Palo Alto Networks to acquire incident response firm Crypsis Group for $265M

Palo Alto Networks on Monday announced its plans to acquire The Crypsis Group, an incident response, risk management and digital forensics consulting firm. Palo Alto plans to pay $265 million in cash for the Crypsis Group, which currently operates as part of the ZP Group, an organization with a portfolio of companies. The deal is expected to close during Palo Alto Networks' fiscal first quarter.

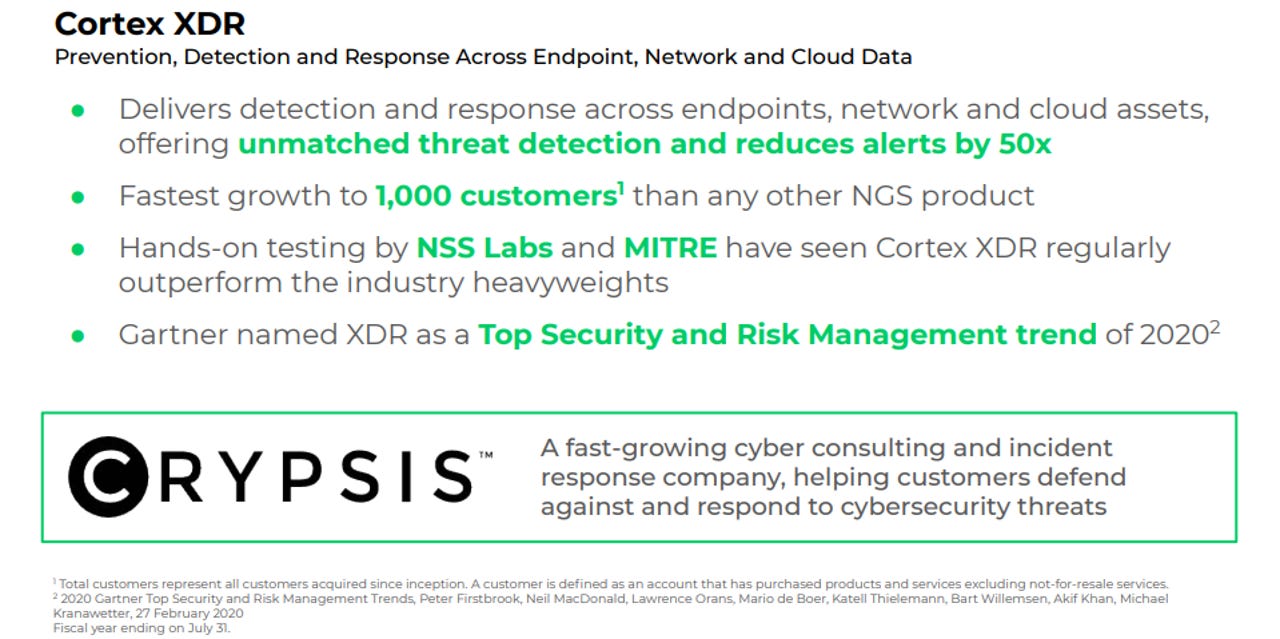

Once the deal closes, Palo Alto plans to integrate the Crypsis Group's processes and technology into Cortex XDR, its cybersecurity product that natively integrates network, endpoint and cloud data.

"The addition of The Crypsis Group's security consulting and forensics capabilities will strengthen Cortex XDR's ability to collect rich security telemetry, manage breaches and initiate rapid response actions," Palo Alto said in its release. "The Crypsis Group's experts and insights will also fuel the Cortex XDR platform with a continuous feedback loop between incident response engagements and product research teams to prevent future cyberattacks."

The Crypsis Group has more than 150 security consultants and responds to more than 1,300 security engagements per year. Its customers span a variety of industries including health care, financial services, retail, e-commerce and energy. The firm's CEO, Bret Padres, will join Palo Alto Networks.

A few days earlier, Palo Alto finalized its $420 million acquisition of CloudGenix, a software-defined wide-area networking (SD-WAN) provider.

Meanwhile, Palo Alto on Monday also reported better-than-expected fourth quarter financial results, driven in part by work-from-home tailwinds.

Non-GAAP net income for the fiscal fourth quarter 2020 was $144.9 million, or $1.48 per diluted share. Revenue grew 18 percent year-over-year to $950.4 million.

Analysts were expecting earnings of $1.39 on revenue of $923.51 million.

For the full fiscal year 2020, Palo Alto's earnings per share came to $4.88 on revenue of $3.4 billion, an increase of 18 percent year-over-year.

In a statement, CEO Nikesh Arora attributed the growth to "strong execution, work-from-home tailwinds, and continued success in next-gen security."

'Fourth quarter billings grew 32 percent year-over-year to $1.4 billion. Fiscal year 2020 billings grew 23 percent year-over-year to $4.3 billion.

Deferred revenue grew 32 percent year-over-year to $3.8 billion.

For the fiscal first quarter 2021, Palo Alto expects revenue in the range of $915 million to $925 million.

Analysts are expecting revenue of $901.08 million.