OCBC Bank offers cash by QR codes

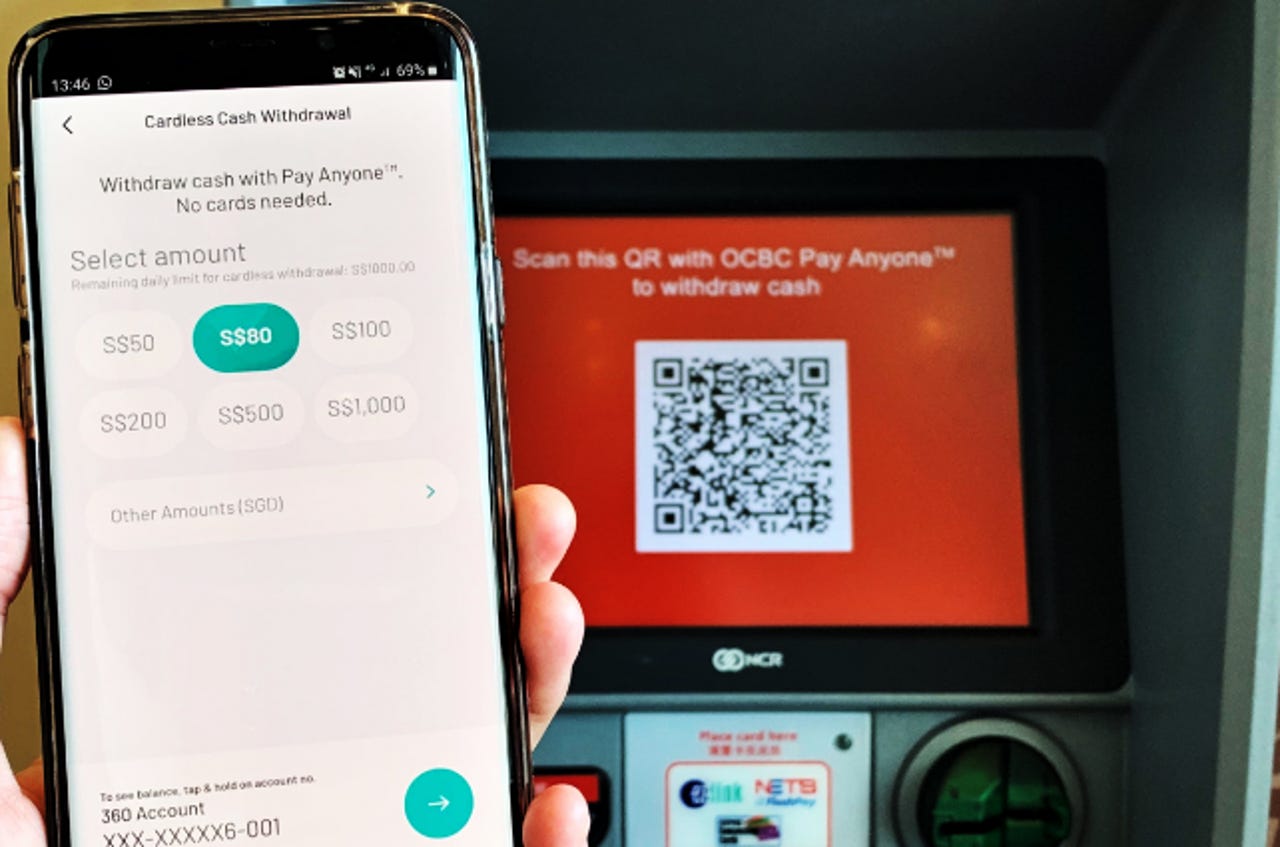

OCBC Bank has introduced QR codes as an alternative way for its customers to process cash withdrawal at its ATMs, bypassing the need for physical ATM cards or PINs. This also offers a more secured way to access money since it taps the customer's biometric data to authenticate transactions, according to the Singapore bank.

Using its Pay Anyone app, OCBC customers can scan a QR code displayed on the screen of the ATM and authenticate the cash withdrawal using their fingerprint or faceprint via their mobile phone. They also can choose to do so with their mobile banking login details, the bank said.

Noting that QR codes offered stronger security compared to PINs, OCBC said in a statement Wednesday: "Using a QR code instead of keying in a PIN is more secure because [customers can choose] biometric authentication, which is a more robust security feature than a PIN number that can be revealed or stolen.

"Furthermore, a physical ATM card can be skimmed while a mobile device cannot. Even if the customer's mobile device falls into the wrong hands, access to his or her bank account can be barred as the customer's fingerprint or faceprint would be required."

The QR code option could slash time spent withdrawing cash at ATMs from 80 seconds to 45 seconds, the bank said, adding that it processed 3 million cash withdrawals at its ATMs each month. This volume was the same as last year's.

OCBC's Singapore and Malaysia head of digital business Aditya Gupta said: "As we accelerate our drive to go cashless, we also recognise ATMs are still an essential and frequently used touchpoint for our customers. Increasingly, more of these customers are getting familiar with and scanning QR codes to pay, and we wanted to bring them the same ease, speed and security when they get cash at our ATMs."

The new service option currently is available at 655 ATMs across the bank's Singapore network, excluding 22 new machines that accept coin and cash deposits.

OCBC earlier this month also launched a service to enable students at Republic Polytechnic to pay for their school fees via QR codes. Provided through the bank's PayNow app, students would be able to do so by scanning the codes displayed on the student portal with their mobile phones.

RELATED COVERAGE

Singapore to launch QR identity verification tool for businesses

Government says it will introduce in third-quarter 2019 a tool called SG-Verify, which will enable businesses to perform secure identity verification and data transfer via QR scans for use cases such as visitor registration and customer acquisition.

Singapore to issue digital bank licenses

Move to issue up to five new digital bank licenses will add market diversity and boost the local banking system in Singapore's bid to become a digital economy, says industry regulator, which will begin reviewing applicants in August

Singapore to develop common QR code to drive e-payments

Stressing the need to improve user interface, Monetary Authority of Singapore says it will lead plans to develop standardised QR specifications by year-end that support local and international payments.

Cashless cannot be the face for Singapore smart nation success

Increased emphasis on building a cashless society to reflect country's success as a smart nation is misplaced, when the importance of getting the fundamentals right is overlooked.

Banks must move past PIN, OTP to ensure mobile security

No longer secured, PINs and one-time passwords should be abolished as a form of authentication for mobile banking apps, and replaced by biometrics such as facial and voice recognition.