451 Research launches Cloud Price Index

I make some of my living from following the newest cloud developments and with constant price discounting I can't keep track of public cloud pricing so how can you be expected to do it? Well, now we can both turn to 451 Research's new Cloud Price Index (CPI) for help.

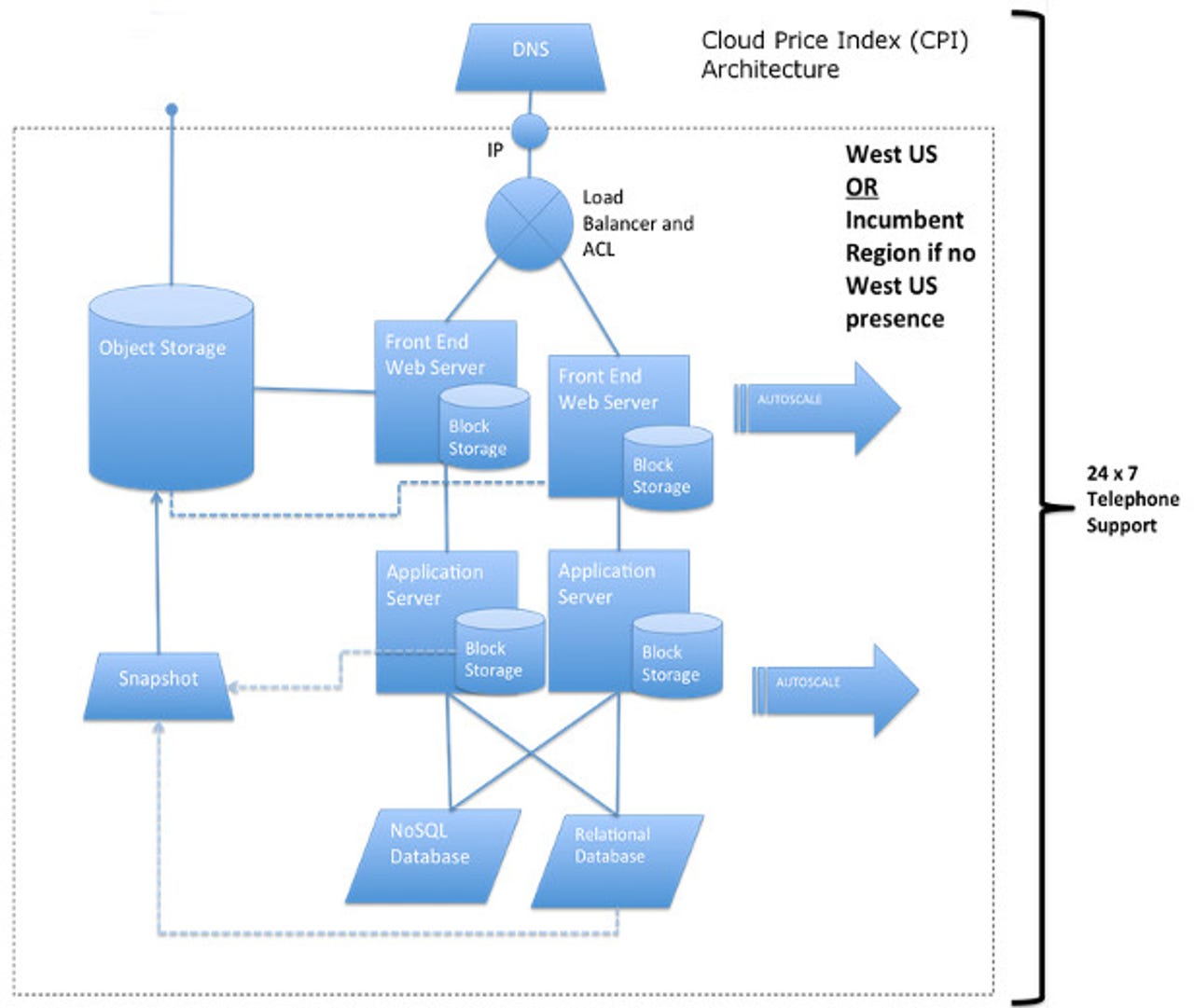

This new "Index" is meant to act like a consumer price index. Specifically, its standard is the services required to operate a typical, multi-service Web server application. In addition, the well-respected 451 Research, is offering a Virtualization Price Index (VPI) for simpler, three-tier Web applications.

What 451 found, in its first CPI, is that the average price for a typical Web application is $2.56 per hour. This was the average quote from a range of cloud providers based on a specification of a typical multi-service cloud application. What 451 calls the "hyperscalers," AWS, Microsoft Azure and Google Compute Engine, were able to offer slightly cheaper prices at an hourly average of $2.36. The VPI is currently $0.73 across all providers, whereas the hyperscalers are slightly more expensive at $0.78.

Must-Read: Cloud

"The current average cost of running a multi-service cloud application includes bandwidth, storage, databases, compute, support and load balancing in a non-geographical resilient configuration,” said Dr. Owen Rogers, Senior Analyst for 451 Research’s Digital Economics unit in a statement.

Rogers continued, "At this hourly price for an application that potentially could deliver in excess of 100,000 page views per month, it's easy to see how cloud is a compelling proposition for enterprises. Our research indicates that savings of up to 49 percent can be achieved by committing to a minimum usage level, so enterprises should consider alternatives to on-demand if they wish to secure cost savings."

One thing is clear: It pays to shop around. The first report found that "The most expensive hyperscale provider and overall provider was more than twice the price of the cheapest ($1.60/$3.64 and $1.52/$4.07, respectively)."

The CPI is based on cloud quotes from a number of providers. These include AWS, Google, Microsoft Azure, Swisscom, Verizon, UpCloud, Gandi, Lunacloud, Internap, Peak10 and Windstream. 451 will update the CPI Index whenever there's significant price-cutting.

In a document explaining 451's methodology, Price added, "A virtual machine does not an application make; cloud applications need an array of services to function optimally. Comparing unit prices to assess changes in dynamics and competition is fraught with issues – just because VMs are becoming cheaper doesn't mean that applications, the real consumed entity in the cloud, are becoming cheaper, too."

The point of this isn't to give you a price comparison chart. You might think that clouds are on their way to being generic. They're not.

451 Research found many companies couldn't give them price quotations. As Rogers commented, "This suggests that the industry is far away from simple, easily understood pricing."

He's right. Cloud pricing is still far too complicated. Still, the CPI at least gives enterprise cloud customers a starting point, and that's more than they had before.

Related Stories:

- Google Cloud Platform prices slashed again, intros Container Engine for Docker

- Forrester's 2015 cloud predictions: Docker rises, storage pricing war claims lives

- Microsoft offers unlimited OneDrive storage with Office 365 subscriptions

- Amazon's ability to invest in AWS: By the numbers

- 2014: The year the cloud killed the datacenter