Qualcomm beats earnings expectations for Q1

Qualcomm published its first quarter financial fiscal 2019 results on Wednesday, beating earnings expectations.

Non-GAAP earnings per share came to $1.20, an increase of 25 percent year-over-year. Revenue for the quarter was $4.8 billion, a decrease of 20 percent year-over-year.

Analysts were looking for earnings of $1.09 per share on revenue of $4.9 billion.

"Our fiscal first quarter results reflected continued strength in our semiconductor business, driven by strong product leadership and operating expense management," CEO Steve Mollenkopf said in a statement. "We continue to execute on our strategic objectives, including driving the global transition to 5G, protecting the established value of our technology and inventions and expanding into new industries and product categories."

First quarter revenues from the Qualcomm Technology Licensing (QTL) segment, Qualcomm's licensing division, came to $1.02 billion, a decrease of 20 percent year-over-year. QTL accounts for a significant portion of Qualcomm's earnings.

The company's other business segment, QCT (Qualcomm CDA Technologies), accounts for most of its revenue. QCT revenues in Q1 were $3.74 billion, a decrease of 20 percent. Within QCT, MSM chip shipments in Q1 reached 186 million, a decrease of 22 percent year-over-year.

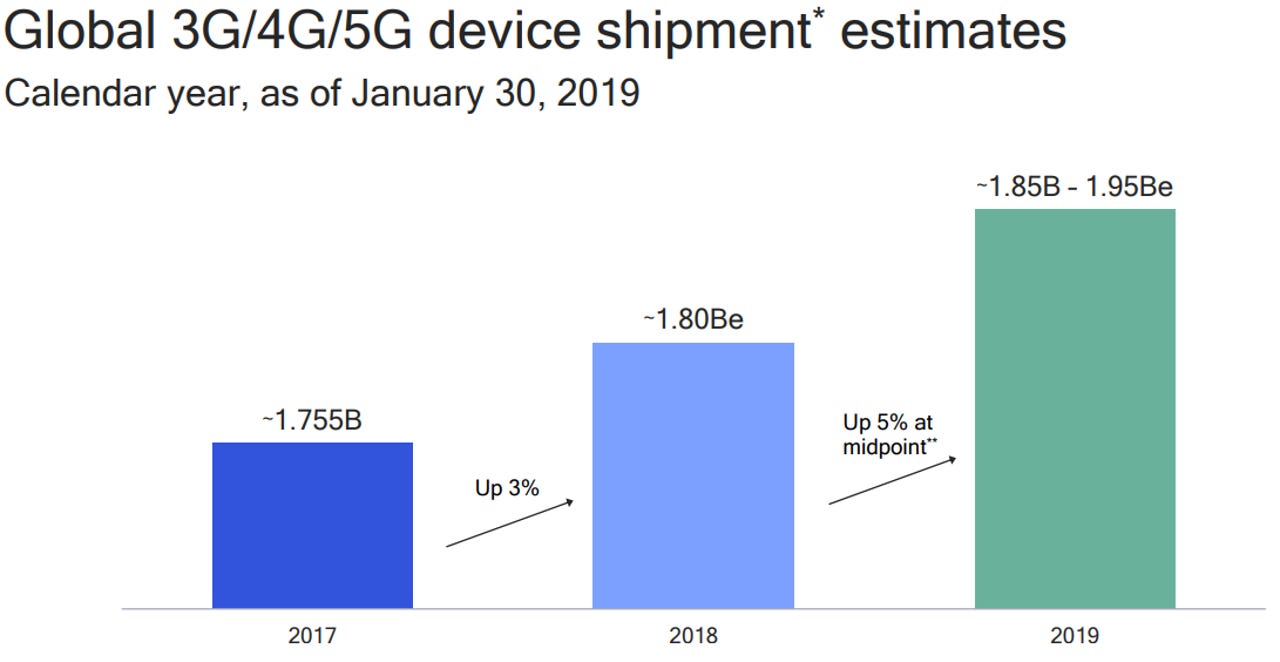

With respect to global 3G/4G device shipments, Qualcomm expects to report shipments of approximately 1.8 billion for calendar year 2018, up 3 percent year-over-year. Qualcomm estimates global 3G/4G/5G device shipments of approximately 1.85 billion to 1.95 billion for calendar year 2019, up 3 percent to 8 percent year-over-year.

Qualcomm noted that since the third quarter of fiscal 2017, its GAAP and Non-GAAP results have been negatively impacted by the company's dispute with Apple and its contract manufacturers (who are our licensees). QTL revenues in Q1 FY 2019 and in fiscal 2018 did not include royalties due on sales of Apple or other products by Apple's contract manufacturers.

Meanwhile, the successful negotiation of a new interim agreement with Huawei -- who was previously disclosed as the other licensee in dispute -- contributed $150 million of QTL royalty revenue in the quarter.

For the second quarter, Qualcomm expects a non-GAAP diluted EPS in the range of 65 cents to 75 cents, on revenue of approximately $4.4 billion to $5.2 billion.

Analysts are expecting earnings of 69 cents per share on revenue of $4.81 billion.