Jabil ups outlook for fiscal 2021, sees digitization of healthcare, electric vehicles as growth engines

Contract equipment manufacturer Jabil reported better-than-expected fiscal second quarter results amid strong demand for its high-tech manufacturing services.

The company reported second quarter earnings of 99 cents a share on revenue of $6.8 billion, up 11% from a year ago. Non-GAAP earnings for Jabil's second quarter were $1.27 a share.

Wall Street was expecting Jabil to report fourth quarter sales of $6.57 billion with non-GAAP earnings of 95 cents a share.

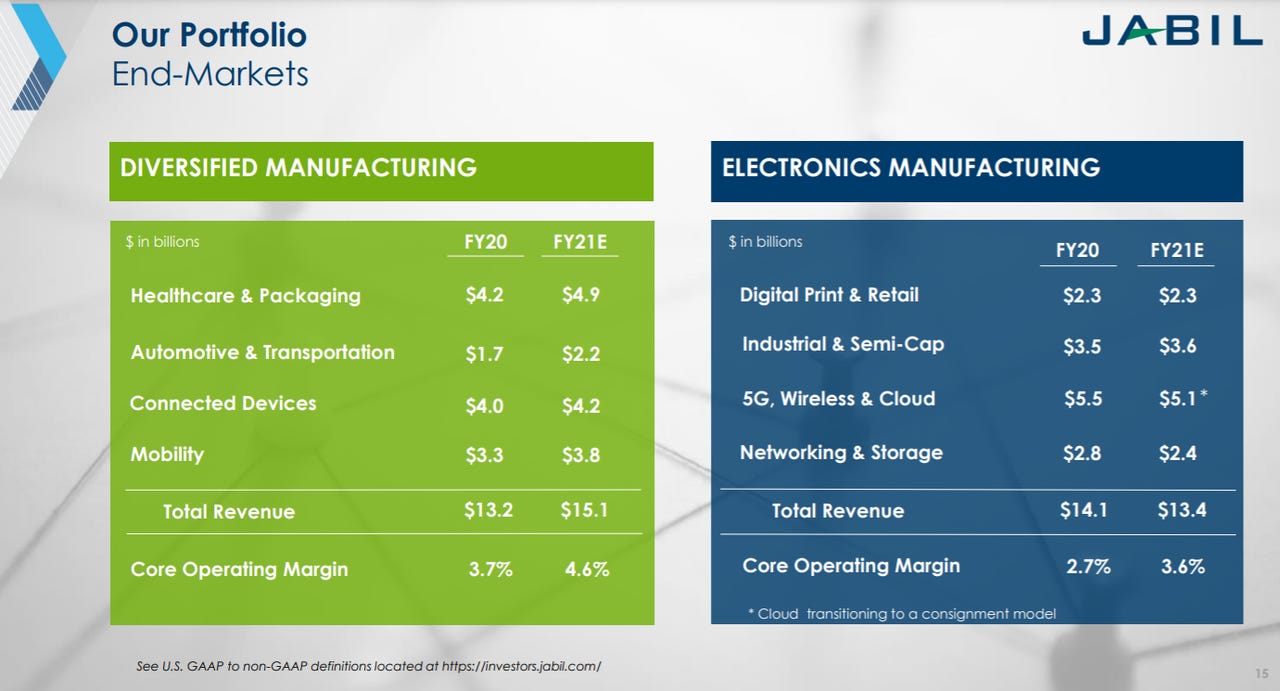

The company said it saw strong demand across multiple categories including mobility, cloud, healthcare, connected devices and automotive. Jabil's diversified manufacturing services sales (think healthcare equipment and Apple iPhone) jumped 26% in the second quarter with electronics manufacturing services falling 1%.

Jabil manufactures gear for everything from cloud to automotive and industrial to telecom, smart home and retail. Apple is Jabil's largest customer. Jabil's cloud electronics manufacturing services has moved to a consignment model where the company gets a commission from suppliers when it sells hardware to the customer. Jabil sees less revenue in the consignment model, but better cash flow and earnings power.

Jabil CFO Michael Dastoor said on an earnings conference call that demand was strong across its customer base. Healthcare is expected to be a growth market. Dastoor said:

In health care today, the industry is undergoing tremendous change due to rising costs, aging populations, the demand for better health care in emerging markets and the accelerated pace of change and innovation. Consequently, we're witnessing health care companies shifting their core competencies away from manufacturing towards innovative and connected product solutions. We're in the early days of outsourcing of manufacturing in the health care space. We're also seeing the impact of connectivity and digitization across health care. I expect these trends to accelerate over the next few years.

Dastoor also said electric vehicles and automotive will be a growth market for Jabil. Regarding 5G, Dastoor said the growth will be in networking gear, infrastructure and end devices.

For the third quarter, Jabil projected revenue between $6.6 billion to $7.2 billion with non-GAAP earnings of 90 cents a share to $1.10 a share. That projection was ahead of Wall Street estimates calling for third quarter revenue of $6.3 billion with non-GAAP earnings of 93 cents a share.

Jabil also raised its outlook for fiscal 2021. The company projected revenue of about $28.5 billion with non-GAAP earnings of about $5 a share. For fiscal 2021, Wall Street was modeling Jabil non-GAAP earnings of $4.64 a share on revenue of $27.6 billion.