Verizon Q1 solid, but wearable connections offset phone, tablet wireless declines

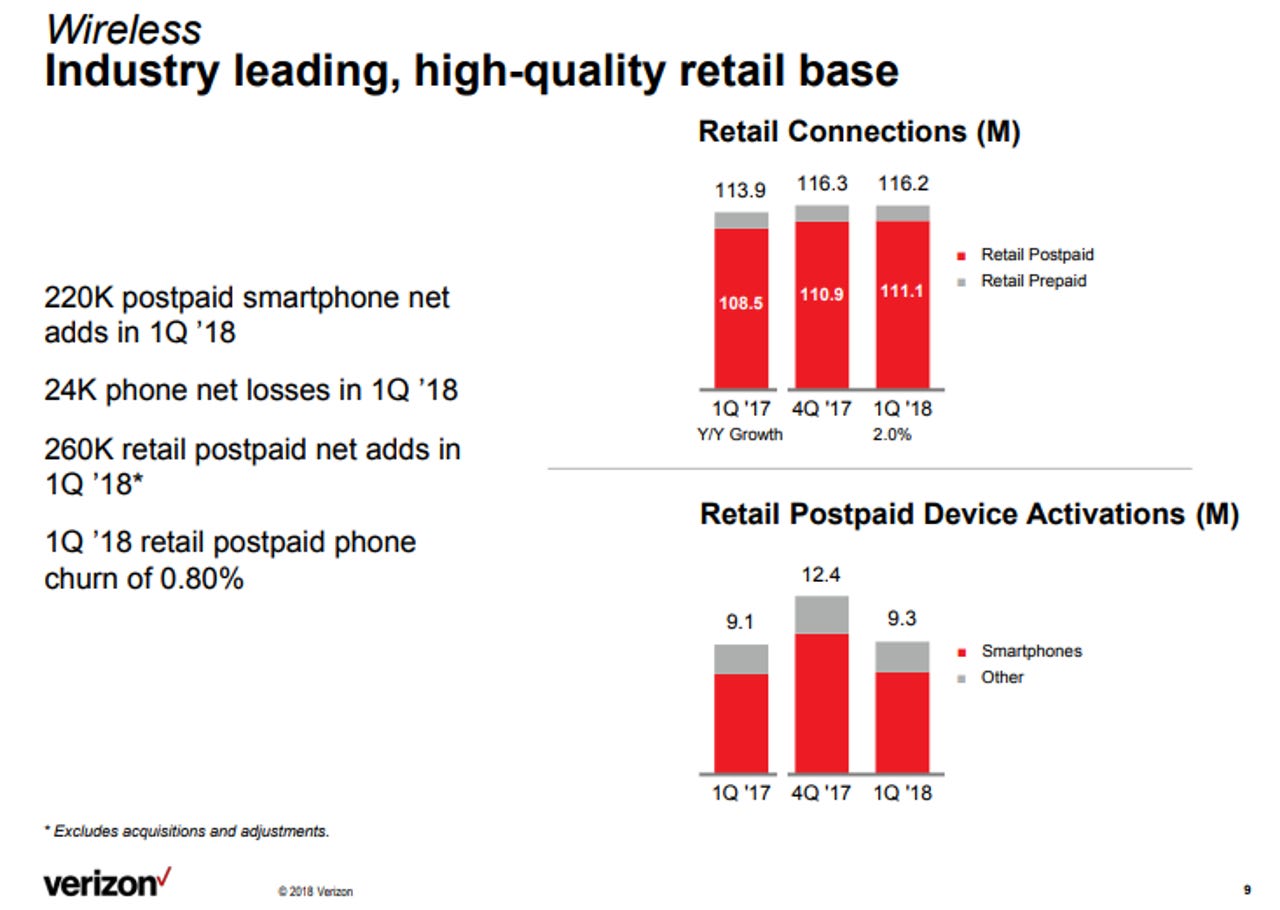

Verizon delivered a better-than-expected first quarter as it added 260,000 retail postpaid connections, garnered telematics and Internet of things sales gains and added FiOS subscribers.

For the first quarter, Verizon reported earnings of $1.11 a share, up from 84 cents a share from a year ago. Non-GAAP earnings in the quarter were $1.17 a share on revenue of $31.8 billion, up 6.6 percent from a year ago.

Wall Street analysts were expecting Verizon to report first quarter earnings of $1.11 a share on revenue of $31.24 billion.

While the quarter was strong, there were a bevy of moving parts. Verizon had a pre-tax charge of about $249 million to early debt retirement and about $107 million of acquisition and integration costs related to Oath (AOL and Yahoo). Verizon also funded its pension plans to the tune of $1 billion.

However, the real moving parts were in the business operations. Consider:

- Verizon Connect, which includes telematics and Internet of things operations, had first quarter revenue of $234 million. IoT revenue including Verizon Connect were up 13 percent from a year ago.

- Wireless revenue was $21.9 billion in the first quarter, up 4.7 percent from a year ago. Service revenue was down 2.4 percent.

- Verizon reported a net increase of 260,000 retail postpaid connections in the first quarter, but had net phone losses of 24,000 and tablet losses of 75,000 subscribers. Verizon added 359,000 wearables and other connected devices. Postpaid net smartphone additions were 220,000.

- Postpaid chain was 1.04 percent.

- Verizon added a net 66,000 FiOS Internet connections and lost 22,000 FioS video connections.

- Oath revenue in the first quarter were $1.9 billion.

As for the outlook, Verizon said it sees revenue growth of low-single digit percentage rates. Earnings per share will grow at the same clip with capital spending of $17 billion to $17.8 billion. The capital spending view includes the launch of 5G services.