Should Amazon be your AI and machine learning platform?

Does your business want to become successful at facial recognition? Image tagging? Translation? As the rise of cloud computing has enabled faster and cheaper data processing, businesses are racing to harness the power of artificial intelligence -- via machine learning -- to understand data. But with Amazon, Google, Microsoft, IBM, and others offering similarly-priced machine learning platforms for the enterprise, it's often difficult to know where to begin.

Here's a comprehensive look at Amazon's platform as one option for your company.

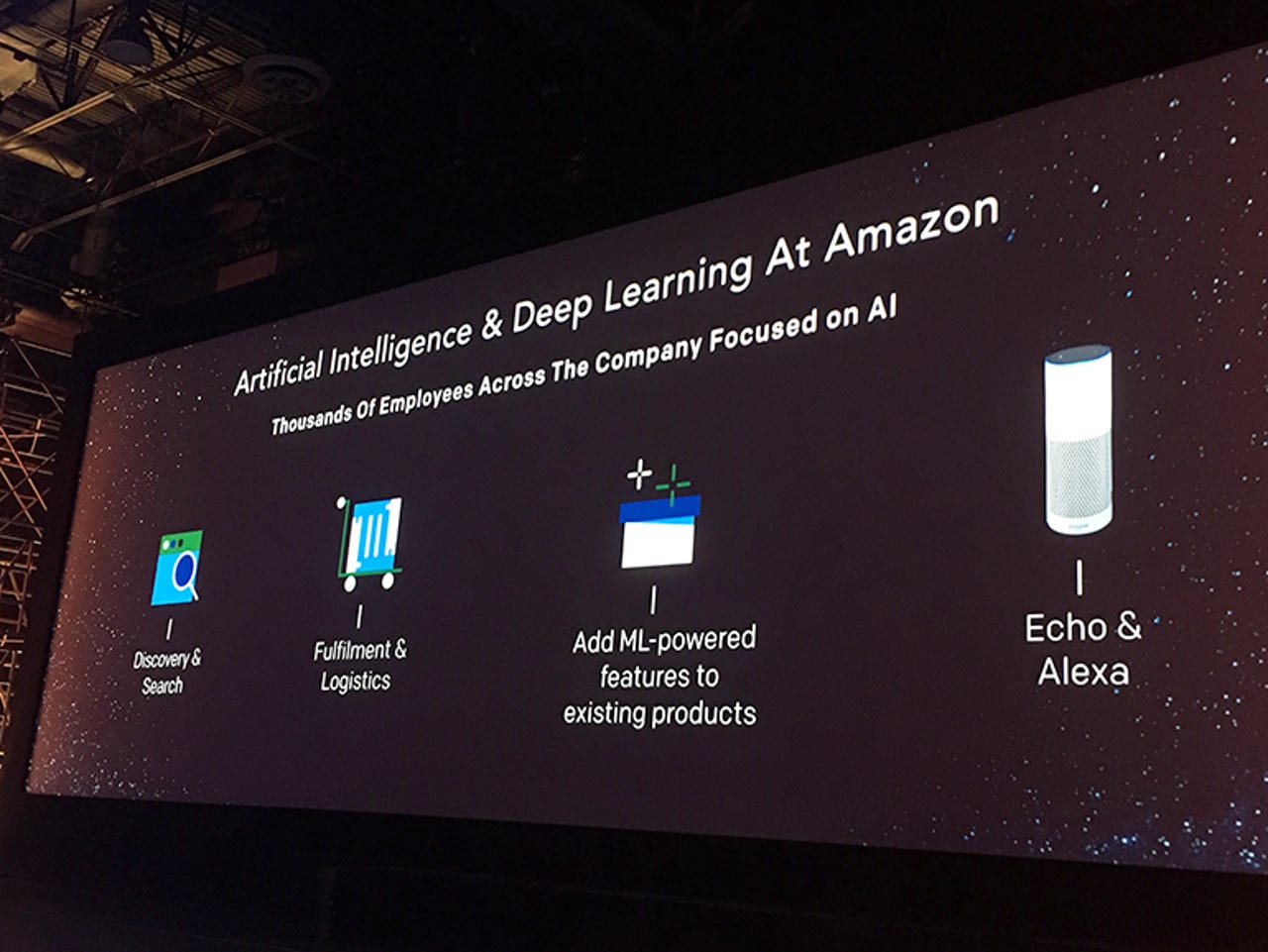

Amazon Machine Learning (AML) offers companies an easy, highly-scalable on-ramp for interpreting data. Under the umbrella of Amazon Web Services (AWS), launched in 2006, AML offers visual aids and easy-to-access analytics to make machine learning accessible to developers without a data science background, using the same technology fueling Amazon's internal algorithms. It requires little in terms of hardware or software investment, and has a pay-as-you-go model. The aim is to help businesses build machine learning models without having to create the code themselves.

Once the models are in place, you can use AML to "obtain predictions for your application using simple APIs, without having to implement custom prediction generation code, or manage any infrastructure," according to Amazon. The platform can "generate billions of predictions daily and serve those predictions in real-time and at high throughput," the company said.

On Wednesday, AWS made some big announcements regarding its cloud offerings, at its annual conference, re:Invent. It is offering three new AI services: Amazon Rekognition, which can perform image recognition, categorization, and facial analysis; Amazon Polly, a deep-learning-driven text-to-speech (TTS) service; and Amazon Lex, a natural language and speech recognition program.

Swaminathan Sivasubramanian, general manager for AWS, said he wants "developers to build a new class of applications" that can see, hear, and help them build. "My goal is to bring machine learning to every AWS developer," he said.

Another part of Amazon's mission, said Sivasubramanian, is to "help customers put intelligence at the heart of every application and business."

The philosophy for Amazon AI is "high quality, best-in-class deep learning systems with deep functionality," Sivasubramanian added; he also noted the importance of Amazon's AI platform and services integrating well with other AWS products.

Sundown AI, a tech company that helps businesses offer customer service via an AI platform called Chloe, uses AML for business operations. Sundown AI works with businesses in 20 countries, mostly in e-commerce. The setup, said CEO Fabio Cardenas, was relatively easy: "We chose Amazon because we already had features deployed in AWS, and thus interoperability was easier to achieve." And, although it's not open source, Cardenas pointed out that "some services provide free tiers that could be used for testing or to create basic scenarios."

Cardenas noted that AWS was behind other competitors at one point, but said "it's Amazon, and we knew they would catch up." He sees the competition as positive, in terms of increasing the quality of the offerings and keeping prices low. AML's price structure, he said, is "based on computing power per hour used, and depending on the service other fees might apply. Data transfer in or out of the cloud is also a factor for calculating costs."

Enterprises 'wake up' to machine learning

Alexander Linden, research vice president at Gartner focusing on data science and machine learning, offered some insight into assessing available machine learning platforms. Everybody this year is "waking up," he said, and saying, "Oh, we're becoming a machine learning company!"

The good thing, said Linden, is that today, "you can trial those systems for almost nothing. I think 1,000 image extractions or classifications cost you something like 10 cents, which is, of course, absolute peanuts." Instead of purchasing something like an image recognition application, which could cost up to a quarter of a million dollars, you can "just fork over the data to Google or Amazon and get it sourced there," he said.

In terms of broad aims for these tech giants, when it comes to their machine learning offerings, Linden said they "definitely" have different goals: Microsoft has a significantly broader offering than Amazon or Google, he said, while Amazon primarily targets software developers -- not the corporate data scientists. "I don't see Amazon playing a role in a banking context, insurance context, retail context, or government context," Linden added.

Linden pointed out some considerations to keep in mind when evaluating Amazon's machine learning platform. First, there's a difference between Amazon's platform and the "pre-baked, ready-made, machine learning API," he said. Although it's difficult to stack the companies against each other, Linden's opinion is that "Amazon is not fully up to speed against Google. I would think Google or Microsoft are probably the cutting-edge folks -- then Amazon would be third, and IBM."

On the other hand, he said, enterprises must sometimes create their own machine learning models, using internal data. "If you think about failure prediction, if you think about customer, database marketing," said Linden, "that's a complete different area. There, Amazon is a distant fourth. It's often not on the client's agenda."

Still, if your business has been using Amazon for a while, and would like to get things done quickly, "Amazon is fine," he said. "It's definitely good enough to solve many different problems. But if you really want to be cutting edge, then I have never seen anybody actually doing machine learning just with Amazon's technology."

Amazon's current offerings are relatively "rudimentary," Linden said. "It works, and it's good enough for many cases, but it pales in comparison to what Microsoft with its Azure machine learning does." To be fair, he added, Google's product is also "still rudimentary," and he would "put them almost in the same ballpark when it comes to making your own machine learning solutions." However, "when it comes to utilizing existing machine learning solutions that Google has created, currently, Google has a clear edge over Amazon," said Linden.

Still, Amazon's machine learning platform should be taken seriously. "AWS has far better traction in all kinds of other cloud services, which will likely outweigh its deficiencies in the machine learning space," said Linden.

"And it's still early in machine learning and AI race," he added. "Let's not forget that."

Also see

- Machine learning: The smart person's guide (TechRepublic)

- How Amazon wants to bridge the data science gap by bringing machine learning to the cloud (TechRepublic)

- IBM Watson: Six lessons from an early adopter on how to do machine learning (TechRepublic)

- Google tailors A.I.-powered search for enterprise (ZDNet)

- Google Cloud Platform signs up enterprise giants, how does it compare to AWS? (TechRepublic)

- How to prepare your business to benefit from AI (TechRepublic)