Analyst: Kindle to reach 10 percent of Amazon's customer base; Ending Target deal a risk

The great Kindle sales guessing game continues.

Cowen and Co. analyst Jim Friedland upgraded Amazon to outperform from neutral on Tuesday and his case depends heavily on future Kindle sales---along with the power of Amazon Prime subscriptions and new businesses like Amazon Web Services. However, Friedland also highlighted the risks to Amazon if its fulfillment partnership ended with Target.

Friedland's big pitch is that Amazon has a lot of upside because it only has 0.3 percent of the U.S. retail market. Wal-Mart has 7.7 percent. In other words, Amazon is big, but not nearly as big as it can be.

But the money quotes from Friedland appear in the Kindle discussion (all content). Friedland writes in a research note:

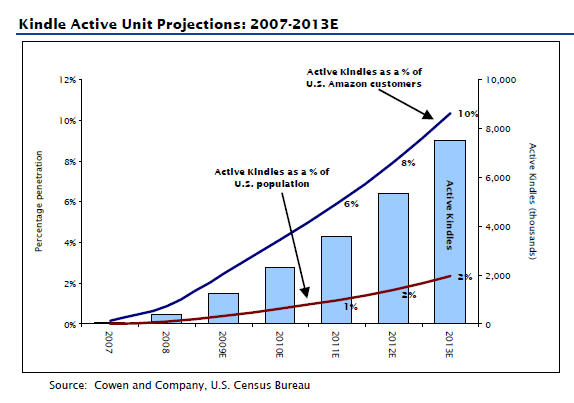

We estimate that Amazon has sold almost 800,000 Kindle units to date. We believe that Kindle sales are ramping up this year due to: (1) the elimination of major supply constraints that limited unit sales for the first 15 months after launch; (2) a large increase in content available on the Kindle Store; and (3) the Kindle2 and Kindle DX product launches. We estimate that Amazon sold 340,000 units in 2008, increasing to 900,000 in 2009 and 1.4 million in 2010. We believe that Kindle penetration could reach 10% of Amazon's U.S. customer base by 2013, or 2% of the U.S. population.

And by the charts:

Here's the Kindle picture in 2013:

Friedland also makes the following interesting point:

- Kindle books are roughly 10 percent to 40 percent cheaper than their hard cover counterparts.

- However, paperbacks are often the same price on the Kindle. "Many popular paperback books are actually priced the same on the Kindle, implying higher margins for Amazon and the publisher," says Friedland.

- The Amazon partnership with Target is a risk to profits. Friedland writes:

Target.com, which accounts for an estimated 7% of 2010 non-GAAP operating profit, could end its partnership with Amazon. Amazon currently powers the website and provides fulfillment for Target.com. We believe Amazon's contract with Target.com ends in August 2010. We believe it is possible that Target will eventually decide to take its website operations in house.

Here's Friedland's Target.com analysis: