Why consumer storage companies are salivating over the enterprise

SanDisk is best known for its memory cards, Flash music players and solid-state drives for consumers. However, the company is increasingly being known as an enterprise vendor and is quickly moving up the storage system chain.

SanDisk isn't alone in this. Primary consumer brands such as Toshiba, Micron and Samsung all have the solid-state storage know-how to move into the enterprise. Of the flash storage providers only Intel has an enterprise pedigree from the get-go, courtesy of its server chips and data center footprint.

How did these commodity memory providers become enterprise players? Here are a few moving parts:

- The move from hard drives to solid-state drives. Spinning disks are going the way of the dinosaur as solid-state drives look like a good economic option over time.

- Established storage giants have to walk the line between preserving existing profit margins on traditional systems and transitioning to solid-state gear. Western Digital recently acquired Skyera to beef up its HGST's offerings.

- Big data analytics require faster access to storage. In-memory databases continue to proliferate.

- Scale matters for vendors looking to play in solid-state enterprise storage. And companies like SanDisk and Samsung clearly know how to deliver product in volume at solid price points.

- The profit margins on enterprise storage are simply better than consumer options.

- Solid-state storage is becoming more complicated, and that will require intellectual property as well as manufacturing prowess.

- Consumer memory players are looking to move up the value chain and are likely to acquire systems vendors. SanDisk's acquisition of Fusion-io provides a blueprint for other memory players to emulate.

- While the term 'consumerization' is often used in mobile, there are elements of the trend in storage too. Chances are your memory card maker is also now in your data center.

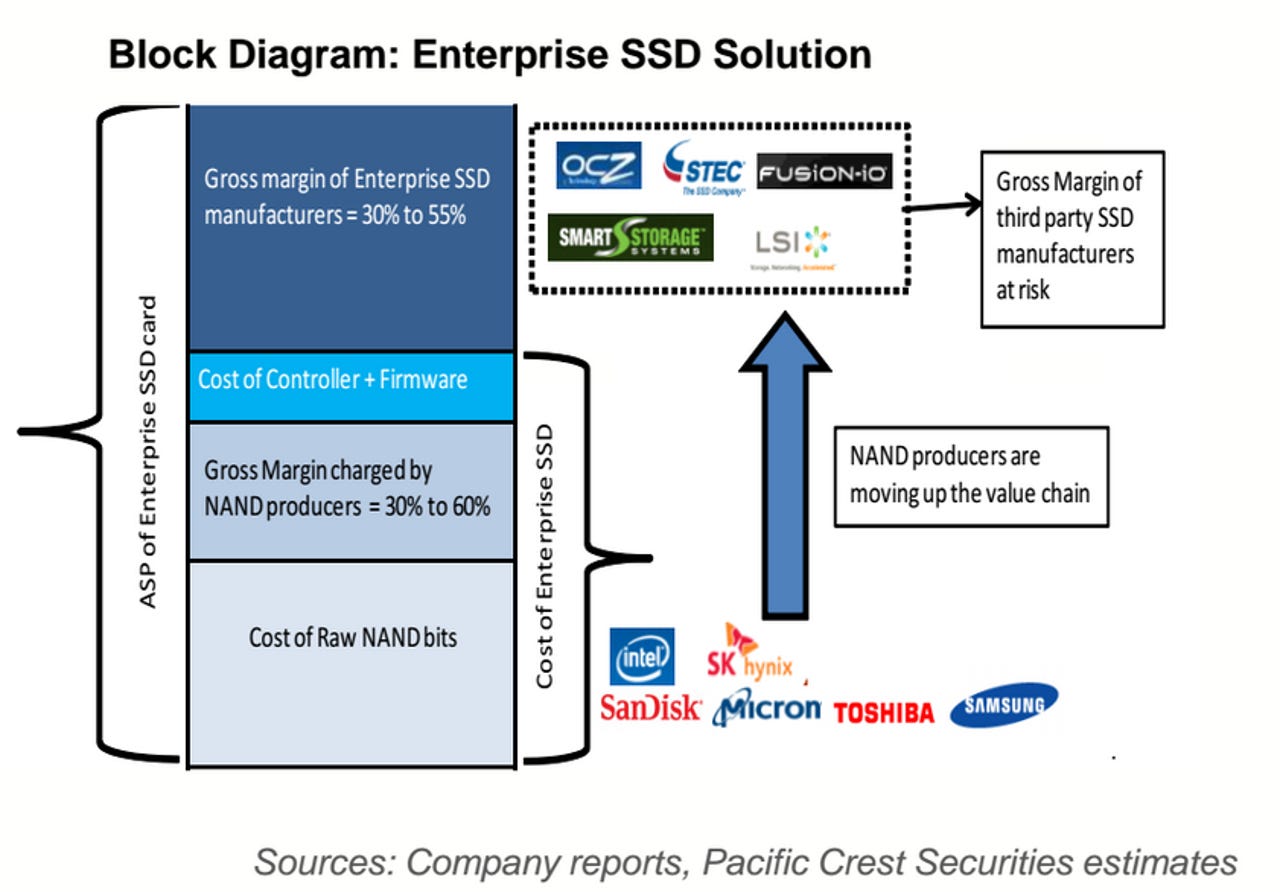

Pacific Crest analyst Monika Garg noted in a recent research report that the move to 3D NAND means that solid-state technology is more enterprise ready. As a result, vendors will acquire or run over third-party solid-state system providers.

This chart highlights the possibilities.

SanDisk's John Scaramuzzo, general manager of the enterprise storage unit, said at a recent investor conference that the company's enterprise moves began in 2011 with the acquisition of Pliant. In 2012, SanDisk focused more on application acceleration with the acquisition of FlashSoft. The purchase of Schooner Technology gave SanDisk unstructured database processing. "We not only sell flash products and enterprise products, but we also want to be able to help our customers run their applications faster," he said.

Now the goal is to take Fusion-io and bypass hardware bottlenecks via software and memory design.

SanDisk has been the consumer memory vendor to make the biggest enterprise splash. The company has bought its way into the market and followed a vertically integrated model.

Mark Durcan, CEO of Micron Technology, made similar points on 3 December at the Credit Suisse investor conference. Durcan said demand remains strong in mobile and the enterprise courtesy of big data analytics and a move to flash. "We see growth continuing," he said. "Flash isn't a one time spike. We see a long steady ramp towards increasing DRAM in the enterprise."

"I do think that it's a sustained phenomenon because the database moves closer to the end customer," said Durcan.

Samsung Electronics Jeeho Baek, vice president of the company's memory business, said enterprise demand is driving DRAM shipments along with mobile.

"Enterprise server demand remained solid, including data center. We actively responded to demand increase by each application and improved profitability by expanding the 20-nanometer class migration," said Baek, speaking on Samsung's third quarter earnings call on 30 October. "For NAND, the overall demand was solid, driven by demand increase for new mobile products, with higher-density storage and strong SSD demand for client and datacenter."

In the years ahead, don't be surprised if these memory providers move up the stack and threaten the companies they supply. The big guns in enterprise storage -- Western Digital's HGST, EMC, NetApp, IBM and Seagate -- are all embracing solid-state technology and do well, but the transition in the data center is opening the door to upstarts such as Pure Storage as well as providers with a more consumer pedigree.