The Trade Desk CEO Jeff Green on ad fraud, connected TV, China and the data marketplace

For marketers, it's likely that their digital advertising budgets will flow through The Trade Desk at some point since the buy-side programmatic platform grabbing share in areas such as connected TV, Web, mobile and audio.

The Trade Desk, an independent ad platform, delivered strong third quarter revenue growth and earnings as it competes against giants for a piece of the ad revenue pie.

For marketers, The Trade Desk has become a key partner due to its independence, buy-side focus and customer service. The company reported third quarter net income of $10.2 million, or 23 cents a share, on revenue of $79.4 million, up 50 percent from a year ago. The Trade Desk recently launched a successful IPO.

The company is riding mobile advertising, in-app opportunities and connected TV as key channels and navigating a downturn in spending from consumer product goods companies and retailers. The Trade Desk is projecting fourth quarter revenue of $101 million and $306 million for the year.

We caught up with The Trade Desk CEO Jeff Green to talk shop and the technology behind the ad market.

Here are the highlights from my conversation with Green.

The emergence of connected TV and audio. The Trade Desk said on its third quarter earnings call that connected TV revenue was up 159 percent with audio up 21 percent. Now these channels are new, but show potential. Green said Roku is benefiting from connected TV advertising, but other services like Crackle are faring well too.

Why? Green said that it's clear consumers are going to over-the-top applications like Amazon and Netflix and cutting the cable cord. The reality is 70 percent of American households already subscribe to Netflix. And 70 percent of households pay for cable. Run the numbers and it's likely that consumers are going to hit pause on adding yet another subscription. Enter the connected TV ad models.

"Connected TV inventory has gone up 10x," said Green. "To us that is quantifiable proof the consumer is being tapped out and interested in ad funded models from the Hulus, Rokus and Crackles."

Audio advertising is also going programmatic due to services such as Pandora and Spotify, said Green. "You can't replicate radio advertising for these services because traditional ads aren't targeted," said Green. "Programmatic can give the customer a better experience and customize what is showing."

How will The Trade Desk's data marketplace differ from all the other ones in the marketplace? Green outlined how The Trade Desk is creating its own anonymized data marketplace so marketers can go cross device per person.

The Trade Desk acquired Adbrain to get a jump start on its data marketplace and has invested millions of dollars to get access to hundreds of millions of anonymized user IDs to bridge screens.

I noted that Adobe, Oracle, Acxiom and others all have data marketplaces. Green said its data efforts will complement those data services and the potential lies in The Trade Desk's position in the sales funnel. "The thing that puts us in a strong position is that we're a data marketplace at the point of consumption. Think about how it's easier to sell candy bars at the cash register," said Green. "We monetize at the point of consumption and are a trusted partner. We're not competing with those data companies, but bringing them together."

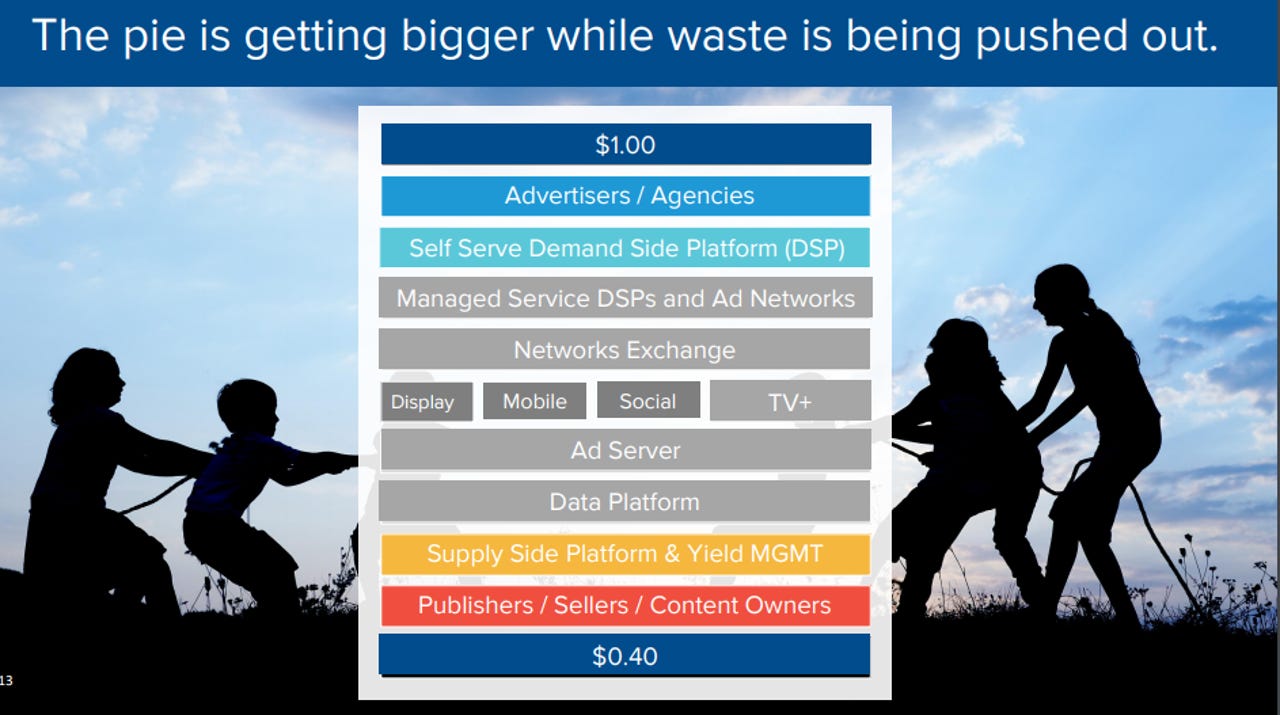

Battling ad fraud. The Trade Desk was one of the key drivers of Ad.txt, an effort to combat ad fraud. Green explained the idea behind Ad.txt on The Trade Desk's third quarter conference call:

It's very simple, which is you ask every publisher in the world to create a text file that just lives publicly on their domain, so you can type in any publisher's name like Google.com/ads.txt, and then you can see which SSPs and exchanges are authorized to sell their inventory. And this becomes really important if you're a premium publisher like CNN or something where there are people that are actually spoofing your domain and pretending to be you so that they can monetize your inventory. So it gets rid of any doubt as to who is authorized to rep the inventory. And by asking every publisher in the world to do this, we're effectively telling CNN, if you make very clear to us who's authorized, then we'll make sure to only buy from those that you tell us to buy from. It gets rid of some of the sub-syndication and resellers of resellers, where things can be misrepresented, and then in those small cases where there's actually fraud.

However, ad fraud quickly followed on large sports sites. How will The Trade Desk combat fraud?

Green said it is already blocking fraud for ad.txt and unauthorized traffic. Green said that the ad.txt effort was about "narrowing the sky" to create a well of quality inventory. "Narrowing it down does a lot so we can be more intelligent. I'm proud of the fact we promoted and encouraged ad.txt as much as any company out there," said Green. "We're making sure that bots aren't generating and buying the traffic. If successful, CPMs will go up because it's fine to pay a few pennies more to know it's a human being seeing the ad."

The Trade Desk has worked closely with White Ops, a cyber security company focused on stopping robots and ad fraud with artificial intelligence. Green was optimistic about the industry's ability to battle ad fraud. "Ad fraud is easier to spot due to the economics. You have to commit fraud so many times to make money. The industry has done more in 2017 to stop ad fraud than any year previously," said Green.

Green acknowledged that battling ad fraud will be an ongoing effort that'll include artificial intelligence, machine learning and industry coordination.

I'd argue that it remains to be seen whether the ad industry players can coordinate enough to harness machine learning and create the systems to combat cybercrime. Google has the AI and machine learning expertise and Facebook is building it, but the entire industry will have to combine forces.

The perception all the good click-based inventory is being gobbled up. Green said The Trade Desk is often characterized as primarily a direct response ad player "since we measure everything," but it's noting that a decade from now direct response and branding will merge. "I'm not certain that there's a clear line now between a Geico ad now with a number or call to action and the branding commercial you see on TV four hours later," said Green. "At the end of the day advertising has to measure everything and win hearts and minds."

Competing with DoubleClick Bid Manager. It's not easy competing with Google's DoubleClick unit, but Green emphasized that The Trade Desk has unique advantages.

"It's fair to say that DBM is our biggest competitor, but we have some strong differences in every way--strategy, go-to-market and technology. The first thing to always preface is that global advertising is a $700 billion industry and I don't believe it's possible for any company to own a majority of that. It will be a big market with plenty of room for us, Google and dozens of other players," explained Green. "DBM is a tiny division of Google and the biggest difference between us is that we can talk about buying media objectively. We don't bias to Ad Exchange or YouTube. We are on the buy side so we win more trust. We're independent and that's the single biggest difference."

Green noted that The Trade Desk has cooperation from the largest media companies as well as players like Alibaba and Baidu.

The China opportunity. The Trade Desk highlighted China as a big market that can fuel growth. However, China can be a headache for U.S. technology companies. Green said that he understood why a China growth strategy could be questioned, but The Trade Desk's business-to-business approach is a differentiator. "To the average person in Silicon Valley I get why you'd look at China and say 'good luck' with a lot of those efforts. But those are B2C plays where an American company is trying to win the hearts and minds of the Chinese consumer. That's not what we're doing," said Green.

"We go to market representing the biggest multinational companies and the world and writing checks to the biggest publishers in China. Instead of taking money out, we're taking dollars from the rest of the world and bringing to China. I don't care if Chinese consumers every know The Trade Desk or our name," he added.

The Trade Desk's plan for its China business is a work in progress. The company is building out teams in Shanghai and Hong Kong and focusing on data and inventory integration. In 2018, that integration work will continue and Green said The Trade Desk will focus on building trust with ad agencies in China.