AMD: Does the resurrection start with 'Shanghai'?

AMD on Thursday launched its Shanghai processor family--the successor to the much maligned Barcelona. The goal: Close the gap on server chips with Intel. The challenge: Convincing customers, shareholders and others in the peanut gallery that a turnaround at AMD is underway.

Later today, AMD will try out its messaging at its analyst meeting (Techmeme, statement). The challenges are the following:

- Deliver a roadmap that's as easy to understand as Intel's "tick tock" approach;

- Convince investors that the company can hang in a downturn;

- And build credibility by providing more perspective on operational improvements.

Shanghai, which is basically the do-over for the quad-core Barcelona platform, goes a long way to alleviating some of those concerns. The big takeaway is that AMD's latest server chips provide a performance boost over Barcelona in the same thermal envelope--shorthand for saying that more power doesn't result in more heat. Shanghai won't match Intel gigahertz for gigahertz, but the company argues successfully that power management, virtualization integration and other perks may allow AMD to pull even with its larger rival. "We made a 400 Mhz jump in the same power band," says Kevin Knox, vice president of AMD's commercial business. "Shanghai pulls us closer to Intel and keeps us competitive for several quarters to come."

Also see: AMD unveils ‘Shanghai’; Aims to better compete with Intel

- Adrian Kingsley-Hughes: AMD introduces 45nm quad-core "Shanghai" Opteron processors

- AMD statement

- Intel's fourth quarter unravels

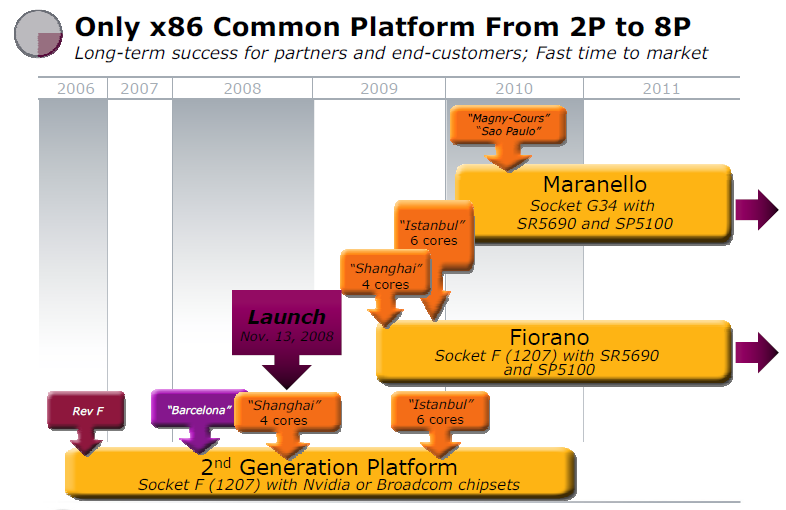

And that competition is a good thing for technology buyers. A strong AMD gives technology managers more leverage in their negotiations--assuming they aren't completely shelving infrastructure upgrades. Here's a look at AMD's roadmap (click to enlarge):

Simply put, AMD's latest server chips are another step in the right direction for company. Among other recent moves:

- AMD finally unveiled its long-awaited asset smart strategy. The move allows AMD to keep its hands in the chip manufacturing game without the balance sheet hit. If there's upside in its former manufacturing unit AMD participates. If not, AMD won't be swallowed alive. Since AMD is still heavily involved in the manufacturing spinoff it minimizes manufacturing risk as it delivers its roadmap.

- AMD's graphic chip business is showing some momentum. Graphic chips--a key cog in AMD's business model--are selling well enough to allow the company to squeeze larger rival Nvidia before Intel enters the market.

- AMD has a new leader. To say Hector Ruiz had lost Wall Street would be a minor understatement. Previous AMD analyst meetings had a familiar ring to them: Optimism--largely unwarranted--followed by poor execution. Ruiz would talk about AMD's asset smart strategy, but wouldn't deliver the goods. Under new CEO Dirk Meyer AMD gets a fresh start. The change was way overdue. If Meyer delivers the details Wall Street demands he can put AMD on better footing.

The problem? AMD is wrestling with an economic slowdown, fixing its balance sheet and is a no-show in the PC industry's fastest growing market--netbooks. And AMD is still losing money. In its third quarter, AMD reported a net loss of $67 million, or 11 cents a share, on revenue of $1.4 billion, up 8 percent from a year ago. While the outlook for AMD--like most technology companies--is murky at best at least units are up with flat average selling prices.

Concerns, however, remain. Morgan Stanley analyst Mark Lipacis notes that AMD has $5 billion in debt and only $1.3 billion in cash at the end of the third quarter. AMD's Asset Smart strategy--if approved by regulators--would fix that balance sheet problem and give the company about $4 billion in cash.

In other words, AMD is still a mixed bag, but there's enough happening to be mildly optimistic.

"It appears the company has remained on the road to profitability," says Wedbush Morgan Securities analyst Patrick Wang in a recent research note. "We recognized that Shanghai represents a game changer in the near-term and expect improvements in sales, margins and market share." That said, Wang keeps a "hold" rating on AMD pending consistent operating profits.

AMD's analyst meeting: What to expect

While Shanghai will occupy a good chunk of AMD's analyst day there is a laundry list of details Meyer will have to deliver.UBS analyst Uche Orji wants the following from Meyer:

- Gross margins topping 50 percent in 2009 even if revenue declines;

- Operating expenses projected to fall more than 13 percent;

- A breakdown of cash flow to show how AMD can preserve cash in a downturn;

- And a roadmap that's believable.

"If AMD were to repeat its 2007 analyst day where it provided an unrealistic set of product road maps, we would expect limited support for the stock," said Orji. Meyer's job: Be upfront, be credible and don't sugar coat things--an annoying habit that belonged to Ruiz.

Analysts are also looking for more detail of AMD's Fusion strategy. Orji said that the case for the processor and graphics capability on a single die is obvious. The big question is this: How will AMD leverage Fusion into new markets?

Assuming the stars line up for AMD the big unknown is how long this resurrection will last. Intel has a strong roadmap and plans to tick tock its smaller rival with incremental core additions to chips. Pressure from Intel isn't going to go away. AMD, however, will cast its lot with the power savings argument and the growth of virtualization. The other unknown is whether AMD's partial spin-off of its manufacturing unit will lead to delays down the line.

AMD's Knox disputes the argument that the company's asset smart strategy could introduce risks. And he may be right. After all, AMD's asset smart manufacturing strategy resembles many outsourcing deals. AMD is unloading its manufacturing assets--and all the capital they gobble up--to another company. That company in turn absorbs all the people and plants. In many respects, AMD's asset smart strategy is a glorified outsourcing deal except there are fabs involved not data centers.

"I'd have more concern if we were dealing with a different foundry," says Knox. "We'll still manufacture out of Dresden and we know all the people. It's as smooth as a spin-off can be. Going forward this just isn't a big issue."

We'll be tuned into the AMD meeting and will blog live.