Okta posts solid Q4 as it grows its enterprise business

Okta capped off fiscal 2020 with better-than-expected financial results, showing signs of strong growth with enterprise customers.

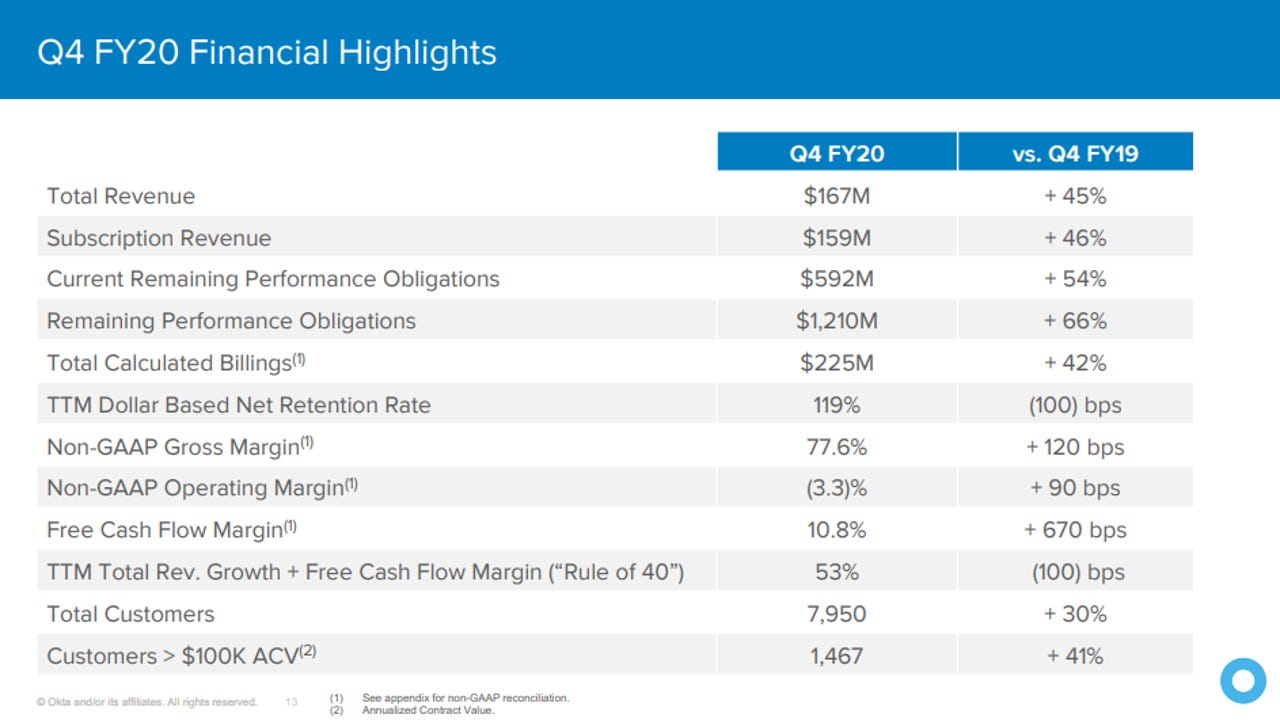

For the fourth quarter, the cloud identity management firm reported a non-GAAP net loss of $1.7 million, or 1 cent per share, on revenue of $167.3 million, an increase of 45 percent year-over-year.

Analysts were expecting a net loss of 5 cents per share on revenue of $155.85 million.

"All these companies taking their technology and adopting more cloud computing, trying to build more mobile applications and websites for customers and trying to do it securely -- having a solid ID system in place helps them," CEO Todd McKinnon said to ZDNet. "That's what's driving our growth. We have the perfect product at the perfect time."

Subscription revenue in the fourth quarter was $158.5 million, an increase of 46 percent year-over-year. Total calculated billings were $225 million, an increase of 42 percent year-over-year.

The total number of companies with annual contracts with Okta greater than $100,000 increased 41 percent in the fourth quarter, reaching 1,467. Total customers in Q4 came to 7,950

"Part of our strategy is to sell to the largest companies in the world," McKinnon said.

In another indication of the company's momentum with the enterprise, Total Remaining Performance Obligations (RPO) came to $1.21 billion, an increase of 66 percent year-over-year.

Current RPO, which is subscription revenue expected to be recognized over the next 12 months, was $592.3 million, up 54 percent compared to the fourth quarter of fiscal 2019.

RPO is an accounting metric that gives investors more visibility into recurring subscription business. While current RPOs refers to contracts coming due over the next 12 months, the total RPO gives a glimpse into the company's overall contractual business -- including multi-year contracts.

Okta's identity management products become more compelling for organizations as they grow, McKinnon argued, because as "they grow in size, whether in terms of revenues or employees, they grow in complexity."

With more applications to manage -- sometimes thousands -- and more employees and customers using them, identity management becomes more critical, he said.

For the full fiscal year 2020, Okta's non-GAAP net loss was $36.7 million, or 31 cents per share, on revenue of $586.1 million, an increase of 47 percent year-over-year.

Subscription revenue was $552.7 million, an increase of 49 percent year-over-year. Total calculated billings were $703.6 million, an increase of 44 percent year-over-year.

For the first fiscal quarter, Okta expects a non-GAAP net loss per share in the range of 24 cents to 23 cents on total revenue between f $171 million and $173 million.