AMD: Positive signs emerge, but Intel and Nvidia loom large

AMD's fourth quarter earnings delivered a series of positive data points for the company, but as the company hones its strategy it still faces an uphill climb against well-heeled rivals like Intel and Nvidia.

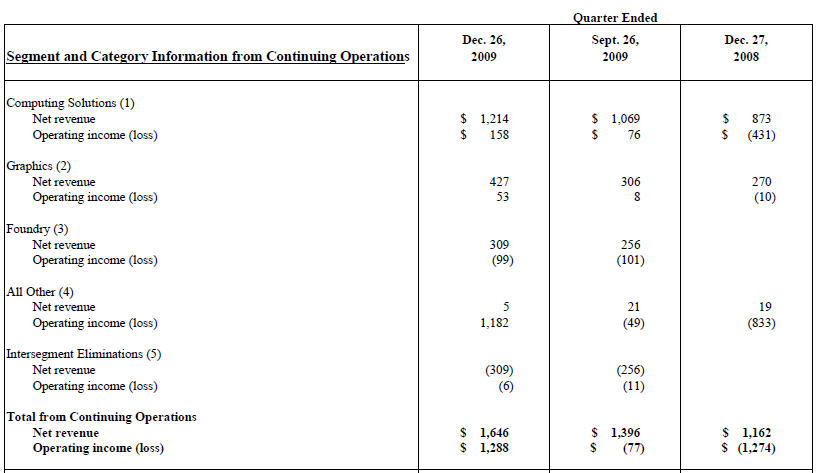

The company's fourth quarter results handily topped Wall Street estimates, but the company said the March quarter would be "seasonally down." Revenue was $1.65 billion, up 42 percent from a year ago. Earnings were $1.52 a share courtesy of a $1.25 billion litigation settlement from Intel. Excluding that gain, AMD had a loss of 5 cents a share in the fourth quarter.

In the quarter, AMD's notebook, graphics and server units all showed good growth.

Here's the breakdown:

On a conference call, AMD CEO Dirk Meyer noted the following:

AMD is targeting the SMB market and hoping that bleeds over into the enterprise upgrade cycle. Meyer said: "The SMB sub-segment of commercial is really our focus area. As an example, the ThinkPad products from Lenovo are really targeted at the SMB segment. Though having said that I do expect and we do see our SMB focused offerings from OEMs bleed over into enterprise because they represent a very good value. So you know not a direct target for us as compared to SMB but to the extent that enterprise takes off, we’ll get some updraft for sure."

AMD is landing design wins for its graphics chips and plans to refresh its lineup in the second half.

The PC market is looking up. Meyer said:

We’re looking into next year feeling pretty good about the opportunity for the PC market being a growth year in 2010. You know low double digits, 10, 11, 12%, something like that, more or less consistent with what we said on the analyst day call in November. You know I would say our experience with Q4 confirms that thesis about the way 2010 will look. End user demand was strong, certainly the holiday sales out were strong and that’s true really in all regions, even in Eastern Europe which was pretty weak through the whole of 2009. We started to see a recovery there.

However, analysts remain a touch skeptical about AMD mainly due to competition. Relative to Intel's quarter, AMD's improvements leave a lot to be desired.

JMP Securities analyst Alex Gauna focuses on AMD's gross margins. In a research note, he writes:

Gross margins for the quarter were up 300 bps to 45%, a nice improvement but well shy of the powerful 710 bps improvement Intel delivered to reach 64.7% in its just reported December quarter. This poor margin performance relative to Intel underscores the ongoing competitive and execution disadvantages AMD suffers owing to inferior process technology and ability to invest in capacity or R&D.

Gauna notes, however, that AMD's products are competitive in virtualized and cloud computing-led data centers. Those markets remain AMD's best hope in the enterprise.

Deutsche Bank analyst Ross Seymore notes that AMD's notebook footing is also weak:

We estimate >70% of AMD’s (chip and chipset) revenue comes from the desktop PC market and any deterioration in desktop demand is likely to hurt AMD as it is unlikely to be offset by share gains in notebooks or servers.

Those mixed bag recaps of AMD were everywhere Friday. It's not that analysts dislike AMD; they just think there are better ways to play the PC upgrade cycle via Intel and Nvidia. Simply put, the jury remains out on AMD.