Recipe for selling software in a pandemic: Be essential, add some machine learning, and focus, focus, focus

Sales of software programs are already being affected by the pandemic, as seen this week in the disappointing results of Slack Technologies, makers of the popular program for team collaboration.

It turns out, when companies are cutting staff, they have less need for such programs.

But it turns out there is a way for a nimble software maker to thrive in the current era, namely, by bringing valuable tools to very specific parts of the market.

Such is the case for thirty-year-old software vendor Prophix, based just outside of Toronto, Ontario, in Mississauga. The company sells software for the finance department of mid-sized companies for evaluating financial data and performing forecasting.

Prophix's tools are designed to be much more accessible than general ledger programs from giant vendors such as Workday and Oracle, for the finance department that doesn't have access to teams of analysts. Most of Prophix's clients are companies in the neighborhood of $100 million to $1 billion in revenue. Clever use of some very basic machine learning techniques allows the programs to automate routine accounting tasks, easing the burden of finance staff.

After a rough patch at the outset of COVID-19 lockdowns, things quickly stabilized for Prophix.

"April, May, were really bad, really tough to sign new business," Alok Ajmera, the company's CEO, told ZDNet. "But we had a monster June, one of our best Junes on record."

Ajmera took over in June as CEO from Prophix founder Paul Barber.

"I think a lot of that is about, we had a really solid pipeline early in COVID, and people were just holding on, not wanting to sign the deal, and then in June, things started dramatically opening up."

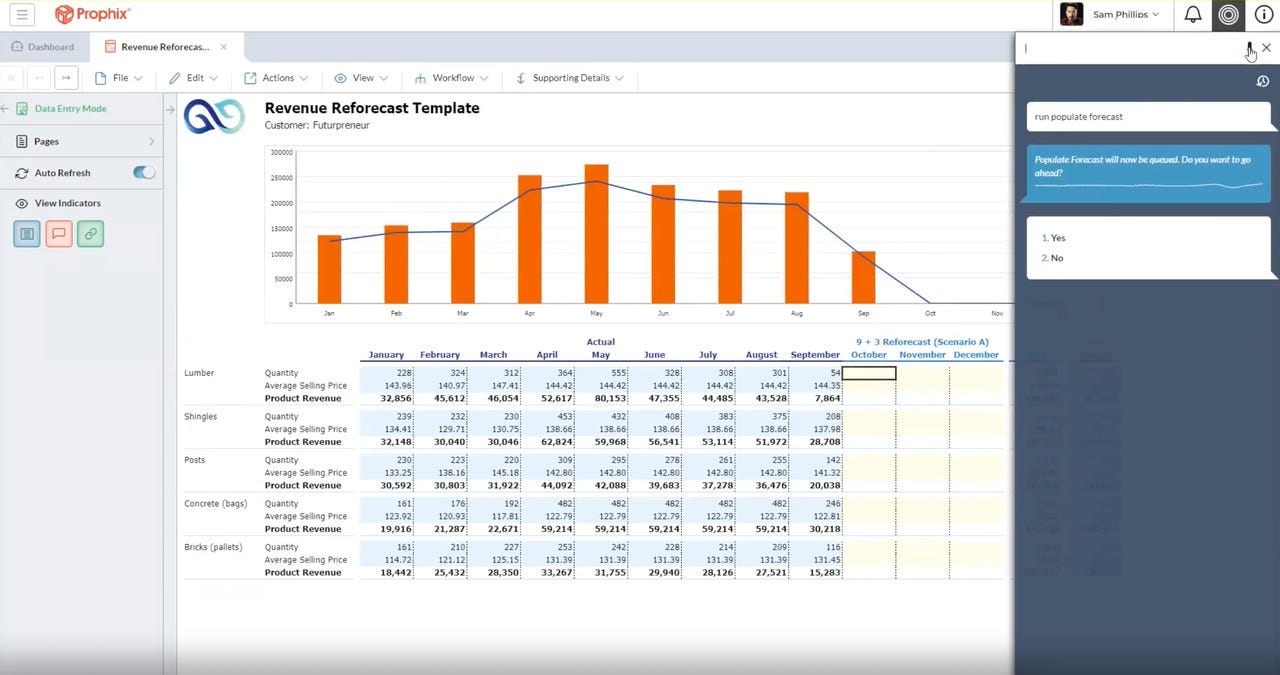

The Virtual Financial Analyst tool from Prophix combines various machine learning functions. Some of them are forecasting tools that come from Amazon's SageMaker machine learning suite. The program also uses natural language processing technology from startup Narrative Science to perform automatic annotations of the data in human-readable sentences.

Positive sales trends continued through July and August, he said. That's despite the fact that deal cycles have stretched out, requiring more approvals than usual.

The company's revenue from cloud computing software sales rose by 140% in Q2, the company said.

Thanks to such positive trends, the company's goal to hit $100 million in annual contract value by 2023 is on track to be reached earlier than that, in 2022, he said.

One important element that allowed the company to soldier on in the last several months is the decision to sell very specifically to certain industries, both direct and through partners, Ajmera told ZDNet.

Even before the pandemic, as part of the company's sales planning, Prophix was studying predictive indicators of what industries would have a "higher propensity to retain software," said Ajmera.

One industry the company had already zeroed in on is construction, which is now a primary vertical for Prophix to sell to.

Also: 'We won't have the sexiest AI, but everything it says is true,' says Narrative Science

"Mid-market construction companies are actually quite busy, they are executing on projects, there's infrastructure spend on the state level, and private level, across the board," despite the pandemic, he said. Although a lot of construction sites have closed, he noted, "their pipeline of jobs have not closed down."

What's more, the general profile of the construction business is favorable in terms of how companies spend on technology.

"There's not a lot of consolidation in the construction space," he said, which means a single large vendor's software is less likely to completely dominate the entire client base. In addition, "They usually have larger projects with longer time horizons, and they go through long cycles, cyclical cycles, but they don't go through short-term cycles, up and down," he said. That means less volatility for Prophix in selling to those companies.

"This gave us a higher propensity to say, this is an industry that might be able to weather some storms."

"In these tough times, when there is uncertainty, it doubles down the value of what we are doing, there is more interest in what we are doing," says Prophix CEO and president Alok Ajmera. Prophix software eases finance tasks such as forecasting for mid-market companies that want to avoid the complexity of giant software programs.

In addition to its own selling efforts, Prophix formed a partnership with one of the leading ERP software vendors catering to construction, Viewpoint, a 40-year-old Portland firm that has over half the market to itself.

To Ajmera, the resiliency of the business is evidence the functionality of the software has value.

"We have now gone through six months of renewals, and for the most part, companies are not having an issue to renew," he said, "which reinforces what we are seeing in terms of the usage statistics in our products: usage has actually gone through the roof."

A great deal of that value has been achieved in recent years via an increasing focus on machine learning.

Instead of trading spreadsheets around, and manually annotating them, the company's Virtual Financial Analyst uses tools from Amazon's SageMaker environment to automatically reveal the anomalies in financial data and to perform forecasting.

Also: AI startup InsideSales asks if a machine can be taught to sell

For example, it can show not only where there is variance between reported financial results and what was budgeted for, but also break it down into which parts of the business account for that variance, such as an individual revenue line item or a given cluster of transactions.

On top of the Amazon SageMaker technology, Prophix employs natural language technology from Chicago-based startup Narrative Science. That storytelling technology is able to the craft notes inside the Prophix program that will explain the anomalies in human-readable sentences.

"Look at all the variances for me, and explain to me why they're there," is how Ajmera characterizes the software's functionality. That has the promise of automating a lot of work. In past, a finance executive would have to manually hunt down the anomalies within various spreadsheets, and then manually type in comments about what was going on.

"People associate natural language with Siri, and it's kind of gimmicky, but in a B-to-B setting, I don't think people have any idea how useful natural language can be," he said.

The next big feature release this fall will be greater integration with Microsoft tools such as Word and Excel.

Also: Moveworks bets IT overload is a natural language processing problem

"If you think about the world of the finance person, it's a lot of heavy Office work, it's Excel, it's Word, etc.," observes Ajmera. "We've now built out a lot more integration points."

In past, the approach was to move people off of Excel.

"What we've realized is there really is a place for Excel," he said. "Some people should remain in Excel, but be connected back to a central ecosystem so that they're still covered from all the normal problems of version control and multiple collaboration; but they can consume their part of Prophix from within Excel."

It should be noted that Microsoft is a customer. Prophix is used at a department level inside the Redmond giant, for individual teams to look at their numbers. That data can be rolled up to a corporate level, a practice that is common among some big companies using the software.

"Oftentimes, we find a very large organization might have a very large, enterprise-grade technology in corporate, they're using — Hyperion Enterprise, say — but it's just not effective to deploy that across the organization," he said.

"And so various parts of the organization will be using Prophix for doing their planning, reporting, analytics, and when they're done, they'll take their top 35 numbers and submit them into Hyperion, into corporate, but all that complex planning is done in Prophix."

As for the coming year, while Ajmera can't obviously predict the course of the pandemic, he sounded confident that customers will stick with the company's products. There may be some companies that just simply go away, but he doesn't see a massive drop in renewals.

It helps that the product gets embedded into the ways that people work.

"When we sell to the office of finance, the interesting thing about accountants and CFOs is, once a solution works, they don't churn, they don't move for the sake of moving," he observed.

It also helps that everyone needs to budget just a bit more assiduously these days.

"In these tough times, when there is uncertainty, it doubles down the value of what we are doing, there is more interest in what we are doing," he noted.

"When times are good, you can kind-of get away with not having to do very complicated planning because it's all trending in the right direction."