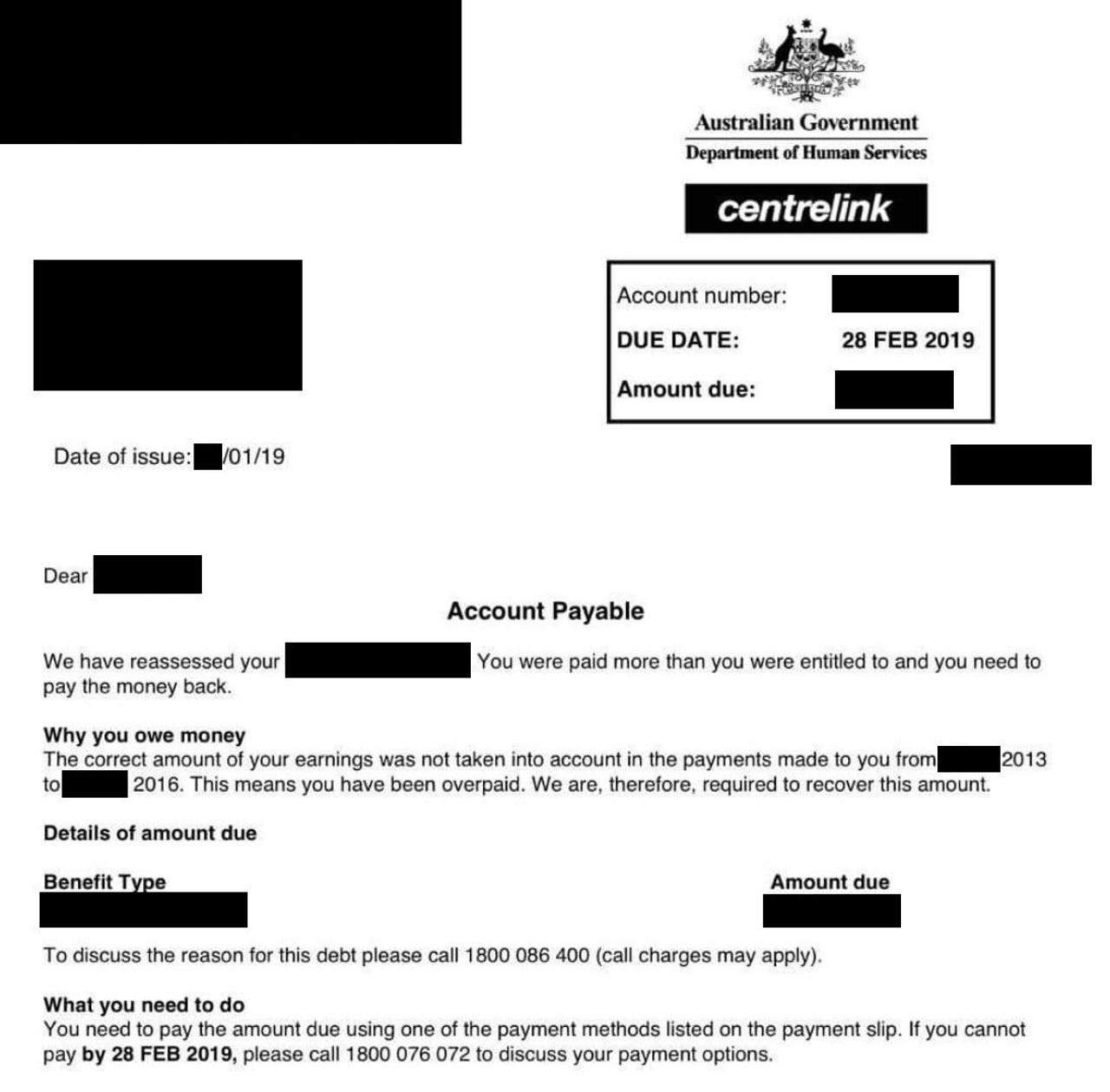

A debt notice issued to a customer does not make it clear, however, that they have the option to work with the department on their debt.

Debt notice issued to a customer asking for payment in full a month after issue.

A department spokesperson had previously told ZDNet that it is inaccurate to say the automated system had incorrectly issued debt notices, saying instead the letters initiated at the commencement of a compliance review are not debt letters.

"To refer to them as debt letters is factually incorrect. The letter asks the customer to engage online or call the department to work through a discrepancy," the spokesperson said in October.

"Last year the Commonwealth Ombudsman confirmed that: It was reasonable and appropriate for the department to ask people to explain data matching discrepancies; the online system accurately calculates debts when the required information is entered; the business rules in the online compliance system that support the debt calculation are comprehensive and accurately capture the legislative and policy requirements; and debts raised are consistent with the previous manual debt investigation process."

DHS acting deputy secretary of Integrity and Information Jason McNamara told the Finance and Public Administration References Committee something similar in March last year, saying the data-matching program went well.

"The department's view would be, we wouldn't agree with the proposition that it didn't go that well," McNamara said with no hesitation.

"Yeah ... We've made it quite clear that we think the project has gone quite well. We've delivered lots of savings. We have quite a number of reviews already undertaken and we have changed some aspects of the system, we've improved aspects of the system but I don't think we'd agree with the proposition that the project hasn't gone well."

In its election campaign, the federal opposition said it would not allow data-matching Commonwealth initiatives to go ahead without a human eye overseeing the work. The Opposition was not elected.