KKR's Internet Brands scoops up WebMD for $2.8 billion

Private equity firm KKR said its Internet Brands subsidiary will buy WebMD in a deal valued at about $2.8 billion. Meanwhile, KKR is buying a majority stake in The Nature's Bounty Co., a health and wellness product manufacturer.

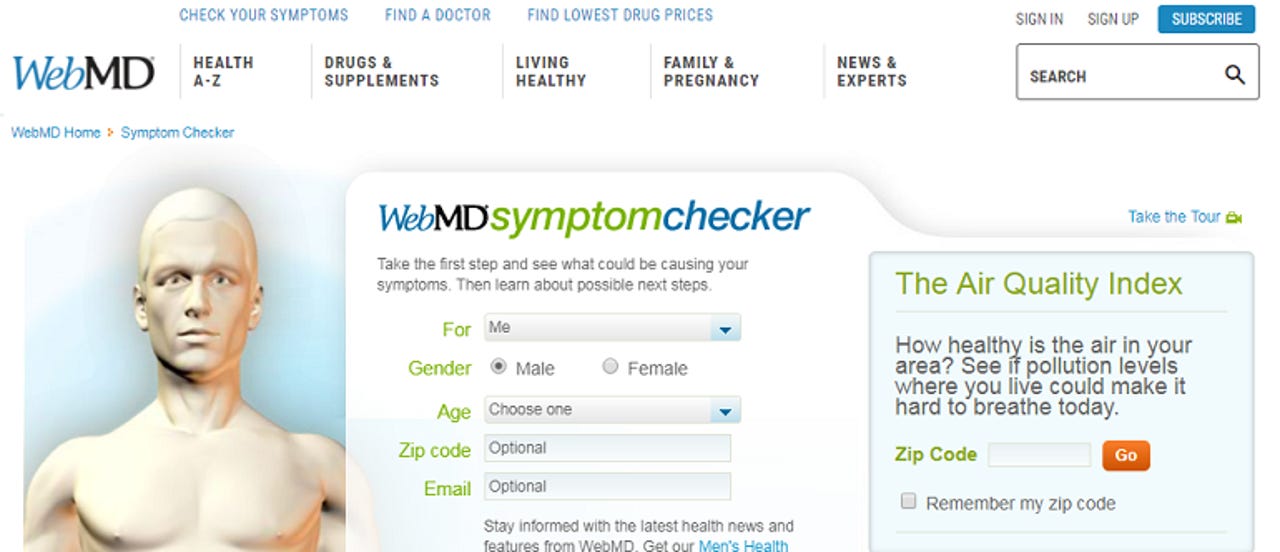

The WebMD purchase gives KKR one of the largest health players on the Internet. KKR will pay $66.50 in cash for WebMD shares. KKR is paying a 20 percent premium from WebMD's closing price on Friday.

On Feb. 15, WebMD said it was exploring strategic alternatives. WebMD also runs Medscape. WebMD said its second quarter revenue will be about $176 million, up 5 percent from a year ago. Net income will be $18.9 million. Both sums were higher than WebMD's previous guidance for net income for $16.9 million to $18.5 million on revenue of $170 million to $173 million.

Internet Brands has a health unit that offers software as a service as well as web hosting for industries such as dental, chiropractic, vision care and veterinary. WebMD will give Internet Brands an anchor for its various content and community sites--DentalPlans.com, FitDay.com and HealthBoards.com--as well as an outlet for software businesses such as Officite, Demandforce and Baystone Media.

With KKR's big bet on health, it's also worth noting that the private equity firm is buying control of The Nature's Bounty Co., which has brands such as Nature's Bounty, Sundown Naturals, Solgar, Osteo Bi-Flex, MET-Rx, Pure Protein and Body Fortress. KKR is buying a majority stake of The Nature's Bounty from Carlyle.

While KKR didn't put the two purchases together, it's not much of a stretch to see WebMD as an e-commerce venue for The Nature's Bounty products.