Twitter Q1 stronger than expected, monetization efforts pay off

Twitter reported better-than-expected first quarter sales as it grew its daily and monthly active user base and its data licensing and enterprise business grew at a rapid clip.

While Twitter doesn't have the scale of Facebook or even Snapchat, the company is monetizing is user base well and capitalizing on its ability to be a go-to venue for live events.

In a shareholder letter, CEO Jack Dorsey noted:

Our machine learning efforts continue to benefit advertisers as we continue to refine our targeting and ad-matching capabilities.

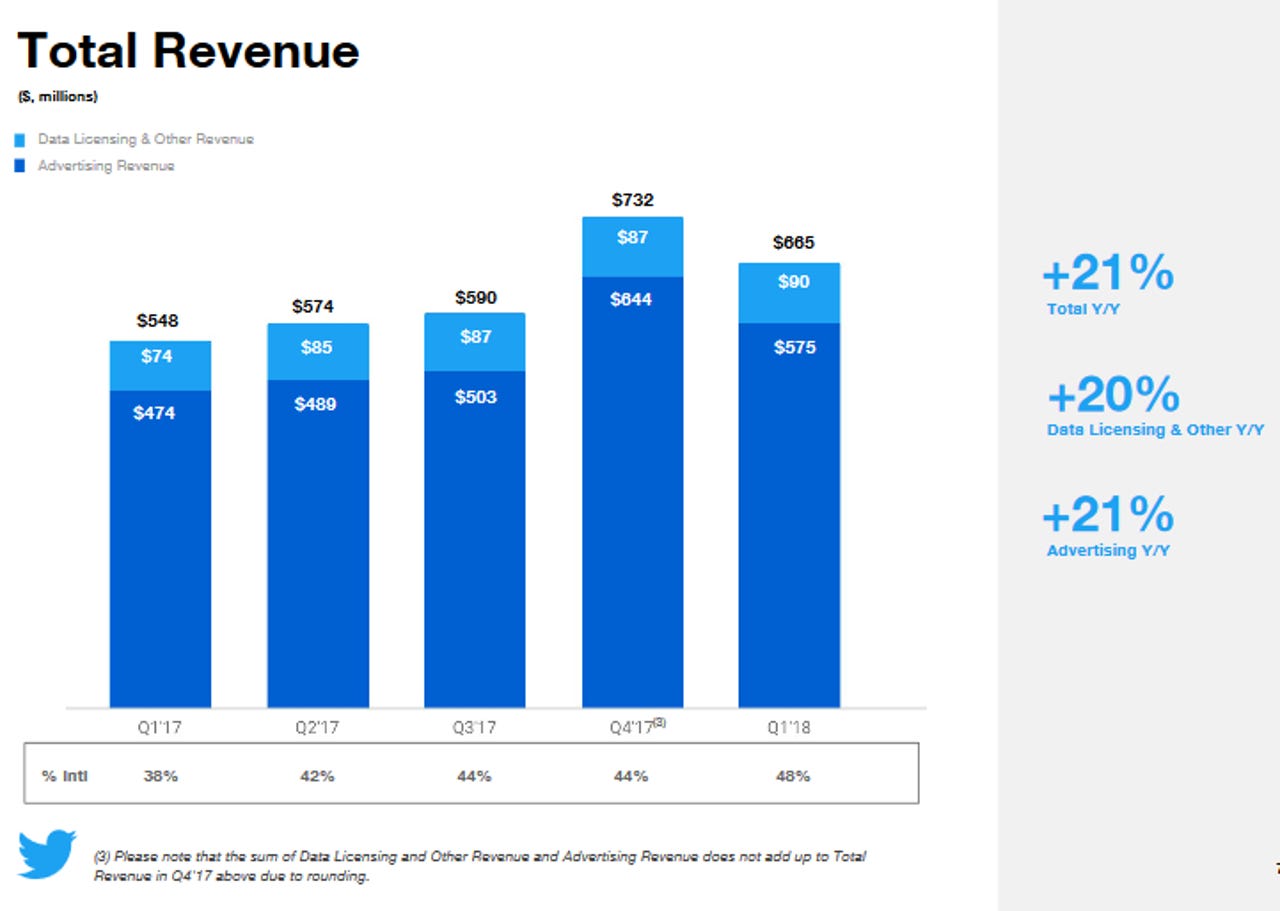

The company reported first quarter earnings of $61 million, or 8 cents a share, on revenue of $665 million, up 21 percent from a year ago. Non-GAAP earnings for the quarter were 16 cents a share.

Wall Street was expecting first quarter earnings of 12 cents a share excluding items on revenue of $607.6 million.

Twitter is also doing a better job diversifying its revenue base. Data licensing and other revenue (essentially its enterprise business) had first quarter revenue of $90 million, up 20 percent from a year ago.

On a conference call with analysts, Dorsey outlined a few key points worth noting. Here's the recap:

Will Twitter's data licensing business be hurt by privacy concerns and regulation such as GDPR?

Dorsey said:

Our data business is something we continue to feel really good about. We are different from our peers in that Twitter is public. We serve the public conversations, so all of our data is out in the public, out in the open. And our data business just organizes that public data in real-time to make it easier for brands, researchers and organizations to utilize it.

And it's useful just to go over some examples of how people use the data business to add some color here. We do a lot of sentiment analysis for brands for them to figure out how people feel about their products or services.

We see a lot of citizen services being used. A good example of this is Virginia. Their Department of Emergency provides citizens info -- citizen info for the residents. And also research, we see a lot of research. A good example of this is Northeastern who developed a flu tracking technique. We do not provide any personal identifiable information that's not already visible on the service.

Twitter is also becoming more efficient with its monetization.

As for the outlook, Twitter said it expects adjusted EBITDA to be between $245 million and $265 million for the second quarter. For 2018, Twitter is projecting capital expenses to be between $375 million and $450 million.

Monthly active users for Twitter were up 3 percent overall, but down 1 percent in the U.S. Twitter is seeing gains internationally. Daily active users were up 10 percent in the first quarter. That growth rate was sequentially lower from the 12 percent in the fourth quarter.