Predictive markets: Can they work for the enterprise?

Best Buy, Corning, Google and a bunch of other companies are dabbling in prediction markets for corporate decision making and there may even be a little return on investment given that traditional forecasting methods aren't better.

Prediction markets are speculation hubs where traders predict future events. In the enterprise, prediction markets are a handy way to aggregate community knowledge, according to a report released by Forrester Research. Prediction markets have also been hitting the roundtable circuit as Google and Best Buy shed light on the approach at a recent event chronicled by Dave Greenfield.

Applied to the enterprise, these markets could get interesting. The use of prediction markets is another milepost in the enterprise 2.0 movement as social technology gathers momentum. According to Forrester analyst G. Oliver Young Qualcomm is using prediction markets to come up with product ideas and new features. Corning is using them to forecast retail sales of LCD TVs. Meanwhile, enterprise prediction market vendors--Consensus Point, Inkling, Gexid, NewsFutures and Spigit--abound.

Also see: Eight pitfalls of predictive markets

SEC unanimously approves use of corporate blogs to meet Reg FD requirements

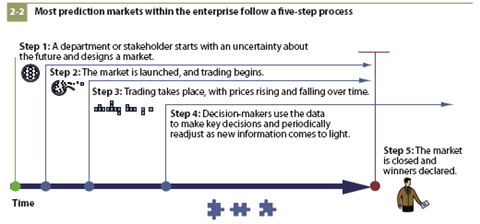

Here's a look at the typical enterprise prediction market process via Forrester:The most common uses for prediction markets revolve around sales projections, features, project management, competitive analysis and market conditions. Obviously the third one applies the most to information technology management. If used correctly I'd argue that prediction markets could prevent IT projects from becoming full-blown failures. Why? Prediction markets cut through the pressure to report only good news. And I also have a hunch that many IT projects have rank and file workers that can tell you what's really going on. The problem is these people aren't consulted and certainly aren't encouraged to say "hey this project makes no sense."

Too often IT gets projects thrown at them from above without much of a reality check. Could prediction markets change that equation? Perhaps. Even if the answer turns out to be a definitive "no" prediction markets are worth a shot.

Young writes:

Throughout its life cycle, the market reports the best collective estimates of a future event. Decision-makers then programmatically apply these estimates to inform and synchronize key decisions. Consequently, organizations should design prediction markets to effuse management information at specific decision-making junctures, usually well in advance of the event the market is tracking. As the market continues to trade, new information will undoubtedly come to light, giving executives guidance for mid-course correction.

Assuming execs play along how many IT projects (not to mention the dollars that go with them) could have been saved?

The other thing worth noting about prediction markets is that they are as good--and a lot cheaper--than traditional forecasting methods. Young writes:

There are academics, economic journals, and even industry trade groups devoted to the topic. In nearly all tests, prediction markets have shown tremendous efficiency for aggregating knowledge and, as a result, are remarkably accurate...All enterprises want to improve forecasting; however, even if the accuracy of prediction markets were no better than traditional processes, they would still represent an upgrade on several major fronts.

Young notes that prediction markets are cheaper, surface information better and offer a diversity of opinions. Young writes that latter point may be critical to getting employee buy-in on a project:

The common criticism of a traditional enterprise decision-making process is that decision-makers are often hindered by limited participation, incomplete information, and political compromises that better reflect individual agendas and goals than what is best for the company. These failings can result in employee frustration and disillusionment with management decisions.

As Greenfield notes there are pitfalls to these predictive markets. Management may not be committed to them, questions may not crafted well and employees may not want to participate. And prediction markets may not apply to all projects and management decisions. But with low investment and some possible upside prediction markets are worth a shot.