Okta beats expectations for Q1 2018

Okta published its first quarter fiscal 2018 financial results on Wednesday, its first earnings report since going public on the NASDAQ market in April.

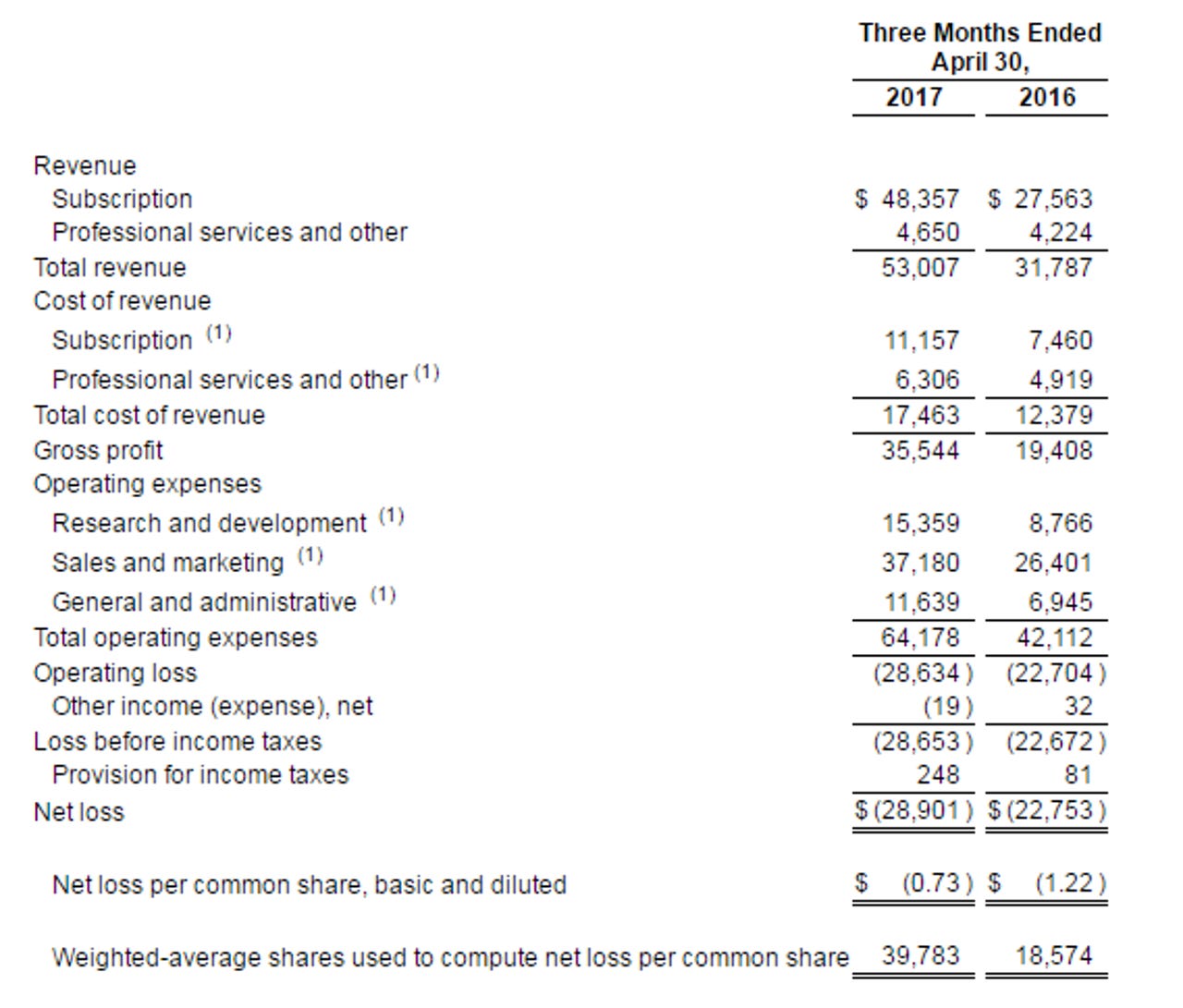

The identity and device management firm posted a non-GAAP loss of 50 cents per share on revenue of $53 million. A year prior, Okta posted a non-GAAP loss of $1.04 per share on revenue of $31.7 million.

The Q1 2018 results beat market expectations for a loss of 62 cents per share on revenue of $49 million. Shares climbed up in after-hours trading.

The bulk of Okta's revenue comes from subscription services, which brought in $48.4 million, an increase of 75.4 percent year-over-year. The company posted a non-GAAP operating loss of $19.7 million, or 37.2 percent of total revenue. That's compared to an operating loss of $19.3 million for Q1 2017, or 60.7% of total revenue. Net cash used in operations was $9.7 million, compared to $15 million a year prior.

In a statement, CEO Todd McKinnon said, "Our strong results were driven by our industry-leading products, the success we enable for our customers' digital initiatives and the need for every organization to manage their business securely in the cloud."

With its Identity Cloud, Okta well positioned to capitalize on two growing markets, McKinnon said -- the management of employee identities, as well as the market for organizations looking to securely manage the identities of their customers, partners and suppliers.

For Q2 2018, Okta expects to post a non-GAAP net loss per share of 26 cents to 25 cents on revenue of $55 million to $56 million. For the full fiscal 2018, the company expects a non-GAAP net loss per share of $1.15 to $1.11 on revenue of $233 to $236 million.