Adobe's Q1 strong: 1.84 million Creative Cloud subscriptions

Adobe's first quarter earnings and revenue came in at the high end of the company's expectations as it continues to land cloud subscriptions.

The company reported first quarter earnings of $47.05 million, or 9 cents a share on revenue of $1 billion. Adjusted earnings were 30 cents a share, a nickel better than estimates.

The main takeaway from Adobe is that it added 405,000 Creative Cloud subscriptions from a year ago and has annualized recurring revenue approaching $1 billion for its Creative business.

In a presentation, Adobe CEO Shantanu Narayen said the company's new features to its Creative Cloud have been well received.

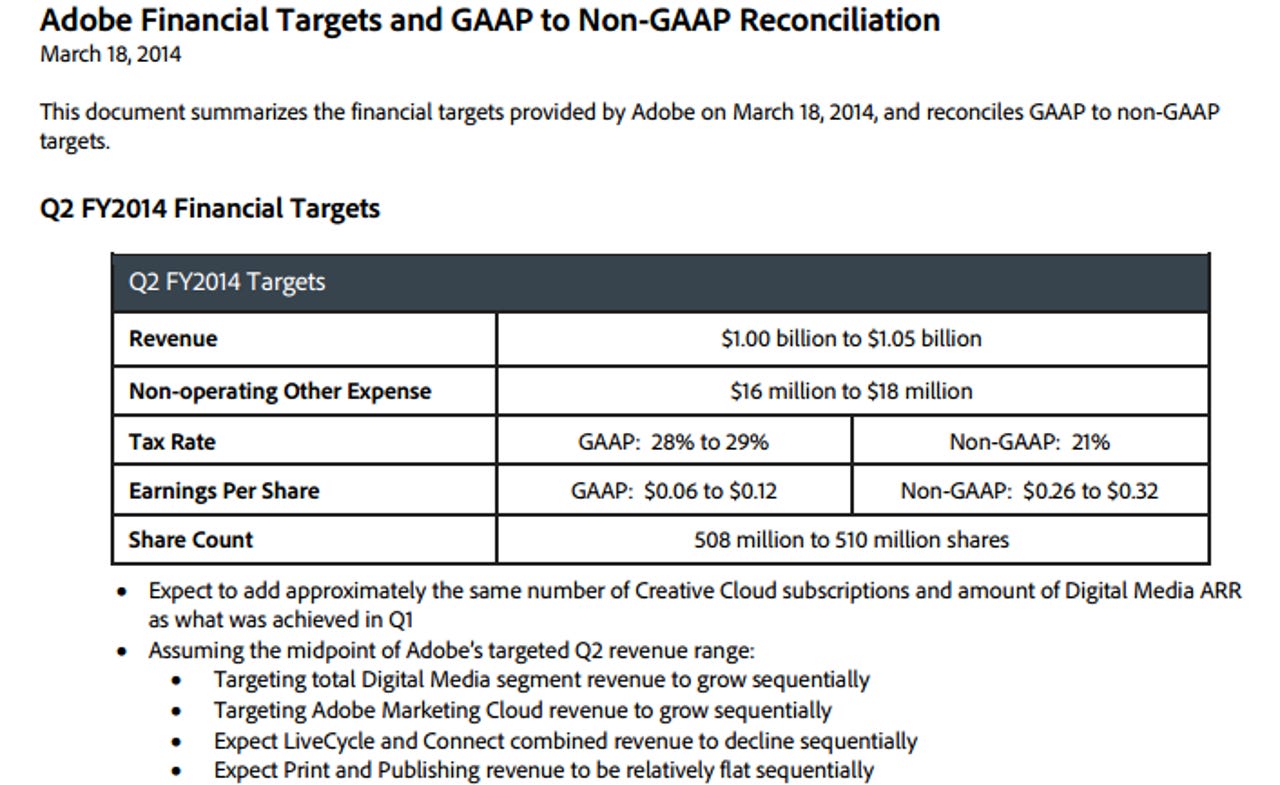

As for the outlook, Adobe projected second quarter revenue of $1 billion to $1.05 billion with non-GAAP earnings per share of 26 cents a share to 32 cents a share. Wall Street is looking for earnings of 26 cents a share.

On a conference call, Narayen noted that Adobe's marketing cloud, which many analysts argue is the best in the industry, is gaining traction. "When we look at it big picture we just continue to see great awareness, good traction with all of our solutions, people adopting the new solutions rather than point products," he said.

Other key points:

Contracts for subscriptions are about 18 months on average, but some are three years.

- Overall, customers are signing up for the full Creative Cloud over point products such as PhotoShop.

- Executives think that the next update to the Creative Cloud will tilt the customer base to the subscription model. Why? Creative Suite 6, the last on-premise suite, will look long in the tooth.

By the numbers:

- Adobe's marketing cloud revenue growth was 24 percent compared to a year ago. Adobe said it is on pace to hit its 30 percent bookings growth target.

- 54 percent of revenue came from Americas followed by 30 percent in EMEA and 16 percent in Asia.

- Deferred revenue at the end of the quarter was $881 million.

- Adobe ended the quarter with $3.13 billion in cash and equivalents.