IBM's Q1 shows progress, 2015 earnings outlook reiterated

IBM's first quarter earnings were better-than-expected and sales were roughly in line as Big Blue's growth businesses performed well. IBM also raised its earnings outlook for 2015.

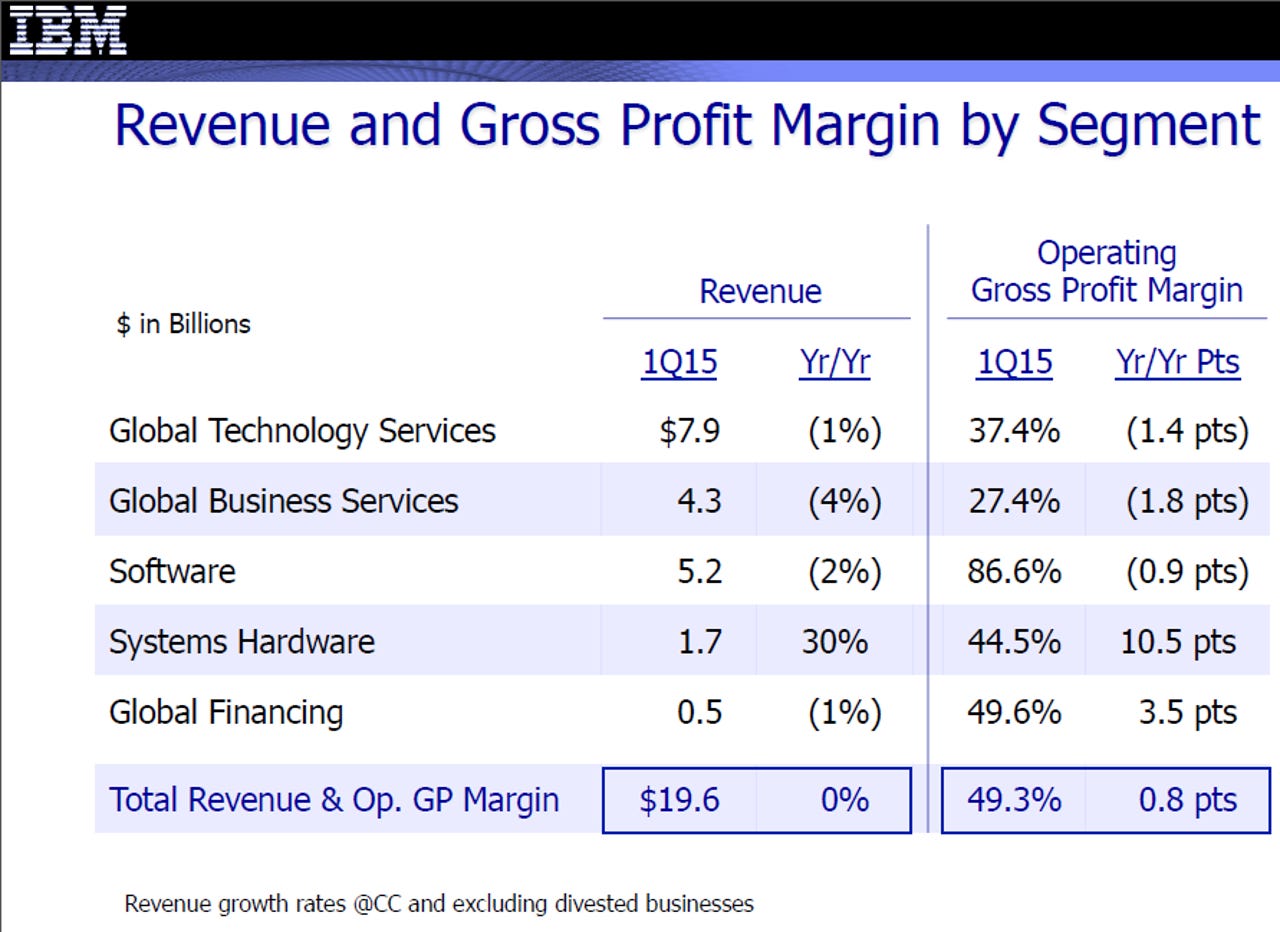

The company reported first quarter non-GAAP earnings of $2.9 billion, or $2.91 a share, on revenue of $19.6 billion. Earnings including charges were $2.44 a share.

Wall Street was expecting IBM to report first quarter non-GAAP earnings of $2.80 a share on revenue of $19.64 billion.

As for the outlook, IBM said it will report 2015 earnings of $14.17 a share to $14.92 a share. Non-GAAP earnings for 2015 will be between $15.75 a share to $16.50 a share. Wall Street is looking for $15.48 a share.

Overall, IBM appears to be on the mend somewhat, but remains a work in progress. Among the moving parts:

- Revenue in the Americas was down 3 percent in the first quarter, Europe, Middle East and Africa sales fell 19 percent and Asia Pacific sales fell 18 percent. Those results are largely due to a stronger dollar.

- Revenue from the company's growth markets were down 16 percent. In constant currency and adjusting for divested businesses, IBM's growth market revenue was down 1 percent.

- That currency theme carried throughout IBM's results. Every division took a sales hit, but looked better in constant currency.

- Mainframe sales were up 118 percent from a year ago, cloud delivered as a service has a run rate of $3.8 billion and cloud revenue overall was up 75 percent from a year ago.

- Middleware accounted for 84 percent of IBM's software revenue.

CFO Martin Schroeter said on a conference call that a stronger dollar was a big challenge for IBM since two-thirds of the company's revenue is outside the U.S.

Schroeter focused on the company's strategic growth businesses. Analytics sales were up more than 20 percent with social up 40 percent. The bulk of cloud sales growth was organic as IBM analyzed customer infrastructure, he added.

IBM forms new health data analytics unit, extends Apple partnership | IBM cloud chief LeBlanc on OpenStack, analytics, PaaS, in-country data | IBM's Rometty pitches 'high value innovation', reinvention, $4 billion more into growth businesses

He said:

We've applied that insight to developing a strong point of view on cloud. The value in cloud is hybrid. In February, we announced a program to make Hybrid Cloud a reality for the enterprise, extended our clients control, visibility, security and governance in a Hybrid Cloud environment. Similar to what they have and the private cloud and existing IT systems. To deal with the data sprawled we provide increased data portability across environments. Now, while we are divesting and driving growth in our strategic imperatives we are continuing to reinvent and bring innovation to our core portfolio.