Startup funding: How this tiny apartment became a hub for innovation

With more than $85 million in assets under management and investments in more than 320 startups to date, Flat6Labs is one of the most prominent seed and early stage venture capital firms in the Middle East.

The firm has offices in seven countries across the region (we profiled the launch of their Abu Dhabi accelerator back in April 2015). The company also runs programmes to support startups and entrepreneurs in new tech-led ventures.

ZDNET Recommends

Since Flat6Labs launched, the FinTech sector – the current vertical du jour for VCs and investors in the region – has emerged and grown in prominence, while the wider ICT landscape has also continued to evolve, benefiting from increased investment and wider efforts to foster innovation and grow knowledge-based economies.

SEE: Innovation is hard. Here are five ways to make it easier

It's also managed to weather COVID-19 storm: the company has almost doubled the assets under its management in the past year and has increased its headcount from less than 50 pre-pandemic to roughly 73 today.

"I feel like we've only just gotten started," Dina El-Shenoufy, Flat6Labs CIO, tells ZDNet.

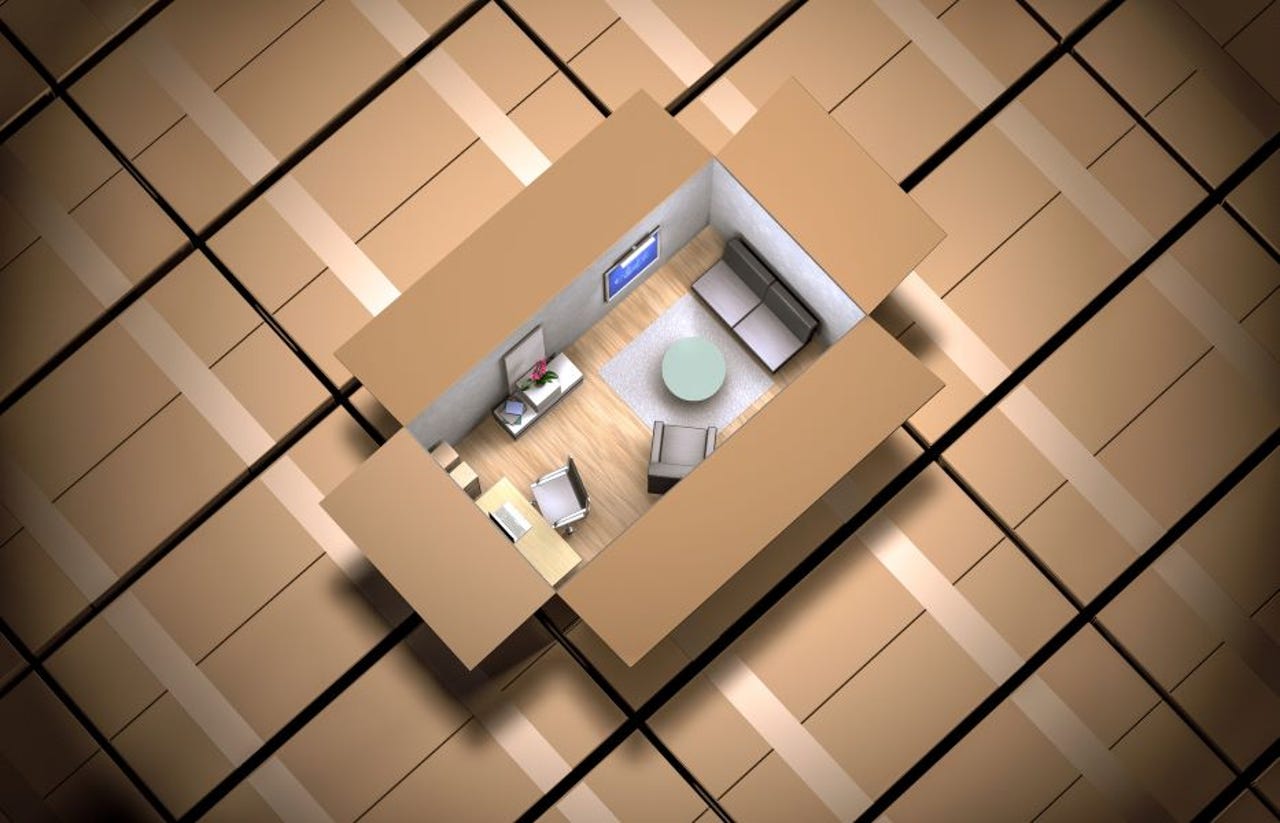

The VC firm has come a long way since its humble beginnings. A little-known secret about the company is how it came to be called Flat6Labs: it was, quite simply, named after the apartment where it all began, in Egypt's Giza District.

"We started in 2011, out of flat number six… a nice small apartment for entrepreneurs to exchange ideas, support each other, get mentored and coached by the community and get funded," Flat6Labs CEO, Ramez El-Serafy, tells ZDNet.

According to El-Serafy, founders Ahmed El Alfi and Hany Al Sonbaty – who also founded the MENA-focused VC Sawari Ventures – quickly realized there was a gap in the market for supporting very early stage startups and ventures needing "small cheques" as well as other forms of support.

Whereas other firms were focusing much more on just training, soft skill development or business coaching, few were combining this with financial investment, El-Serafy explains.

"I think we stayed true to this [model], where we have two things that almost run in parallel. We have a seed fund where we would invest in startup companies, and we'll put them into a seed program or an accelerator where they would get all the support they need, [including] cash investments."

Today, there's a far greater willingness from governments in MENA to facilitate the startup scene – or at least, as El-Shenoufy puts it, "to just lessen the burden" on VCs and accelerator initiatives

That said, the CIO notes that the market remains very much focused on the later stages of investment, with very little institutional funding for those starting out. This remaining gap is pivotal to Flat6Labs' work.

"If you look at many of the other support programs available in town, these tend to be short-term funders, and so the team behind them are often quite consumed by trying to fundraise or get or find a sponsor for the next cohort, or the next cycle, rather than being fully focused on just managing that portfolio and supporting it."

With more than 180 investors from across MENA and outside it, Flat6Lab's depth of experience, regional footprint and positioning as a "co-founder" for the startups they support are considered integral to its success.

There are, of course, other VC firms and accelerator programmes that have established a presence in the Middle East, including TechStars and 500 Startups. But Flat6Labs doesn't view these as rivals. "We see them as partners and co-investors," says El-Serafy.

A changing landscape

As MENA's sector matures, so too does the profile of those organisations that Flat6Labs works with.

Whereas the accelerator used to mostly attract entrepreneurs fresh out of college, it's now attracting more seasoned professionals with 10 to 15 years of industry experience. "Our first cohort had an average age of 22. Currently, our cohorts have an average age of 35," El-Shenoufy says.

Tech Jobs Explained

This experience, coupled with the wider maturity of the sector, also means it's easier to attract international investors from the UAE, Europe and the US, rather than just being limited to the local market. That wasn't the case a few years ago, says El-Shenoufy.

SEE: Want to get things done in tech? You'll need these surprising new allies

Among the companies they have supported, both El-Serafy and El-Shenoufy highlight the accomplishments of Instabug – a software development kit (SDK) that offers bug and crash insights for mobile apps – as an exemplar for Flat6Labs' model.

"These guys were amazing," says El-Shenoufy. "They had just graduated school, and now they're leading a company with a $100 million valuation, they employ more than 100 people, and they serve thousands and thousands of paying customers, including really big names like Google and Facebook."

Tunisia's GoMyCode is also namechecked by El-Serafy. An educational platform for coding, GoMyCode has helped thousands of individuals learn essential programming skills after expanding from Tunisia to Egypt, Senegal, Nigeria and the Gulf.

COVID-induced moves to more online and virtual communication will also unlock further regional possibilities, El-Shenoufy says, with CEO Ramez El-Serafy pointing to FinTech, logistics and health as key sectors it plans to target.

"We invested in 300 startups over the last 10 years. We're hoping that maybe we'll be able to multiply this number and go up to 3,000," the CIO adds.

"I feel like the next 10 years are going to be a mixture of doing it bigger, doing it better."