Key NBN takeaways from ABC's Cabinet documents

Australian Cabinet-in-Confidence documents published by the ABC on Wednesday have shown what the National Broadband Network (NBN) funding and negotiation plans looked like back in 2009.

Two of the documents -- which the ABC obtained after someone purchased a filing cabinet during an ex-government sale that had the papers locked inside -- detailed the government's position on negotiating with Telstra and other potential investors in the project, and with the funding and rollout plans.

The government expected NBN investors

According to Strategy for negotiating with potential investors in NBN Co [PDF], the Australian government was expecting to negotiate on investors wanting part-ownership of the company rolling out the NBN.

"The overarching goal is to build the NBN Co network in the most efficient way, with a secondary aim to attract private sector investment into NBN Co to reduce the overall cost to the Commonwealth while preserving the structural reform and competition benefits of the government's package," the document says.

"In the longer term, the approach to privatisation is also dependent on the extent of private sector investment in NBN Co in the immediate lead up to divestment. If the company is successful in attracting private equity investment to any significant extent, the scale of the government stake to be divested would be reduced."

The government foresaw negotiations with Telstra on this, which it said "will be looking for influence and control over NBN"; other retail telcos such as Optus, Macquarie, and Internode; wholesale fibre optic transmission network operators including Nextgen, over using their fibre assets; non-telcos such as electricity retailers, over using their ducts and poles; and infrastructure funds "looking for safe passive investments with long-term sustainable returns".

"It is expected that it will be some time before conditions exist that are conductive to private equity participation. This will be well after the implementation study is completed, and will occur once NBN Co has a credible business plan, is operating effectively, and its prospects for success can be adequately ascertained by prospective equity investors."

The papers add that the government's "key public message" should be that it is looking to attract private equity but with ownership restrictions, pointing to an ownership cap of somewhere between 5 and 15 percent.

But private investment was subject to the network being fibre

The papers add that investment from the private sector should only be permitted if it "meets or is consistent with" the network being based on fibre optic to the home and workplace.

Other conditions included that NBN would build and operate the network on a wholesale basis; no customer of NBN can gain control of the company, including veto or powers of influence; network services must be regulated by the Australian Competition and Consumer Commission; and the terms are "consistent with the long-term objective to privatise the government's stake in NBN".

NBN today remains a wholly government-owned company, having purchased and built its own assets.

Negotiation strategy pushed Telstra structural separation

According to the paper, the government went into its discussions with Telstra with the goal of influencing the incumbent telco to structurally separate.

"With respect to Telstra, the strategy is to adopt and maintain a strong and credible position from the announcement, with the goal of getting Telstra to reconsider its position and ultimately approach government to invest in or use NBN Co's network on the government's terms," the paper says.

"In the near term, the strategy is to maintain a strong, credible, and consistent position to Telstra without tying the government's hands. The ideal outcome over time, is the structural separation of Telstra by action of the board."

Saying that the government should focus on creating a setting wherein Telstra will decide it is within its long-term interests to negotiate on the government's terms, the paper points out that Telstra could choose to use its hybrid fibre-coaxial (HFC) network to compete with NBN on price during the initial build phase.

"The working group considers it likely that Telstra will initially approach the government with a number of proposals which the government will need to politely but firmly resist," it says.

"A wholesale company's (spun off from Telstra) interests in NBN Co would be more aligned but not identical to the government's ... a wholesaler has no incentive to discriminate in favour of any particular retail company."

Government was open to negotiating on NBN timing and location

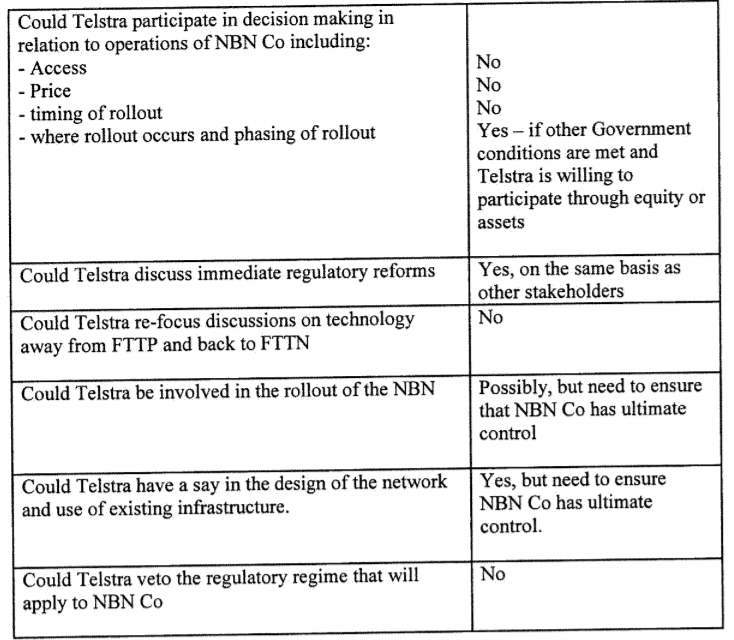

The negotiation sequencing table

The government's negotiating document says it was expecting Telstra to try to negotiate the "timing and location of the network rollout" during its possible investment in NBN, with the government saying it "could negotiate with Telstra on these to some extent if Telstra decides to invest".

The negotiation sequencing table included in the document shows that while the access, price, and timing of the rollout cannot be negotiated on, however, the government was open to negotiating with Telstra on "where rollout occurs and phasing of rollout".

The table also shows the government expected Telstra to "offer to put its assets into NBN Co in return for an equity stake" after legislation settled NBN's governance; and, after the rollout commenced, the government expected Telstra to "offer to become a customer of NBN Co but only if it can also have some control over NBN Co". For the latter point, the government said this would require a structural separation by Telstra.

On whether it would negotiate on Telstra having involvement in the NBN rollout or having a say in the design of the network, the government said this would be permitted as long as "NBN Co has ultimate control".

However, it said it would not allow Telstra to "refocus discussions on technology away from FttP and back to FttN", emphasising the government's intention to roll out a pure fibre network at that point.

Telstra did in fact structurally separate, with its Structural Separation Undertaking (SSU) accepted by the ACCC in February 2012 after the regulator rejected Telstra's first attempt at the document. The SSU governs how the telco's wholesale business is to function during the rollout of the NBN and commits it to structurally separating its wholesale and retail businesses by 2018.

However, Telstra never took ownership of any part of NBN. Instead, an AU$11 billion deal was struck between NBN, Telstra, and Optus for the former to progressively take ownership of their fibre, HFC, and copper network assets.

Funding the NBN; fibre blackspot program

The NBN financing options and borrowing and Budget impacts [PDF] document, also from 2009, shows an estimate in project cost of between AU$38 billion and AU$43 billion.

The document earmarks an initial funding package from the government of AU$4.7 billion to cover startup capital; AU$53.2 million for the implementation study; and AU$250 million to fill in blackspots across the nation with fibre optic transmission links that would later form part of the NBN.

The document included a table "for illustrative purposes only" citing "aggressive" numbers over the first two years: AU$1.2 billion in 2009-10; AU$4.1 billion in 2010-11; AU$6.7 billion in 2011-12; AU$7.2 billion in 2012-13; AU$7.3 billion in 2013-14; AU$6.4 billion in 2014-15; AU$5.2 billion in 2015-16; AU$3.9 billion in 2016-17; and AU$1 billion in 2017-18.

Such funding models show that the government expected the NBN to be complete by mid-2018. It is now expected to cost between AU$47 billion and AU$51 billion and be complete by the end of 2020.

The document also points to the possibility of needing equity injections from the government in future.

"The key characteristic of an equity injection is that the government could reasonably expect to make a return on the capital. It is reasonable to expect that the government could make equity injections into a greenfields project such as the NBN on the basis of a prolonged dividend holiday," it says.

It adds that raising debt from the government or private sector "once it is in a position to service its debt from revenue generated from the sale of its products" could also be an option for NBN.

NBN was eventually given AU$29.5 billion in equity by the government, with the remaining AU$19.5 billion to be sourced through private debt funding by NBN itself once the government's funding ran dry.

However, NBN was then loaned the additional AU$19.5 billion needed to complete the rollout by the government, citing the reason that this was the most cost-efficient way for NBN to raise debt and secure funding without impacting the time frame of the NBN rollout.

Initial Tasmanian optimism

Also noted in the original funding plan is "a funding envelope of AU$500 million to achieve an early rollout of a fibre-to-the-home and premises network (supplemented by wireless and satellite services) in Tasmania".

"The government will provide up to (AU$500 million) over four years to Tasmania to implement an early rollout of a mainly fibre-based network in the state. The investment will be in the form of a loan (details to be confirmed) to Tasmania," the document says.

"The early investment in Tasmania will bring the benefits of widely available broadband sooner than otherwise to the homes and businesses of the state. The network (may/will) later form part of the National Broadband Network, and the experience in Tasmania will assist the rollout of broadband elsewhere in Australia."

While Tasmania did end up being one of the first regions where NBN construction commenced, with Hobart and Launceston both connected with FttP, it halted due to disputes over payments to contractors and sub-contractors.

By the time the rollout recommenced in Tasmania, the Coalition had been elected and the remainder of Tasmania was subsequently shifted over to slower-speed connections.

The fallout from this then saw both major parties campaign on fibre connectivity for Western Tasmania in the lead-up to the 2016 federal election.

One Tasmanian council did attempt to use the fibre option in 2016; however, it then declined to upgrade two regions from FttN to FttP due to the cost cited of up to AU$3.3 million, adding that it would also be requesting a refund on the AU$10,000 fee it was charged by NBN for the analysis.

Related Coverage

- Government contends rural NBN subsidy and new USO will fix regional coverage

- NBN copper purchase total sits at 16,600 kilometres

- NBN fibre increase: Government says no

- Kogan.com in a 'brilliant position' for NBN: Ruslan Kogan

- Fines for NBN installation delays proposed by ACMA

- USO to be axed in 2020 for Universal Service Guarantee

- TPG refunding 8,000 NBN customers for slow speeds

- NBN extends fixed-wireless, satellite partnerships with Ericsson

- ACCC kicks off NBN wholesale service levels inquiry

- Optus hauled to court over allegations of misleading NBN HFC customers