South Korea looks to own startups for growth, here are the top 5 in 2019

South Korea's economy is in turmoil. The OECD is projecting a real GDP growth rate of 2.4% this year, its lowest since 2012. The projection for 2020 by the organisation is 2.49%, a slight rise, but the country's fundamentals have not changed -- it is still very much stuck in the mindset of focusing only on manufacturing and hardware. The country needs innovation, but more importantly, the type of innovation that can scale globally. One that is not defined by hardware, but by the development of software and platforms.

South Korea has never lacked for good ideas. Cyworld is a great example of this. It was a social media service launched in 1999 by KAIST university students that was later bought by SK Communications. By 2005, Cyworld was used by practically every Korean, riding the internet boom of the early 00s. Many cite it as an example of the country being the "first" to successfully launch a social media platform. But the problem with this argument becomes apparent when looking at Cyworld's scoreboard globally. In a nutshell, all of its endeavours in North America, Europe, and Asia, did not work out in the end. Cyworld was a good idea that failed, with the market delivering better platforms, such as Facebook and Instagram, that were more applicable and scalable upon the introduction of smartphones.

There are many reasons as to why Cyworld failed. For one, it didn't have original, innovative software, something the country has never been good at. It also failed to adapt to global trends. While Facebook offered a simple looking and simple-to-use service optimised for smartphones, Cyworld was late to change its UI that had been designed for PC. Launching first doesn't define innovation. Scalability, adaptability, and proper funding do.

See: SK Telecom signs deals for 5G hospitals, smart cities, self-driving infrastructure

There are positive developments, however, in these areas. According to the Korean Venture Capital Association (KVCA), in 2014, around 1.64 trillion won was invested in startups. In 2015, the figure reached 2.09 trillion won and in 2016, 2.05 trillion won. Starting in 2017, the number rose drastically to 2.38 trillion won, and did so again in 2018, to 3.42 trillion won.

The government announced in March that it wanted this figure to rise to 5 trillion won by 2022. It vowed to be a startup "supporter" -- unlike during the 20th century -- that fostered merger and acquisitions, and collaboration with credible venture capital firms that could provide proper funding with a long-term view.

The hope here is that these developments will break the cycle of venture capital firms only focusing on a return of investment. The traditional funding structure in the South Korean startup scene has primarily focused on investing in local services rather than core technologies. Local services tend to attain profitability faster, compared to say, investing in the development of a semiconductor instruction-set like ARM. These companies are then, in turn, listed on KOSDAQ.

If the government wants to become a proper supporter, it needs to allow technology startups to dive into their technology instead of having to worry about selling for profits in the short-term. With South Korea being the "first" to launch 5G wireless networks, it allows the country to be a testing ground for technology trends such as mobility, virtual reality (VR) and augmented reality (AR), artificial intelligence (AI), and blockchain. South Korean tech giants such as Samsung and LG have also noted these changes and have been more open to creating deals with local technology startups rather than only looking towards Silicon Valley and Israel.

See: South Korea to see location-based services grow to $1.1 billion

Working with local firms are also providing them with advantages in protecting patents and is a fresh change as they can emphasise the development of software and platforms instead of focusing solely on hardware. So are there startups in South Korea worthy of this kind of support? Here are five South Korea companies that, at least in 2019, show potential in rivalling any other technology being developed in the startup scenes around the world.

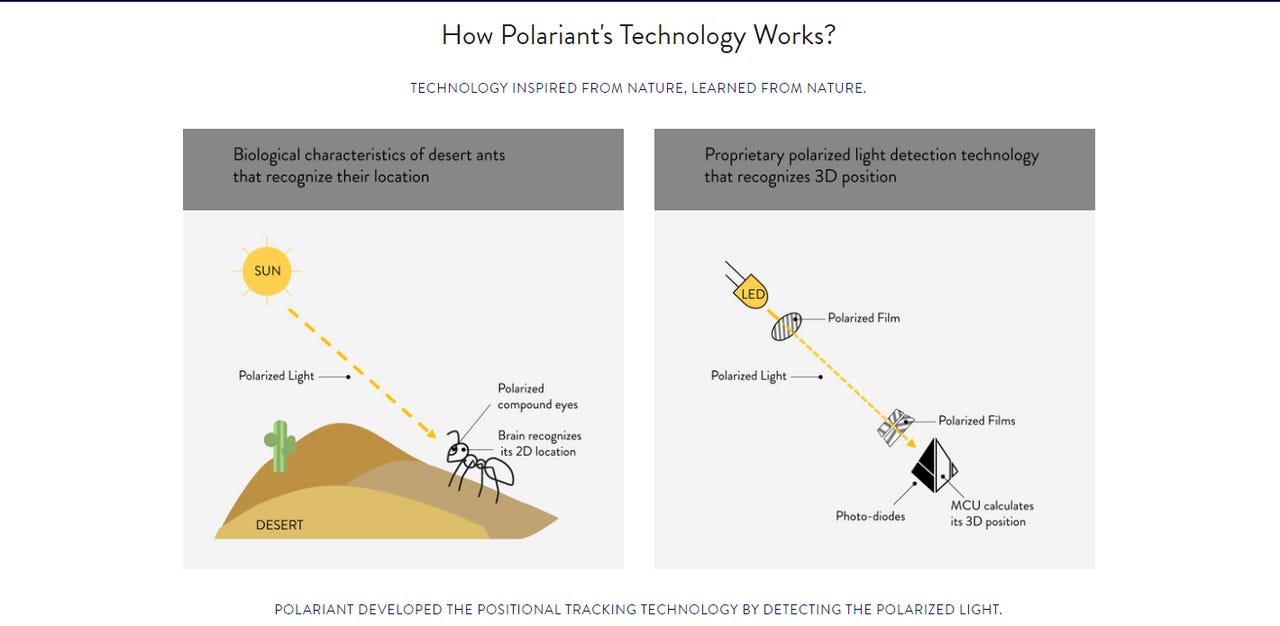

MOBILITY: POLARIANT

Founded in 2015, the company has developed its own location sensor that uses polarised light. Polariant's Polarized Light Sensing (PLS) solution can be used in places where conventional GPS tracking can be difficult such as underground parking lots, airports, and malls. Naver, South Korea's counterpart to Google, has invested in the firm and car-hailing firm Socar has bought a majority share of the company.

The company is now focused on developing spatial intelligence technologies. Polariant's core technology has a wide application range from autonomous cars to robotics -- areas that the country's biggest technology companies like Samsung, LG, and Hyundai are all focused on. Expect more partnerships for this soon-to-be giant.

Sensors, such as Polariant's that uses polarized light, are in high demand thanks to the rollout of 5G that could be a potential gamechanger for the rising IoT and mobility market.

AI: LABLUP

It's been hard to discern the fake from the real when it comes to AI startups in South Korea, especially after the big wave of name-changes that were inspired by Google's AlphaGo, which used AI to beat South Korea's Go champion. But a couple of years onward, the dust has settled and we have a start-up like Lablup making waves. Due to the boom of machine learning, scalable computing platform has become increasingly important. Lablup offers a platform-as-a-service for automated cloud and server management and scaling.

Access to AI development will not just be limited to big companies such as Samsung, Google, or Amazon thanks to this kind of platform. The company has a partnership with graphics card giant Nvidia to foster deep learning and machine learning models. Lablup's platform will help AI developers scale, and by helping the latter, the company has the potential to scale itself.

BLOCKCHAIN: HAECHI LABS

Bitcoin prices aren't what it used to be, but the focus should have always been on blockchain technology rather than its derivative cryptocurrency. Haechi Labs was founded in 2017 but is already partnered with Samsung Electronics, which launched its first cryptocurrency wallet on the Galaxy S10.

The company offers security audits for smart contracts to determine whether the code is secure or whether prices are optimised. A lot of people think blockchain is inherently perfect and incorruptible but poor coding will always leave room for hacking threats, and Haechi Labs' solution hopes to offsets these. In March, it launched a smart contract development tool. These kinds of services prioritise industry over profits and will be an important part of an ever-maturing blockchain market. Haechi Labs will surely mature alongside these developments.

GAMING: MINKONET

The gaming market's potential seems bottomless -- the global growth of eSports being the prime example -- but how we watch and view gameplay has pretty much stayed the same. Minkonet is a company that wants to change that: it offers a fresh, interactive watching experience for gamers through its patented data compression technology.

The company's solution allows viewers to watch live eSports matches from selectable, multiple viewpoints as if they are in the game themselves. Offering a live in-game viewing experience is much more difficult than it seems; it is incredibly data intensive and requires close collaboration with the game developer. The company already offers its solutions to PlayerUnknown's Battlegrounds (PUBG), one of the biggest global shooting games over the past few years. One of the solutions, 3D Replay Engine 2.0, allow players to replay their games as well as edit them to post on social media. Minkonet also has a plan to launch a gaming video-content creation platform called Playground aimed at children.

Companies like Minkonet are offering innovative new solutions to help create gaming content, which is growing exponentially thanks to the popularity of eSports.

AR: SEERSLAB

SeersLab had humble beginnings and its first success was a selfie app in 2015 which was hardly "innovative." But the app eventually reached 10 million downloads. The startup leveraged that success and expanded itself to become an "augmented reality sticker", or 3D animation maker.

The firm is now partnered with Rollercoaster Boy Nori, a hugely popular children's animated show in South Korea, to make its characters into 3D animations that can be used for AR. Most worldwide animation studios are looking into AR and VR, and really, nothing has more scalability than services aimed at kids. SeersLab's technology seems perfect for those.

Related Coverage on South Korean Innovation

- Samsung and 5G: Will this time be different?

- Naver adds Korean honorific feature to its Papago AI translation app

- Koh Young applies Fasoo's DRM to prevent against copycat products

- Hyundai partners with AI start-up to make HD maps for autonomous cars

- Lazada to establish intellectual property protection framework for South Korea

- AI will eliminate 1 of 8 jobs in Asia by 2024 (TechRepublic)