Salesforce.com's front office suite play

Salesforce.com's acquisition of Buddy Media marks what I see as the acquirer's latest move in fleshing out a powerful front office suite. Many are pitching this as a social play but if you think about where all the social 'stuff' is headed then it is not really about an IT related category but about the way business is being done by some companies but which will likely be the norm in the future. At least for the large consumer brands if not by all consumer related businesses.

Right now it is convenient for Salesforce.com to hammer home the 'social business' play because that's how it drives attention as the leader in that space. They also have the benefit of encouraging a large subset of otherwise under employed PR and marketing people to declare expertise in this field and so amplify the broader message. The projected numbers are impressive as well. From the Benioff conference call:

Gartner says that CRM is 15% of the purchase intention of global CIOs this year. That’s the number one global purchasing intention.

While I am usually down on Gartner I'm not going to argue about that prediction for several reasons. It is sufficiently near term for there to be good reasons to assume they're not far off the mark and from soundings in the market, CRM as a broad category within the ERP framework is still a big draw. There are other factors in play that reinforce this idea.

- A number of the mobile applications I saw at Microsoft Convergence were aggressively targeted at CRM use cases. During the keynote we saw:

Microsoft demonstrated a consumer application running on a tablet where business data was effectively mashed up with Facebook. The idea was to show how Facebook could be used to deliver offers while the Dynamics system made pairing product suggestions, offered bonus products and the like.

- The same went for Infor. In talking about the partnership between itself and Salesforce.com I said:

Given Infor has barely scratched the surface of introducing customers to cloud solutions, they have a lot of runway in front of them. Their relative success and past technology investments (as opposed to applications) bodes well for the future.

- The explosive growth in demand at Appirio for applications that stitch together elements of the marketing online puzzle with Salesforce.com implies there is much experimentation going on.

- Despite the post Facebook IPO re-assessment of its potential, we are still very early in this game. Even if Facebook eventually fails, the genre it has spawned will not go away any time soon. It will be replaced, replicated and improved upon over time and in different geographies.

- The fact that advertising and marketing spend is shifting so quickly to online social systems and mobile derivatives suggests that trend is irreversible.

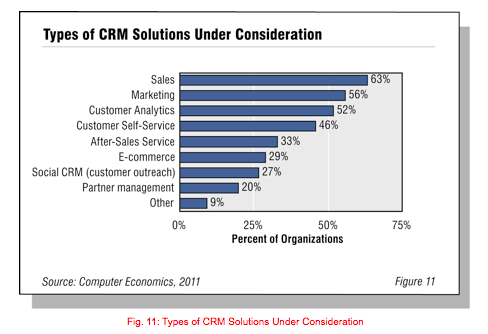

Elsewhere, that trend seems to be confirmed in a recent report by Frank Scavo at Computer Economics, entitled, Current Trends in CRM Adoption and Customer Experience. They say that sales (63%) and marketing (56%) spend top the list of CRM style applications under consideration. Social CRM (where Salesforce.com is currently positioning itself) sits at 27%. If you accept that as facts capable of being generalised across the market then Salesforce.com is hitting a sweet spot that no other major vendor has realised exists in the way they perceive the future market.Now let's extrapolate that into why a suite play of this kind is so compelling:

- What makes the suite proposition more compelling in my mind is that when we look across the whole apps landscape, the last 20+ years have been given to cost reduction via ERP and other back office functions. We used to count CRM (aka SFA) as amongst that group. The reality is there is little more fat of any significance to cut. If anything, companies are now looking to drastically reduce their commitment to those solutions as they seek to free up resources for value delivering solutions. That makes a front office suite play the ideal alternative.That is because nothing has more impact on performance than solutions that drive top line revenue.

- Salesforce.com doesn't have to work too hard to persuade the business to invest. It has already bypassed IT by appealing directly to line of business managers AND built a large ecosystem of partners churning out mods that avoid costly customizations. It has moved well beyond the 'niche' applications space where its competitors attempted to pigeon hole it.

- Flesh that out with service offerings and now a credible marketing play that taps into the current topics du jour and you have the bones of a winning combination.

- Salesforce.com has cleverly positioned itself as a willing partner to the back office titans such as SAP and Oracle. This allows them to appear playing nicely with their competitors while relegating them to a subservient position.

- I have long held the view that the 'suite always wins.' This new twist on that broad idea needs redefining. The suite always wins when it embraces an ecosystem of developers who can add value to the core offerings.

- Salesforce.com has said that it can integrate its acquired offerings inside the Salesforce.com UI. It therefore makes the suite play not only palatable as a continuing concept but reinforces the differences between its relative ease of achieving that goal with older plays where integration may be the watchword but where accomplishing that is on a piecemeal and customer by customer basis.

If the incumbent players thought life was difficult now then it is about to get a whole lot more testing. Returning to Computer Economics:

Note that only 27% of surveyed organizations are saying they will only look at existing providers. When you join the dots among these different factors it is hard to believe that Salesforce.com will not meet its stated goal of becoming a $10 billion business in the medium term. There are plenty of pieces of the puzzle that need fleshing out but this is the first time I have seen something I could clearly identify as a suite for the front office that meets the needs of 21st century business.

What will be the response from the SAPs and Oracle's of this world? We will have to wait and see but right now, both SAP and Oracle appear to be gearing themselves up for LOB plays. That won't work in the Saleforce.com world.

One thing we can be sure of: Dreamforce 2012 now takes on refreshed interest.

Disclosure: the report I saw was a final copy for peer review with permission to reproduce the two tables above.

PS - If you want a tug at the ol' heartstrings regarding the Buddy Media deal then look no further than this extraordinary video from CEO Michael Lazerow.