LinkedIn crushes Q1 earnings, shares pop on strong guidance

LinkedIn published better-than-expected first quarter results Thursday after the bell.

Tech Earnings

The social network for professionals reported a Q1 net income of $46 million, or 35 cents per share (statement).

Non-GAAP earnings were 74 cents per share on revenue of $860.7 million, up 35 percent from the year prior.

Wall Street was looking for earnings of 60 cents per share with at least $828.5 million in revenue.

For the current quarter, Wall Street expects LinkedIn to deliver earnings per share of 71 cents on revenue of $886 million.

LinkedIn followed up with a strong guidance range of $885 million to $895 million with projected earnings of 74 cents to 77 cents per share.

The company's shares popped as much as 15 percent in after hours trading -- a far cry from last quarter, when soft revenue guidance sent LinkedIn's shares crashing after hours.

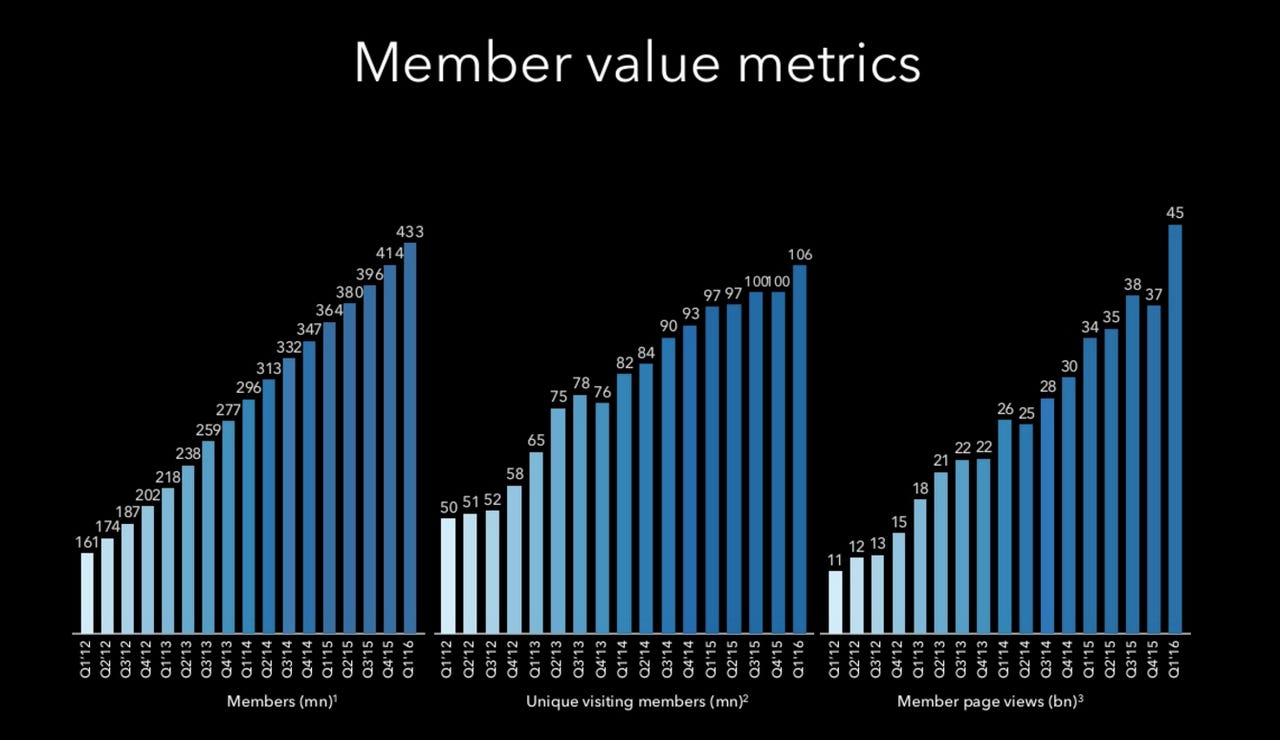

On the user front, LinkedIn says it now has 433 million members, an increase of 19 percent from the year prior. LinkedIn called the user growth its "strongest net-add quarter since the beginning of 2014."

Unique visitors were up 9 percent to an average of 106 million per month, and member page views grew 34 percent to 45 billion.

"LinkedIn delivered strong financial results and growth across our core product lines," said Jeff Weiner, CEO of LinkedIn. "As a result of our new mobile experience, members are increasing their activity on LinkedIn, helping drive strong levels of engagement across the platform."

Out of LinkedIn's three main divisions, Talent Solutions posted the most revenue and highest annual growth rate with $558 million during the quarter, up 41 percent from the same time last year.

Marketing Solutions revenue followed with $154 million, up 29 percent, while Premium Subscriptions delivered $149 million, an increase of 22 percent compared to the same quarter last year.